Blockchain Unveiled: A Journey Through Evolution, History, and Future Perspectives

Today, we embark on a journey through the historical milestones and forward-looking horizons of one of the most transformative innovations of the modern digital era: blockchain technology. What began as a seemingly niche experiment has grown into a global force reshaping finance, technology, governance, and digital ownership. This exploration delves deep into the origins of blockchain, its technological evolution, the rise of decentralized finance, the expanding role of crypto consulting, and the future innovations that promise to redefine how value is created and exchanged.

Prepare yourself for a detailed examination enriched with intriguing facts, real-world examples, and an insightful dive into the interconnected worlds of blockchain and crypto consulting. The story of blockchain is not merely a technological narrative—it is a testament to humanity’s pursuit of transparency, security, and decentralization in an increasingly digital world.

The Genesis: Birth of Blockchain

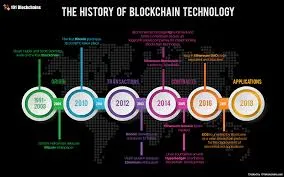

The story of blockchain begins with a name that has become legendary in the world of technology and finance: Satoshi Nakamoto. In 2009, Nakamoto introduced blockchain technology to the world through the creation of Bitcoin. At its core, Bitcoin was envisioned as a decentralized digital currency, designed to operate without reliance on central banks or financial intermediaries.

This breakthrough was revolutionary. At a time when trust in traditional financial institutions was shaken, blockchain emerged as a system built on cryptographic proof rather than institutional authority. Transactions were recorded on a distributed ledger, shared across a global network of computers, making manipulation or fraud extraordinarily difficult.

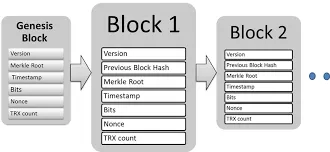

Decentralization and Tamper Resistance

Two defining characteristics quickly set blockchain apart: decentralization and tamper resistance. Unlike centralized databases controlled by a single authority, blockchain distributes data across multiple nodes. Every transaction is validated by consensus and permanently recorded, forming an immutable chain of data blocks.

This architecture laid the groundwork for a technological renaissance. Blockchain was no longer just a method of transferring digital currency; it became a new paradigm for storing and verifying data. The implications extended far beyond finance, signaling a fundamental shift in how digital trust could be established.

Blockchain’s Evolution: From Bitcoin to Beyond

While Bitcoin remains the trailblazer and most widely recognized application of blockchain, its success sparked an era of rapid innovation and diversification. Developers and visionaries soon realized that blockchain’s potential extended far beyond peer-to-peer payments.

Ethereum and the Rise of Smart Contracts

In 2015, Ethereum entered the scene and fundamentally altered the blockchain landscape. Ethereum introduced the concept of smart contracts—self-executing agreements written in code that automatically enforce terms when predefined conditions are met. This innovation marked a paradigm shift in blockchain’s functionality.

Smart contracts eliminated the need for intermediaries in contractual agreements, reducing costs, increasing efficiency, and minimizing disputes. More importantly, they expanded blockchain’s scope beyond simple transactions, enabling complex programmable logic to operate on decentralized networks.

Decentralized Applications (DApps)

With smart contracts came the rise of decentralized applications, commonly known as DApps. These applications run on blockchain networks rather than centralized servers, offering enhanced transparency, security, and resistance to censorship.

Today, blockchain functions as a versatile toolkit. Developers across the globe leverage it to build systems that facilitate transparent and secure interactions in industries ranging from supply chain management and healthcare to gaming and digital identity. The evolution from Bitcoin to a multi-purpose blockchain ecosystem underscores the adaptability and enduring relevance of this technology.

The Rise of Decentralized Finance (DeFi): A Game-Changer

One of the most transformative chapters in blockchain’s evolution is the emergence of decentralized finance, widely known as DeFi. DeFi represents a bold reimagining of traditional financial services, rebuilt from the ground up using blockchain technology.

Reinventing Financial Services

DeFi platforms offer services such as lending, borrowing, trading, and yield farming without relying on banks or centralized institutions. Through smart contracts, users can interact directly with financial protocols, maintaining full control over their assets at all times.

This decentralized model challenges long-standing financial structures by increasing accessibility and inclusivity. Anyone with an internet connection can participate, regardless of geographic location or socioeconomic status. For many, DeFi is not just an alternative—it is a financial lifeline.

Transparency and User Empowerment

Blockchain’s transparent nature ensures that all transactions are publicly verifiable, fostering trust in systems that operate without central oversight. Users can audit protocols themselves, reducing reliance on opaque institutions.

As decentralized finance continues to mature, it is reshaping the global financial landscape. While challenges such as security risks and regulatory uncertainty remain, DeFi’s potential to democratize finance is undeniable.

Crypto Consulting: Guiding the Wave of Innovation

As blockchain ecosystems grow increasingly complex, the role of crypto consulting has become essential. Businesses eager to adopt blockchain solutions often face technical, regulatory, and strategic challenges. Crypto consultants serve as trusted guides, helping organizations navigate this evolving terrain.

Strategic Implementation and Compliance

Crypto consulting professionals advise on a wide range of issues, including regulatory compliance, security protocols, tokenomics, and blockchain integration strategies. In a rapidly changing regulatory environment, expert guidance ensures that businesses remain compliant while innovating responsibly.

Consultants also help organizations identify use cases where blockchain adds genuine value rather than implementing it as a superficial trend. This strategic approach maximizes return on investment and minimizes operational risks.

Security and Long-Term Vision

Security remains a critical concern in blockchain adoption. Crypto consulting services often include audits, risk assessments, and best-practice frameworks to protect digital assets and user data. By addressing vulnerabilities early, consultants help enterprises build resilient systems.

In essence, crypto consultants act as lighthouses, guiding businesses through the vast sea of blockchain possibilities and ensuring sustainable growth in an ever-evolving digital economy.

Interesting Facts and Examples: Unveiling the Intricacies

Blockchain’s journey is filled with remarkable stories that highlight its unpredictable yet fascinating evolution. These moments offer insight into the technology’s growth and cultural impact.

The Pizza Paradigm

Rewinding to 2010, one of the most iconic events in blockchain history took place. Programmer Laszlo Hanyecz made the first real-world Bitcoin transaction by exchanging 10,000 Bitcoins for two pizzas. At the time, the transaction seemed trivial. Today, it stands as a powerful reminder of blockchain’s extraordinary journey, with those Bitcoins now worth millions.

The Pizza Paradigm symbolizes both the humble beginnings of blockchain and its explosive growth. It underscores how revolutionary technologies often start with modest use cases before reshaping entire industries.

Tokenization Transcending Frontiers

Another groundbreaking development enabled by blockchain is tokenization. This process transforms tangible and digital assets into tradeable tokens recorded on a blockchain. Tokenization has far-reaching implications, from real estate and finance to art and intellectual property.

A striking example is Beeple’s digital artwork “Everydays: The First 5000 Days,” which was tokenized and sold as an NFT for $69 million in 2021. This moment not only redefined digital art ownership but also demonstrated how blockchain can democratize investment by enabling fractional ownership and global participation.

The Future Horizon: NFTs, Sustainability, and Beyond

As blockchain continues to evolve, its future is adorned with exciting prospects that promise to expand its influence even further.

The Rise of Non-Fungible Tokens (NFTs)

Non-Fungible Tokens, or NFTs, are gaining prominence across art, gaming, and entertainment industries. Unlike cryptocurrencies, NFTs represent unique digital assets, enabling verifiable ownership and provenance.

NFTs are transforming how creators monetize their work and how audiences engage with digital content. From virtual real estate to in-game assets, NFTs are redefining value in the digital age.

Sustainability and Eco-Friendly Innovations

Environmental concerns have prompted the blockchain industry to prioritize sustainability. Traditional consensus mechanisms, while secure, have raised questions about energy consumption. In response, developers are designing eco-friendly alternatives that significantly reduce environmental impact.

These innovations demonstrate the industry’s commitment to balancing technological advancement with environmental responsibility, ensuring blockchain’s long-term viability.

Conclusion: A Canvas of Infinite Possibilities

The evolution of blockchain technology is a compelling narrative of innovation, disruption, and boundless potential. From its genesis with Bitcoin to the sophisticated ecosystems of decentralized applications, DeFi, NFTs, and crypto consulting, blockchain continues to redefine the digital landscape.

What began as a decentralized digital currency has grown into a transformative force shaping the future of finance, ownership, and trust. As businesses, developers, and users continue to explore blockchain’s capabilities, one truth remains clear: the story of blockchain is far from complete.

The canvas of blockchain’s future is vast and ever-expanding, and the masterpiece is still unfolding.

For more

For more exclusive influencer stories, visit influencergonewild