Psychological and Emotional Aspects of Risk Calculation in Investing

Risk-taking is an unavoidable part of life, and investing is no different. Every financial decision—whether made by a beginner or an experienced market participant—carries an element of uncertainty. At its core, investing is a balancing act between opportunity and risk. The difference between long-term success and repeated disappointment often comes down to one essential skill: risk management in investing.

Many investors struggle not because they lack intelligence or ambition, but because fear, hesitation, or overconfidence interferes with rational decision-making. Understanding how to manage risk effectively allows investors to act with clarity, confidence, and discipline—even when markets behave unpredictably.

This article explores how investors can overcome fear, balance intuition with logic, and train themselves to navigate uncertainty. Rather than avoiding risk altogether, successful investors learn how to measure, manage, and adapt to it.

Understanding Risk Management in Investing

Risk management in investing is not about eliminating risk. That would be impossible. Instead, it is about understanding potential downsides, preparing for unfavorable outcomes, and ensuring that no single decision can cause irreversible damage to your financial position.

Every investment carries risk, whether it is a volatile stock, a long-term portfolio, or even a seemingly stable asset. The key lies in how well that risk is anticipated and controlled.

Effective risk management allows investors to:

- Protect capital during uncertain periods

- Reduce emotional decision-making

- Maintain consistency over time

- Learn from losses instead of being defeated by them

Investors who master this discipline are better equipped to survive market downturns and capitalize on opportunities when conditions improve.

Overcoming Fear of Risk in Investment Decisions

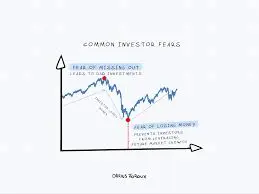

Why Fear Plays Such a Powerful Role

Fear is a natural human response to uncertainty. When money is involved, emotions intensify. Investors often imagine worst-case scenarios—losing savings, making irreversible mistakes, or missing better opportunities. While fear exists to protect us, it can become harmful when it paralyzes decision-making.

In investing, fear often leads to:

- Avoiding good opportunities

- Selling too early

- Hesitating during critical moments

- Overreacting to short-term volatility

Understanding fear is the first step toward controlling it.

Breaking Risk Into Manageable Pieces

One effective way to reduce fear is to break large decisions into smaller, more manageable steps. Instead of focusing on everything that could go wrong, focus on what can be controlled.

This includes:

- Studying market trends

- Analyzing company fundamentals

- Defining acceptable loss limits

- Planning exit strategies in advance

When risk is broken down logically, it becomes less intimidating and more manageable.

Identifying the Root of Investment Fear

Many investors fear risk without fully understanding why. Ask yourself:

- Am I afraid of losing money or being wrong?

- Is my fear based on past losses?

- Do I feel unprepared or uninformed?

Once fear is identified, it becomes easier to address through education, preparation, and experience.

Starting Small to Build Confidence

Confidence grows through experience. Investors who hesitate to act often benefit from starting with smaller positions. This allows them to:

- Gain real market exposure

- Learn without excessive pressure

- Build emotional resilience

Small steps create momentum and gradually reduce fear over time.

Balancing Intuition and Logic in Investing

The Role of Intuition

Intuition is not random guesswork. It is the result of experience, pattern recognition, and subconscious learning. Seasoned investors often sense when something feels right or wrong—even before data confirms it.

Intuition can be valuable in:

- Fast-moving markets

- High-volatility situations

- Time-sensitive decisions

However, intuition alone is not enough.

Why Logic and Analysis Matter

Logic relies on data, research, and measurable facts. It involves:

- Financial analysis

- Historical performance review

- Risk-reward calculations

- Objective decision-making

Logic helps remove emotional bias and ensures decisions are grounded in reality rather than impulse.

Finding the Right Balance

The most successful investors combine intuition and logic. They use intuition as a signal and logic as confirmation.

For example:

- If an investment feels too good to be true, logic helps verify assumptions

- If data supports an opportunity but intuition signals caution, further analysis is warranted

Rather than choosing one over the other, smart investors allow intuition and logic to work together.

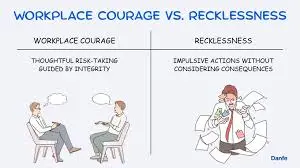

Risk-Taking vs Recklessness

Calculated Risk vs Blind Risk

There is a significant difference between taking calculated risks and acting recklessly. Calculated risks are taken after:

- Proper research

- Understanding downside potential

- Planning exit strategies

Reckless decisions are driven by emotion, hype, or pressure.

Risk management in investing emphasizes preparation, not impulsiveness.

Why Avoiding Risk Is Also Risky

Ironically, avoiding risk altogether can be just as harmful. Investors who never act often miss long-term growth opportunities. Inflation, missed compounding, and stagnation quietly erode value.

Managing risk does not mean avoiding action—it means acting wisely.

Training Yourself to Handle Market Uncertainty

Accepting That Uncertainty Is Normal

Markets are unpredictable by nature. Successful investors accept uncertainty instead of fighting it. They understand that no strategy guarantees perfect outcomes.

This mindset shift reduces stress and allows investors to focus on long-term performance rather than short-term fluctuations.

Educating Yourself Continuously

Knowledge reduces uncertainty. Investors who understand:

- Market cycles

- Economic indicators

- Sector behavior

feel more confident making decisions, even during volatile periods.

Education transforms fear into informed caution.

Using Simulations and Practice

Many investors refine their skills through simulations, paper trading, or mock portfolios. This allows them to:

- Practice decision-making

- Test strategies

- Learn without financial risk

Preparation builds confidence before real capital is at stake.

The Power of Diversification

Why Diversification Reduces Risk

Diversification is a cornerstone of risk management in investing. Spreading capital across different assets reduces dependence on any single outcome.

Diversification helps by:

- Reducing emotional stress

- Limiting potential losses

- Smoothing long-term returns

It acts as both a financial and psychological safeguard.

Avoiding Emotional Attachment to Single Investments

Investors who concentrate too heavily on one asset often experience heightened stress. Diversification encourages objectivity and discipline, making it easier to accept losses without panic.

De-Personalizing Losses

Why Losses Feel Personal

Losses often trigger self-doubt and frustration. Many investors interpret losses as personal failures rather than learning experiences.

This mindset can lead to:

- Revenge trading

- Overcorrection

- Emotional exhaustion

Turning Losses Into Lessons

Successful investors treat losses as data. Each loss provides insight into:

- Strategy flaws

- Market behavior

- Emotional responses

By reviewing mistakes objectively, investors improve future decision-making.

The Role of Mindset in Risk Management

Developing an Investor Mindset

Risk management is as much psychological as it is technical. Investors with strong mindsets:

- Remain calm under pressure

- Stick to plans during volatility

- Avoid emotional extremes

Mindset discipline allows investors to act rationally even when markets are chaotic.

Seeking Guidance and Perspective

No investor succeeds alone. Seeking guidance from experienced professionals or peers helps uncover blind spots and refine strategies.

Different perspectives improve judgment and reduce emotional bias.

Risk Management and Long-Term Investing Success

Long-term success is not achieved by avoiding risk, but by managing it consistently. Investors who survive downturns and remain disciplined during uncertainty are better positioned for sustained growth.

Risk management in investing supports:

- Capital preservation

- Emotional stability

- Strategic adaptability

Over time, these advantages compound just as investments do.

Final Thoughts: Your Approach to Risk Management in Investing

Risk-taking in investing is not about blind confidence or reckless behavior. It is a structured process built on education, self-awareness, and preparation. Overcoming fear, balancing intuition and logic, and training yourself to handle uncertainty are essential skills for every investor.

Each investor’s journey is different. Some rely more on data, others on experience—but all successful investors share one trait: they respect risk.

The most important step is not perfection—it is participation. Whether you are cautiously planning or just beginning to trust your instincts, thoughtful risk management allows you to move forward with confidence.

For more

For more exclusive influencer stories, visit influencergonewild