Bitcoin Investing in 2025: How X’s Financial Tools Are Changing the Market

By 2025, social media no longer performs its traditional duties of casual opinion sharing, meme distribution, or simply breaking news faster than television. Instead, it has evolved into a powerful economic force—one that actively shapes cryptocurrency markets in real time. At the center of this transformation stands X (formerly Twitter), a platform that has redefined itself as a hybrid of media network, financial technology ecosystem, and real-time market intelligence tool.

What was once a place for crypto conversations has matured into a functional environment where Bitcoin is analyzed, traded, discussed, and emotionally interpreted—often within seconds. This shift has fundamentally changed how both retail and institutional investors observe Bitcoin, understand its behavior, and respond to market movements.

Under Elon Musk’s leadership, X has gradually developed a collection of financial instruments that influence how investment groups monitor Bitcoin price today, execute trades, and interpret its dynamics. The result is a platform that no longer sits on the sidelines of financial markets but actively participates in shaping them.

The Transformation of X into a Financial Intelligence Platform

X’s evolution did not happen overnight. It followed a gradual but deliberate transition from being a crypto discussion hub into an essential investor tool. In its early stages, the platform’s involvement in cryptocurrency was largely informal. Users shared opinions, memes, screenshots of charts, and speculative predictions. Over time, however, these interactions revealed something powerful: market sentiment was forming—and spreading—faster on X than anywhere else.

From Social Conversation to Market Infrastructure

The app transformation of X now combines live market displays, wallet connections, and prediction analysis functions. These changes have converted the platform from a space for crypto debate into a real-time financial dashboard.

Bitcoin buyers and long-term holders no longer need to rely on external exchanges or analytical websites just to track Bitcoin price today. Through X, users can instantly view dynamic price charts, monitor market signals, and observe sentiment trends without ever leaving their timelines.

This shift has collapsed the distance between information, emotion, and action. Where investors once consumed data separately from discussion, X has unified these elements into a single experience.

X as the New Crypto Dashboard

The Evolution of Cashtags into Full Market Tools

What began as simple cashtag searches—such as $BTC or $ETH—has expanded into a fully integrated crypto dashboard. Early cashtags allowed users to filter conversations around specific assets. Today, they function as gateways into live financial ecosystems.

Investors can access real-time charts, automated analytics, and historical comparisons directly within their feeds. Through wallet connections and brokerage integrations, users can initiate Bitcoin transfers or trades with minimal friction.

This transformation has changed how Bitcoin markets are accessed. Users who once followed Bitcoin memes or Elon Musk’s tweets can now swipe through live price movements, trading signals, and sentiment indicators with ease.

Lowering the Barrier to Active Investing

One of the most profound effects of X’s evolution is how effortlessly crypto-curious users become active investors. Because market data appears within a familiar platform, users are more likely to engage with it.

The learning curve that once discouraged newcomers has been reduced. Instead of navigating complex exchanges, users encounter Bitcoin market information alongside discussions, opinions, and educational threads. This seamless exposure accelerates adoption and participation.

Premium Features and Advanced Trading Capabilities

X’s premium membership tier has further enhanced its role as a crypto market hub. Premium users gain access to advanced trading capabilities that were once reserved for professional platforms.

Enhanced Tools for Traders and Investors

These features include adjustable alerts, smart contract monitoring, and social mood visualization tools. Traders can track shifts in crowd emotion in real time, observing how optimism or fear spreads across the network.

For day traders, this interface technology has significantly improved trading performance. The ability to see market speed, momentum, and engagement levels in one place provides a strategic edge.

Long-term crypto holders also benefit. By observing sustained sentiment patterns and investor behavior, they gain deeper insights into market cycles and accumulation phases.

The Power of Real-Time Sentiment Analysis

Social Signals as Market Indicators

Perhaps the most influential contribution of X to Bitcoin investing is its ability to perform large-scale sentiment analysis. Using AI-driven tools, X examines millions of posts every hour to analyze Bitcoin-related discussions.

The Crypto Mood Index aggregates linguistic patterns, engagement metrics, and audience responses to determine real-time community sentiment. This index reflects whether discussions around Bitcoin skew bullish, bearish, or neutral.

What has emerged is a new type of market indicator: the social signal.

When Sentiment Moves Markets

Market participants now track engagement spikes, influencer activity, and emotional tone with the same seriousness as technical analysis and on-chain metrics. In many cases, Bitcoin price movements closely follow shifts in X sentiment within minutes.

This phenomenon highlights how deeply social dynamics influence financial behavior. When optimism spreads rapidly, buying pressure often follows. When fear dominates conversations, selling activity increases.

Elon Musk’s Influence and Market Volatility

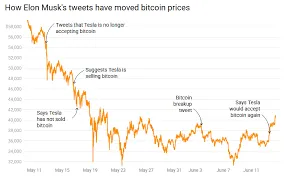

Elon Musk’s presence on X continues to exert extraordinary influence over Bitcoin markets. When he interacts with content—whether through posts, replies, or reposts—millions of engagements often follow within minutes.

These interactions frequently trigger immediate market reactions. Critics argue that such volatility introduces instability, while supporters view it as a reflection of decentralized influence in a digital society.

In this modern environment, power does not flow solely from institutions or official announcements. Instead, influence emerges from attention, reach, and engagement. X has become the arena where this new form of market power is exercised.

Seamless Integration with Wallets and Markets

Bridging Social Interaction and Financial Action

By introducing direct money exchange functions, X has merged social engagement with financial execution. Through partnerships with wallet providers and crypto platforms, users can now buy Bitcoin, transfer assets, and manage holdings directly from their profiles.

Selecting a cashtag can initiate an instant Bitcoin transaction. This functionality transforms passive observers into active participants with minimal delay.

Expanding Global Access to Bitcoin

This integration has had a particularly strong impact in emerging markets and underbanked regions. Users who rely on X for social interaction now gain direct exposure to cryptocurrency markets without traditional banking infrastructure.

Educational resources and built-in security measures help users navigate this ecosystem more safely. X has effectively combined information, execution, and learning into a single integrated platform.

Social Trading and Collective Market Behavior

Copy-Trading and Strategy Sharing

X has also introduced a competitive edge through social trading dynamics. Traders share strategies, performance insights, and portfolio snapshots. Users monitor popular investor accounts and automated bots, engaging in copy-trading behaviors by mirroring successful trades.

This environment creates a market driven by group behavior and emotional feedback loops. Decisions are made collectively, influenced by visible success stories and trending strategies.

While this socialization of investing democratizes access to information, it also amplifies emotional responses—both positive and negative.

Risks and Rewards of Social-Driven Investing

The Dangers of Crowd Psychology

With increased power comes increased risk. The fusion of social media and finance creates conditions where misinformation, hype, and herd behavior can distort markets.

In 2025 alone, several incidents of fake news and manipulated Bitcoin price graphs circulated on X, triggering short-lived price fluctuations. Authorities have begun investigating how organized groups exploit viral dynamics to manipulate markets.

Platform Responses and Safeguards

X has responded by introducing transparency tools, financial influencer labeling, and warning indicators for high-risk content. These measures aim to balance open discussion with user protection.

Despite safeguards, viral events—whether positive or negative—can still produce immediate portfolio impacts. These effects often fade quickly, but their emotional influence remains significant.

Community Acceptance and Decentralized Ideals

The Bitcoin community has largely embraced X’s transformation. Many view it as an extension of blockchain’s core principles: decentralization, open access, and global participation.

Through X, individuals can act as analysts, traders, educators, and broadcasters—roles once dominated by institutions and traditional media. This redistribution of influence aligns closely with Bitcoin’s foundational philosophy.

The Future of Investing Is Social

A New Understanding of Bitcoin

X’s evolution into a real-time trading and intelligence platform has reshaped how Bitcoin is perceived and exchanged. Investing in Bitcoin has shifted away from isolated trading platforms and lengthy forum discussions.

Instead, it has become an open, continuous process driven by live information flows and collective interpretation.

X as a Central Control Center

With advanced AI sentiment tools and deep wallet integrations, X is positioned to dominate as both a crypto observation tool and a centralized coordination space.

Bitcoin investors increasingly rely not just on charts and forecasts, but on real-time social signals that reflect global attention and emotion.

Conclusion: Where Bitcoin Investing Begins in 2025

By 2025, Bitcoin investing has reached its socialization milestone. The line between conversation and execution has blurred, and X sits firmly at the center of this transformation.

Bitcoin is no longer just a digital asset analyzed in isolation. It is a living, evolving narrative shaped by real-time sentiment, global participation, and instant action. And in this new era, X is where it all begins.

For more

For more exclusive influencer stories, visit influencergonewild