Should I Discuss My Investment Strategies and Mindset With Experts?

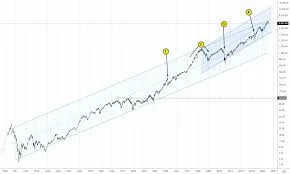

Investing is rarely a straight path. It is a journey filled with uncertainty, emotional highs and lows, unexpected market shifts, and moments where clarity feels out of reach. While data, charts, and analysis form the visible layer of investing, the deeper foundation lies in psychology, discipline, and decision-making quality. This is where expert guidance in investing becomes a transformative force rather than a simple support tool.

Many investors assume that better results come solely from better information. In reality, markets are flooded with information. What differentiates successful investors is not access to data, but the ability to interpret, prioritize, and act on that data with composure. Expert guidance strengthens this ability by offering perspective, structure, and emotional balance.

This extended guide explores how expert guidance in investing influences mindset, enhances resilience, protects intellectual capital, improves timing, and creates a repeatable framework for long-term success. Rather than focusing on short-term wins, it emphasizes sustainable decision-making that compounds over time.

Understanding the Real Value of Expert Guidance in Investing

Expert guidance is often misunderstood as a shortcut to profits. In truth, it is a process of refining how decisions are made, not dictating what decisions to take.

Professional insight adds value by:

- Reducing emotional interference in critical moments

- Helping investors recognize blind spots

- Encouraging consistency over impulsive action

Investors who rely solely on self-direction may succeed temporarily, but long-term stability often requires an external lens that challenges assumptions and reinforces discipline.

Mindset Mastery: The Psychological Foundation of Smart Investing

Why Investing Is Primarily a Mental Game

Every investment decision carries emotional weight. Fear of loss, excitement over gains, regret from missed opportunities—all shape behavior more powerfully than logic alone. Without psychological control, even sound strategies can collapse.

Expert guidance in investing addresses mindset before mechanics. Advisors often focus on:

- Emotional awareness

- Patience during uncertainty

- Detachment from short-term outcomes

This mental alignment allows investors to stay committed to strategy even when emotions fluctuate.

Overcoming Fear and Decision Paralysis

Fear does not always manifest as panic selling. Often, it appears as hesitation—endless analysis without action. Many investors delay decisions because uncertainty feels uncomfortable.

Expert guidance reframes uncertainty as a constant rather than a threat. Through structured reasoning, investors learn to:

- Accept imperfect information

- Act within defined risk boundaries

- Replace fear-driven avoidance with calculated action

Confidence grows when decisions follow a clear framework instead of emotional impulse.

Building Confidence Without Overconfidence

Confidence is essential, but unchecked confidence leads to reckless behavior. Expert guidance helps strike the balance between self-belief and humility.

This balance involves:

- Acknowledging what is unknown

- Respecting market complexity

- Maintaining flexibility

Such grounded confidence supports longevity in investing.

Strategic Thinking Under Pressure: Staying Rational in Volatile Markets

Why Pressure Distorts Judgment

Market volatility amplifies emotional responses. Rapid price changes trigger instinctive reactions that often contradict long-term goals.

Expert guidance in investing introduces structure during chaos. Professionals emphasize:

- Process over prediction

- Risk control over emotional reaction

- Perspective over immediacy

This structured approach reduces the likelihood of costly, reactionary decisions.

Adaptability as a Core Investment Skill

Markets evolve, and rigid thinking can be dangerous. However, constant strategy changes can be equally harmful. Expert guidance helps investors adapt intelligently.

Effective adaptability means:

- Adjusting exposure thoughtfully

- Responding to fundamental changes rather than noise

- Preserving strategic integrity while refining execution

This balance allows investors to evolve without losing direction.

Behavioral Finance and the Power of External Perspective

Why Investors Repeat the Same Mistakes

Human behavior is predictable, even in complex markets. Biases such as loss aversion, confirmation bias, and overconfidence repeatedly influence decisions.

Expert guidance in investing acts as a corrective force by:

- Identifying behavioral patterns

- Challenging emotional reasoning

- Reinforcing evidence-based thinking

An external perspective often reveals flaws that self-assessment misses.

Transforming Behavioral Awareness Into Better Decisions

Awareness alone does not change behavior. Investors need systems that translate insight into action.

Guided improvement includes:

- Post-decision reviews

- Scenario analysis

- Continuous learning loops

Over time, this process strengthens judgment and reduces repeated errors.

Confidentiality and Knowledge Sharing: A Delicate Balance

The Risks of Over-Sharing Investment Ideas

Collaboration accelerates learning, but indiscriminate sharing can dilute competitive advantage. Revealing detailed strategies may expose vulnerabilities.

Expert guidance helps investors manage this risk by clarifying:

- What information can be shared safely

- How to frame discussions strategically

- When discretion is essential

Confidentiality is not secrecy—it is strategic communication.

Learning Without Compromising Originality

Investors can expand knowledge without exposing proprietary thinking by:

- Discussing principles instead of tactics

- Using hypothetical scenarios

- Seeking feedback on decision frameworks

This approach preserves intellectual capital while encouraging growth.

Establishing Trust and Boundaries in Professional Relationships

Clear expectations strengthen advisory relationships. Investors benefit when discussions are purposeful and structured.

Practical safeguards include:

- Defined objectives

- Selective disclosure

- Mutual understanding of confidentiality

Trust thrives on clarity.

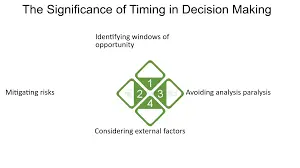

Timing Expert Guidance for Maximum Impact

Moments When Guidance Matters Most

Expert guidance in investing is most valuable during pivotal moments, such as:

- Market regime shifts

- Portfolio concentration risks

- Major personal financial changes

Proactive consultation often prevents losses rather than reacting to them later.

Preparation: The Hidden Multiplier of Expert Advice

Prepared investors extract more value from expert discussions. Preparation includes:

- Clarifying goals

- Identifying constraints

- Asking targeted questions

Well-structured conversations yield actionable insights rather than generic advice.

Choosing the Right Experts: Alignment Over Authority

Evaluating Expertise Beyond Titles

Credentials matter, but compatibility matters more. Effective guidance comes from professionals who:

- Communicate clearly

- Respect investor autonomy

- Demonstrate consistent reasoning

Trust builds through understanding, not prestige.

Shared Vision and Risk Philosophy

Guidance is most effective when aligned with personal objectives and risk tolerance. Misalignment creates confusion, even if advice is technically sound.

Execution: Turning Expert Insight Into Results

From Strategy to Action

Advice without execution delivers limited value. Expert guidance must translate into:

- Clear actions

- Defined timelines

- Measurable outcomes

Discipline transforms insight into performance.

Continuous Refinement Through Feedback

Markets change, and strategies must evolve. Regular reflection with expert input helps investors:

- Identify weaknesses

- Reinforce strengths

- Adapt intelligently

This feedback loop supports long-term resilience.

Independent Research and Expert Guidance: A Powerful Combination

Expert guidance does not replace independent thinking—it enhances it. Informed investors:

- Ask better questions

- Understand recommendations deeply

- Retain ownership of decisions

This partnership strengthens confidence and accountability.

The Long-Term Compounding Effect of Expert Guidance in Investing

Over time, guided investors develop:

- Emotional discipline

- Strategic patience

- Improved risk perception

These traits compound quietly, often producing outcomes superior to reactive approaches.

Dialogue as a Strategic Asset in Investing

Thoughtful discussions uncover insights that isolated analysis may miss. Expert dialogue:

- Challenges assumptions

- Reduces bias

- Strengthens decision frameworks

Well-managed conversations sharpen strategic thinking.

Final Thoughts: Expert Guidance in Investing as a Sustainable Advantage

Expert guidance in investing is not about surrendering control—it is about elevating decision quality. The strongest investors combine independent thinking with informed collaboration.

By mastering mindset, protecting intellectual capital, timing consultations wisely, and executing with discipline, investors build a durable framework for success. Markets remain unpredictable, but clarity, preparation, and expert insight convert uncertainty into opportunity.

In the end, investing rewards those who think clearly, act deliberately, and learn continuously—and expert guidance accelerates that journey.

For more

For more exclusive influencer stories, visit influencergonewild