Everything You Need to Know Before Investing in Tesla in 2026

Tesla has become one of the most discussed and closely followed companies in the modern financial world. From Wall Street analysts to everyday retail investors, everyone seems to have an opinion about Tesla and its future. Under the leadership of Elon Musk, the company has grown far beyond its original identity and has positioned itself at the intersection of technology, transportation, and clean energy.

As we move deeper into 2025, interest in Tesla stock continues to rise. Investors are no longer looking at Tesla only as a car manufacturer; instead, they see it as a global innovator shaping the future of electric vehicles, energy storage, and solar technology. This detailed guide will help you fully understand why Tesla remains relevant, how it has achieved its success, what risks you should consider, and whether investing in Tesla in 2025 aligns with your financial goals.

Why Tesla Is Still Relevant in 2026

Tesla is not just another automotive brand competing in the electric vehicle market. It is a technology-driven company with a broader mission: to accelerate the world’s transition to sustainable energy. This mission is what separates Tesla from traditional automakers and keeps investors interested year after year.

In 2025, Tesla continues to sit at the center of conversations about the future of transportation and clean energy. The global shift away from fossil fuels, combined with rising environmental awareness, has created a favorable environment for companies focused on sustainability. Tesla benefits directly from these long-term global trends.

Another major reason Tesla remains relevant is its ability to stay ahead of competitors. While many companies are now producing electric vehicles, Tesla still leads in software integration, battery efficiency, and autonomous driving capabilities. Investors view this innovation-first mindset as a strong indicator of long-term growth potential.

Tesla’s expanding global presence also plays a key role. The company continues to grow its market share in North America, Europe, and Asia while entering new markets where demand for electric vehicles is rapidly increasing. This international expansion supports revenue growth and strengthens Tesla’s position as a global leader.

Tesla as More Than a Car Company

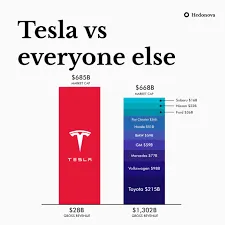

One of the biggest misunderstandings about Tesla stock is the idea that its value depends solely on car sales. In reality, Tesla operates across multiple industries, which makes it more resilient and more attractive to long-term investors.

Tesla’s business model includes:

- Electric vehicles for personal and commercial use

- Energy storage solutions for homes and businesses

- Solar technology that enables clean power generation

- Software systems for autonomous driving and energy management

This diversified approach allows Tesla to generate revenue from multiple sources while building an ecosystem of interconnected products. Investors often see this strategy as a major advantage, especially in uncertain economic conditions.

Key Innovations Driving Tesla’s Growth

Tesla’s rise has been fueled by consistent innovation. The company has repeatedly introduced products that redefine expectations and disrupt entire industries. These innovations have played a significant role in boosting Tesla stock and maintaining investor confidence.

Electric Vehicles That Changed the Market

Tesla’s Model S and Model 3 were turning points for the electric vehicle industry. These cars proved that EVs could be fast, stylish, efficient, and practical for everyday use. They helped eliminate the outdated belief that electric vehicles were slow or limited in range.

By delivering performance and design comparable to luxury gasoline-powered cars, Tesla attracted a new class of buyers and investors alike.

Autopilot and Self-Driving Technology

Tesla’s Autopilot system is among the most advanced driver-assist technologies available in consumer vehicles. While fully autonomous driving is still evolving, Tesla’s continuous software updates and real-world data collection give it a competitive edge.

Investors closely watch Tesla’s progress in this area because successful self-driving technology could unlock entirely new revenue streams, including ride-sharing networks and autonomous delivery services.

Energy Storage Solutions

Tesla’s Powerwall and other energy storage products allow homeowners and businesses to store solar energy for later use. This technology is especially valuable in regions with unstable power grids or high electricity costs.

Energy storage has become an increasingly important part of Tesla’s business, supporting the company’s broader clean energy mission and diversifying its income sources.

Solar Technology and Renewable Power

Tesla’s Solar Roof represents a bold step toward integrating renewable energy directly into everyday infrastructure. By turning rooftops into power generators, Tesla offers a long-term solution for sustainable energy production.

This focus on solar technology strengthens Tesla’s position as a comprehensive clean energy company rather than just an electric vehicle manufacturer.

Cybertruck and Bold Design Choices

The Cybertruck attracted global attention due to its unconventional design and ambitious performance claims. While opinions were divided, the massive public interest resulted in strong pre-orders and renewed excitement around Tesla’s innovation strategy.

How to Start Investing in Tesla Stock

Investing in Tesla in 2025 is more accessible than ever. You do not need to be a professional trader or financial expert to get started. With the right approach, even beginners can participate in the stock market.

Step-by-Step Overview

- Choose a reliable trading platform that suits your needs

- Create an account and complete the verification process

- Deposit funds into your trading account

- Search for Tesla stock using its ticker symbol (TSLA)

- Decide how much you want to invest

- Place your trade and monitor performance regularly

Starting small is often a smart strategy, especially if you are new to investing. Over time, you can adjust your position as you gain experience and confidence.

Tools That Help You Trade Better

Modern trading platforms provide advanced tools that make investing more informed and strategic. These tools are especially useful when dealing with high-profile stocks like Tesla.

Many platforms now offer:

- Real-time stock charts and market data

- AI-powered insights and trend analysis

- Automated trading strategies

- Risk management features

Access to updated data is critical when trading Tesla stock, as public sentiment and news events can influence price movements quickly.

Some platforms also allow trading during both rising and falling markets. This flexibility gives investors more opportunities, but it also requires a solid understanding of market dynamics.

Risks You Should Be Aware Of

No investment is without risk, and Tesla stock is no exception. Understanding potential challenges is just as important as recognizing growth opportunities.

Market Volatility

Tesla stock is known for its sharp price movements. High volatility can lead to significant gains, but it can also result in sudden losses. Investors should be prepared for fluctuations and avoid emotional decision-making.

External Factors

Government regulations, changes in environmental policies, and global supply chain disruptions can all impact Tesla’s operations and stock price. These external factors are often beyond the company’s control.

Public Attention and Media Influence

Tesla receives constant media coverage, which can amplify market reactions. Positive news may drive prices up quickly, while negative headlines can cause sudden drops.

Historical Performance of Tesla Stock

Tesla’s journey in the stock market has been marked by both dramatic highs and challenging lows. Since its IPO in 2010, the company has experienced periods of intense scrutiny and remarkable growth.

Launch of Model S in 2012

The release of the Model S was a defining moment. It demonstrated that electric vehicles could compete with luxury cars in performance and comfort. Investor confidence grew as Tesla proved its vision was achievable.

Introduction of Autopilot in 2014

The launch of Autopilot placed Tesla at the forefront of self-driving technology. This innovation strengthened the company’s reputation as a technology leader rather than just an automaker.

Acquisition of SolarCity in 2016

By acquiring SolarCity, Tesla expanded into the clean energy sector. This move aligned perfectly with its mission and positioned the company as a major player in renewable energy solutions.

Cybertruck Reveal in 2019

The Cybertruck reveal captured global attention and sparked intense debate. Despite mixed reactions, the overwhelming interest translated into strong market enthusiasm and stock momentum.

Pros and Cons of Investing in Tesla

Before investing, it is important to weigh both the advantages and disadvantages of Tesla stock.

Pros of Investing in Tesla

- Strong growth potential

- Leadership in innovation and technology

- Expanding global market presence

- Strong brand recognition and public interest

Cons of Investing in Tesla

- High market volatility

- Regulatory and political risks

- Stock performance is not guaranteed

- Heavy reliance on continued innovation

Is Tesla a Good Long-Term Investment in 2025?

For many investors, Tesla represents a long-term opportunity rather than a short-term trade. The company’s focus on electric vehicles, renewable energy, and advanced technology aligns with major global trends expected to shape the next several decades.

If you believe in the future of clean energy and sustainable transportation, Tesla may fit well into a diversified investment portfolio. However, it is essential to remember that markets evolve, competition increases, and economic conditions change.

Doing your own research, understanding your risk tolerance, and setting clear financial goals are critical steps before investing in Tesla stock.

Common Questions Investors Ask About Tesla

Many investors have similar concerns before making a decision. Some of the most frequently asked questions include:

- What is the best time to invest in Tesla?

- How much money should I invest?

- Which trading platform should I use?

- Should I trade Tesla short-term or hold it long-term?

The answers depend on your personal financial situation, investment strategy, and risk tolerance. Consulting a financial advisor can provide additional clarity.

Conclusion: Final Thoughts on Tesla Stock in 2025

Tesla remains one of the most talked-about stocks in 2025 for good reason. Its continued focus on innovation, sustainability, and technological leadership keeps it at the forefront of multiple industries. From electric vehicles to energy storage and solar technology, Tesla’s influence extends far beyond traditional automotive boundaries.

At the same time, investing in Tesla stock requires careful consideration. High volatility, external risks, and intense public scrutiny mean that investors must stay informed and disciplined.

If you are ready to begin your investment journey, take the time to understand the market, use reliable tools, and invest responsibly. With the right approach, Tesla can be a meaningful part of a forward-looking investment strategy.

For more

For more exclusive influencer stories, visit influencergonewild