The Unavoidable Truth: Why Ignoring the Numbers Leads to Failure in Data-Driven Trading

At first glance, trading can look like a thrilling game of fast reactions, sharp instincts, and split-second decisions. Charts move quickly, prices jump without warning, and stories of overnight profits make it tempting to believe that success comes from gut feelings alone. Many traders fall into this trap early, treating the market as if it rewards courage and intuition more than preparation.

This mindset is dangerous.

Trading without structure, data, and measurable logic is not trading at all—it is gambling in disguise. The difference between the two lies in how decisions are made. Gambling relies on chance and emotion. Trading, when done correctly, relies on probability, statistical advantage, and disciplined execution.

Ignoring numbers may feel liberating in the moment, but it often leads to repeated losses, frustration, and eventual burnout. This guide explores why overlooking key metrics is one of the most common reasons traders fail, how successful traders approach the market differently, and what practical steps you can take to shift from random guessing to consistent, informed decision-making.

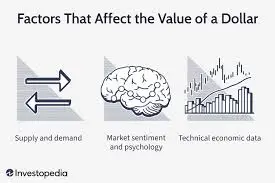

The Illusion of Instinct in Financial Markets

Many new traders believe their instincts will improve with time. After a few winning trades, confidence grows. That confidence can quickly turn into overconfidence, where decisions are made based on feelings rather than facts.

Markets, however, do not reward confidence alone. They respond to supply, demand, liquidity, macroeconomic forces, and collective behavior—none of which care about personal opinions.

Why Gut Feelings Fail Over Time

A hunch might work once or twice, but without a measurable edge, the odds eventually catch up. Markets are designed to expose randomness. Without data, traders cannot tell whether a win came from skill or pure luck.

When losses begin to pile up, traders who rely on instinct often respond emotionally—doubling down, revenge trading, or abandoning strategies altogether. This creates a vicious cycle that drains both capital and confidence.

The uncomfortable truth is simple: intuition without structure is unreliable, especially in unpredictable markets.

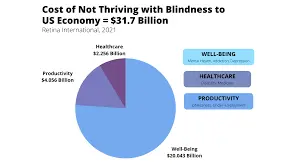

Risk Without Metrics: The Dangerous Gamble of Ignoring Probability

Trading Without Probability Is Blind Risk

Every trade carries risk. That risk does not disappear just because a trader chooses not to measure it. When probability is ignored, risk becomes invisible—and invisible risk is the most dangerous kind.

Trading without probability is similar to walking into a casino and placing all your money on a single roulette spin. The outcome might favor you once, but over time, the house edge wins.

Probability provides clarity. It answers critical questions:

- How often does this setup succeed?

- What is the average loss compared to the average gain?

- How many losing trades can occur in a row?

Without these answers, traders operate in the dark.

Why Probability Is the Foundation of Real Trading

Probability transforms trading from guesswork into a structured process. It does not eliminate losses, but it defines expectations.

Probability matters because:

- It defines your odds

Knowing how often a setup works allows you to size positions correctly and avoid overexposure. - It reduces emotional decision-making

When outcomes are expected and measured, short-term losses feel less personal. - It strengthens long-term performance

A probabilistic approach allows strategies to be refined, tested, and improved over time.

Successful traders accept uncertainty, but they manage it through mathematics rather than emotion.

Turning Probability Into Practice

Understanding probability does not require advanced mathematics. Traders can begin by:

- Backtesting strategies using historical data

- Tracking win rates and risk-to-reward ratios

- Using demo accounts to test ideas without financial pressure

Tools and educational platforms exist specifically to help traders understand market behavior before risking real capital. Learning to think in probabilities is one of the most important steps in transitioning from amateur to professional trading.

Chart Blindness and Its Costly Consequences

Why Charts Are Not Optional

Charts are not decorative tools—they are visual representations of market behavior. Ignoring them is like driving across unfamiliar terrain without navigation.

Some traders avoid charts because they appear complex or intimidating. Others dismiss technical analysis entirely, believing fundamentals or news alone are sufficient. Both approaches are incomplete.

Charts reveal:

- Where buyers and sellers are active

- How price reacts at key levels

- Whether momentum supports a move or contradicts it

Without this information, traders are guessing blindly.

The Real Cost of Ignoring Technical Analysis

Price does not move randomly. It reacts to historical levels, volume changes, and market psychology. Traders who ignore charts often:

- Enter trades too late

- Exit profitable positions too early

- Get trapped in false breakouts

- Miss trend reversals entirely

These mistakes compound over time, slowly eroding capital.

How Charts Protect Your Capital

Technical analysis does not predict the future, but it improves probability. Charts help traders:

- Identify support and resistance levels

These areas highlight where price is likely to react, pause, or reverse. - Recognize patterns

Repeating formations often signal continuation or reversal scenarios. - Confirm breakouts using volume

Price movements backed by strong volume are more reliable than weak ones.

Traders do not need dozens of indicators. Starting with basic tools like moving averages and simple trendlines is enough to build clarity and confidence.

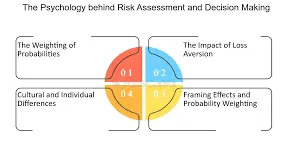

Understanding Market Psychology: Why Traders Ignore the Numbers

Even when traders know data matters, many still ignore it. The reason is psychological.

Human brains are wired for shortcuts, not statistical thinking. This creates predictable biases that influence trading decisions.

Overconfidence Bias

Overconfidence occurs when traders believe they understand the market better than they actually do. A few successful trades can inflate ego and suppress caution.

This bias leads to:

- Oversized positions

- Ignoring stop losses

- Refusing to accept when a strategy stops working

Markets punish arrogance quickly.

Confirmation Bias

Confirmation bias pushes traders to seek information that supports their existing beliefs while ignoring conflicting data.

For example, a trader who believes price will rise may:

- Focus only on bullish indicators

- Ignore weakening volume

- Dismiss negative news

This selective thinking blinds traders to reality and delays necessary adjustments.

Loss Aversion

Loss aversion causes traders to avoid analyzing losing trades because it feels uncomfortable. Losses hurt more emotionally than equivalent gains feel good.

As a result, traders:

- Hold losing positions too long

- Avoid reviewing mistakes

- Repeat the same errors

Ironically, avoiding losses emotionally often leads to larger financial losses.

Managing Bias Instead of Fighting It

Successful traders do not eliminate bias—they manage it.

They do this by:

- Writing down every trade and the reasoning behind it

- Reviewing performance objectively

- Following predefined rules regardless of emotion

- Seeking external feedback or mentorship

When decisions are documented, numbers reveal patterns that emotions try to hide.

From Data to Dollars: How Professionals Trade

The most profitable traders in the world do not chase excitement. They chase consistency.

They treat trading as a business, not entertainment.

How Data-Driven Traders Operate

Professional traders rely on systems, not impulses. Their process often includes:

- Historical analysis

Strategies are tested across different market conditions before being used live. - Performance tracking

Every trade is logged, allowing patterns of success and failure to emerge. - Probability-based diversification

Capital is allocated based on statistical expectation, not hype. - Technology and automation

Advanced software and AI tools help identify opportunities and manage risk in real time.

This disciplined approach removes randomness and replaces it with structure.

Why Consistency Beats Brilliance

You do not need to predict every market move to be profitable. You only need a small statistical edge applied consistently over time.

Traders who survive and thrive for years share common traits:

- Patience

- Discipline

- Data literacy

- Respect for risk

These qualities matter far more than intelligence or creativity.

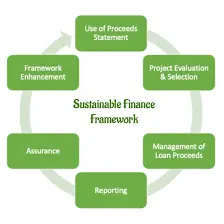

Building a Sustainable Trading Framework

Step 1: Define Risk Before Reward

Every trade should begin with risk assessment. Know how much you are willing to lose before entering a position.

This single habit prevents catastrophic losses.

Step 2: Use Data to Validate Ideas

Before risking money, ask:

- Has this setup worked before?

- What is the historical success rate?

- Does the risk justify the potential reward?

If the data does not support the idea, skip the trade.

Step 3: Track Everything

A trading journal is one of the most powerful tools available. Record:

- Entry and exit points

- Reasoning behind the trade

- Emotional state

- Outcome

Over time, patterns become impossible to ignore.

Step 4: Continuously Refine Strategies

Markets evolve. Strategies must evolve with them.

Regular review allows traders to:

- Remove ineffective setups

- Adjust risk parameters

- Improve overall performance

Growth in trading comes from refinement, not reinvention.

Final Thoughts: Are You Trading or Guessing?

The difference between long-term success and repeated failure in trading is rarely luck. It is preparation, discipline, and respect for data.

Treating trades as calculated decisions rather than emotional guesses changes everything. Probability, charts, and self-awareness are not optional tools—they are essential components of survival in financial markets.

If you want to stay in the game and profit from it, commit to learning, measuring, and refining your approach. Do the work others avoid. Let numbers guide your decisions. Over time, discipline compounds just like capital.

The market rewards those who treat it seriously. The question is simple: will you?

For more

For more exclusive influencer stories, visit influencergonewild

2 Comments