Academy Pro Forex courses: Can Trading Strategies Really Make a Difference?

Most people step into Forex trading believing it is simply about predicting whether one currency will rise or fall against another. While price direction is part of the equation, the real nature of Forex trading goes far deeper. The Forex market is a complex ecosystem shaped by human psychology, global economics, institutional behavior, and algorithmic execution. It is a battlefield where emotions collide with data, and even minor shifts in sentiment can spark powerful price movements.

Unlike traditional stock markets, where traders invest in the long-term future of companies, Forex operates as a global, decentralized marketplace that runs 24 hours a day, five days a week. Currency values constantly react to central bank decisions, political developments, economic data releases, and sometimes even unverified rumors. The market never pauses, never sleeps, and never stops evolving. Traders who thrive in this environment do not rely on guesses or intuition alone. They build systems, refine strategies, and execute trades with discipline and adaptability.

Understanding the True Nature of the Forex Market

Forex trading is fundamentally different from other financial markets. It is driven by relative value rather than absolute value. When you trade currencies, you are always comparing one economy against another. This makes Forex extremely sensitive to macroeconomic forces such as interest rates, inflation expectations, employment data, and geopolitical stability.

Another defining characteristic of Forex is liquidity. Trillions of dollars move through the market every single day, largely controlled by banks, institutions, hedge funds, and central authorities. Retail traders participate within this ocean of capital, meaning success depends not on fighting institutions, but on understanding how they operate and aligning with their movements.

Emotion also plays a massive role. Fear, greed, impatience, and overconfidence can distort judgment and lead to poor decision-making. Successful Forex traders develop emotional discipline and rely on structured plans rather than impulses.

The Unconventional Guide to Forex Trading Strategies

Why Traditional Strategy Labels Are Not Enough

Most trading resources categorize strategies into scalping, day trading, or swing trading. While timeframes are important, they only scratch the surface. True Forex strategies are built around mindset, adaptability, and awareness of market conditions. A strategy that works perfectly in one environment may fail completely in another.

Effective traders understand that strategy is not static. It evolves with volatility, liquidity, and sentiment. Below are unconventional yet highly effective approaches that reflect how modern Forex trading really works.

The News Hunter Strategy

Some traders thrive on volatility generated by economic announcements. These traders do not react impulsively to news; they prepare in advance. They study economic calendars, forecast expectations, and analyze how markets are positioned before major releases.

What separates successful news traders is their focus on market reaction rather than the data itself. Sometimes positive news causes price drops, and sometimes bad news leads to rallies. Understanding sentiment before and after announcements allows News Hunters to capitalize on sharp, decisive movements while managing risk carefully.

The Liquidity Sniper Approach

Sudden price spikes followed by sharp reversals are not random. They often occur because large institutions are searching for liquidity. Stop-loss clusters and retail positions provide that liquidity. Traders who understand this behavior look for areas where price is likely to sweep liquidity before making its true move.

Liquidity Snipers wait patiently for false breakouts, emotional reactions, and stop hunts. Once liquidity is collected, they enter in the direction institutions are likely to push price. This approach requires patience, precision, and strong risk control, but it aligns closely with how professional money operates.

The Session Switcher Strategy

Forex trading sessions each have distinct personalities. The Asian session is typically quieter and more range-bound. The London session often introduces strong directional moves, while the New York session can either continue trends or reverse them depending on news and liquidity flow.

Session Switchers adapt their strategies based on the time of day. They may use range trading techniques during low volatility periods and breakout or momentum strategies during high-volume sessions. This flexibility allows traders to stay aligned with market behavior instead of forcing trades when conditions are unfavorable.

What Is Academy Pro and Why Traders Are Paying Attention

Academy Pro is designed for traders who want to move beyond surface-level knowledge and develop a genuine edge in the Forex market. Instead of offering generic lessons or rigid systems, it focuses on practical skill development and real-world application.

The core philosophy behind the academy is that markets change, and traders must change with them. Rather than teaching fixed strategies, the program emphasizes adaptability, critical thinking, and execution discipline. This approach resonates with traders who understand that long-term success depends on evolution, not shortcuts.

A Learning Structure Built for Real Market Conditions

Academy Pro emphasizes hands-on learning. Traders are exposed to live market scenarios, practical examples, and mentorship that reflects current market behavior rather than outdated theories. The curriculum is continuously updated to account for shifting volatility, liquidity patterns, and institutional activity.

This structure allows traders to bridge the gap between theory and execution. Instead of memorizing rules, participants learn how to interpret price action, manage risk dynamically, and refine strategies based on real-time feedback.

Academy Pro Courses: Education Beyond Theory

Courses Designed for Every Skill Level

Academy Pro offers structured learning paths for traders at different stages of their journey. Each course builds upon the previous one, ensuring steady progression rather than overwhelming complexity.

Forex Fundamentals and Smart Risk Management

This foundational course is ideal for beginners. It explains how the Forex market works, how currency pairs move, and why risk management is more important than strategy selection. Traders learn to avoid common mistakes such as overleveraging, emotional trading, and inconsistent position sizing.

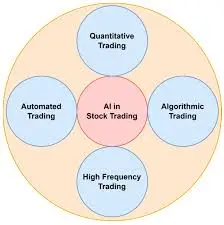

Algorithmic Trading and Market Psychology

For traders seeking advanced knowledge, this course explores automation, trading systems, and the psychological elements that influence decision-making. Understanding how algorithms interact with price and how emotions affect execution allows traders to improve consistency and reduce costly errors.

Live Strategy Sessions and Personalized Feedback

One of the most valuable aspects of Academy Pro is its live interaction. Traders can analyze real trades, ask questions, and receive feedback based on current market conditions. This interactive learning environment accelerates growth and helps traders refine their approach more effectively than pre-recorded content alone.

Adapting to Changing Market Conditions

Why Adaptability Determines Long-Term Success

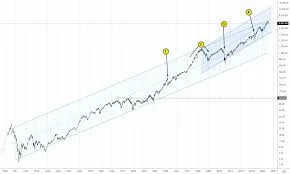

Forex markets are not static. Trending phases, ranging conditions, and high-volatility environments rotate continuously. A strategy that performs well today may struggle tomorrow. Academy Pro emphasizes adaptability as a core skill rather than an afterthought.

Traders are trained to assess volatility levels, identify liquidity conditions, and recognize institutional participation. This awareness allows them to adjust position size, trade frequency, and strategy selection based on what the market is offering at any given time.

Building an Evolving Trading Plan

Rather than relying on fixed rules, traders learn to develop flexible trading plans that grow alongside their experience. As skills improve and market understanding deepens, strategies are refined rather than replaced. This approach encourages sustainable development instead of constant system hopping.

Guidance for Beginners and Experienced Traders

For Beginners

New traders benefit most from structure and simplicity. The focus should be on:

- Understanding risk management

- Trading smaller positions

- Mastering one strategy at a time

- Avoiding emotional decision-making

Academy Pro helps beginners build confidence by removing unnecessary complexity and emphasizing disciplined habits.

For Experienced Traders

For advanced traders, the challenge shifts from making profits to maintaining them consistently. Academy Pro supports experienced traders by offering:

- Advanced risk techniques

- Institutional market insights

- Algorithmic perspectives

- Professional-grade analysis

This level of refinement helps experienced traders protect capital while improving efficiency and consistency.

Academy Pro Courses Reviews: Insights from Traders

Feedback from traders suggests that Academy Pro provides a realistic view of Forex trading. Many describe it as an eye-opening experience that strips away illusions and false promises. Instead of marketing overnight success, the program focuses on the mechanics of liquidity, volume, and institutional behavior.

Beginners often highlight how complex concepts are simplified without being oversimplified. Experienced traders appreciate the depth of analysis and strategic insight. Some users note challenges, such as a learning curve in navigating the platform or pacing of course delivery, but overall feedback emphasizes educational value over hype.

Final Thoughts: Is Academy Pro Worth Considering?

Trading success is not built on knowledge alone. It requires execution, discipline, emotional control, and the ability to adapt to ever-changing market conditions. Academy Pro provides a structured pathway that supports these elements, helping traders develop practical skills rather than chasing unrealistic expectations.

For traders who are serious about improving their Forex performance and are willing to invest time and effort into their development, this educational approach offers meaningful value. In a market where evolution is constant, learning how to evolve may be the most powerful strategy of all.

For more

For more exclusive influencer stories, visit influencergonewild

3 Comments