How to Read the SP500 Live Chart Effectively

The SP500 is widely regarded as one of the most reliable benchmarks for measuring the overall health of the American economy and the stock market. Because it represents the performance of 500 of the largest publicly traded companies in the United States, movements in the SP500 often reflect broader economic trends, investor confidence, and institutional activity. For this reason, traders and investors around the world closely monitor the SP500 chart to guide their decisions.

Those who know how to interpret the SP500 live chart correctly often gain a meaningful advantage in the market. Many experienced investors begin their day by checking the SP500 chart today to assess market sentiment before taking any action. By analyzing price action, trends, pivots, and volume in real time, market participants can improve the timing of entries and exits. Whether you are day trading, swing trading, or investing for the long term, understanding how to read this instrument places you one step ahead in today’s complex and fast-moving market environment.

The real strength of SP500 charts lies in their ability to transform massive amounts of data into a clear visual story. When you look at an SP500 chart today, you are not simply observing numbers—you are seeing the combined decisions of millions of traders and investors. Economic conditions, corporate performance, global events, and investor psychology are all reflected in a single visual framework, making the SP500 live chart one of the most powerful analytical tools available.

What Is the SP500 and Why It Matters

The SP500 refers to the S&P 500, a market-cap-weighted index that tracks the performance of 500 leading U.S. companies across various industries. Because of its broad coverage, it is often used as a proxy for the overall stock market and the U.S. economy.

When the SP500 is trending upward, it typically signals economic optimism and strong corporate earnings. When it declines, it may reflect economic uncertainty, tightening financial conditions, or declining investor confidence. This is why the SP500 chart today is watched not only by traders but also by policymakers, economists, and long-term investors.

Why the SP500 Live Chart Is So Important

The SP500 live chart provides real-time insight into market behavior. Unlike delayed or static data, live charts allow traders to see how prices react instantly to news releases, economic data, and shifts in sentiment.

Key reasons investors rely on the SP500 live chart include:

- Real-time assessment of market sentiment

- Better timing for entries and exits

- Identification of trends and reversals

- Confirmation of broader market direction

Because many individual stocks move in the same direction as the overall market, understanding the SP500 chart helps traders align their strategies with prevailing conditions instead of trading against the trend.

Understanding Chart Time Frames

Choosing the right timeframe is the foundation of effective chart analysis. Different timeframes reveal different aspects of market behavior, and the SP500 live chart can tell very different stories depending on the timeframe you select.

Intraday Timeframes

Intraday charts display price movements on a minute-by-minute or hourly basis. These are especially useful for day traders who focus on short-term price fluctuations.

- Minute charts help identify quick scalping opportunities

- Hourly charts show intraday trends and momentum shifts

When using the SP500 live chart for intraday trading, speed and precision are critical. Small price movements can offer opportunities, but they also require strict risk management.

Daily Timeframes

Daily charts provide a balanced view of market behavior and are commonly used by swing traders and medium-term investors. They help identify trends that last weeks or months.

Analyzing the SP500 chart today on a daily timeframe allows traders to:

- Spot trend continuations

- Identify pullbacks within trends

- Recognize early reversal signals

Weekly and Monthly Timeframes

Longer timeframes reveal the broader market structure. Weekly and monthly SP500 charts highlight long-term cycles, major support and resistance zones, and secular trends.

Many experienced analysts recommend starting with a long-term SP500 chart today and then zooming in to shorter timeframes. This top-down approach ensures that short-term trades align with the dominant trend rather than fighting against it.

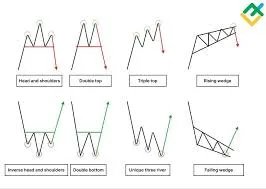

Recognizing Key Chart Patterns

Chart patterns are recurring formations created by collective investor behavior. These patterns appear frequently on the SP500 chart and can provide valuable clues about potential future price movements.

Common Chart Patterns on the SP500 Chart

Some of the most reliable patterns include:

- Head and shoulders

- Double tops and double bottoms

- Triangles (ascending, descending, symmetrical)

- Flags and pennants

These formations develop due to market psychology, making them useful predictive tools rather than random shapes.

Using Pattern Confirmation

When analyzing the SP500 live chart, confirmation is essential. For example, if a head and shoulders pattern appears on the SP500 chart today, traders often wait for a decisive break below the neckline before acting. This reduces the risk of false signals.

While no pattern guarantees success, consistent pattern recognition improves probability-based decision-making.

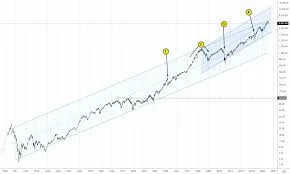

Trend Lines and Price Channels

Trend lines are among the simplest yet most powerful tools in technical analysis. They help define the direction and strength of a trend on the SP500 chart.

Drawing Trend Lines

- An uptrend line connects higher lows

- A downtrend line connects lower highs

These lines act as dynamic support and resistance levels.

When examining the SP500 live chart, observe how prices react near trend lines. A bounce from an uptrend line may signal a buying opportunity, while a break below it can indicate a potential trend change.

Using Price Channels

Price channels are formed by drawing parallel lines around price action. They help traders identify potential targets and boundaries when the SP500 chart today shows range-bound movement.

Channels are particularly useful for identifying overbought and oversold conditions within a trend.

Moving Averages as Trend Indicators

Moving averages smooth price data and help clarify trend direction. They are widely used on the SP500 chart because they adapt to changing market conditions.

Common Moving Averages on the SP500 Chart

- 20-day moving average for short-term trends

- 50-day moving average for medium-term trends

- 200-day moving average for long-term trends

When the SP500 live chart shows prices above the 200-day moving average, it often signals a bullish long-term environment. Prices below this level may indicate bearish conditions.

Moving Average Crossovers

Crossovers between moving averages can highlight potential trend shifts. A well-known example is the golden cross, which occurs when the 50-day moving average crosses above the 200-day. Monitoring these signals on the SP500 chart today helps traders stay aligned with major market movements.

Volume Analysis and Market Conviction

Volume adds context to price movements. It reveals the level of participation and conviction behind market moves.

Interpreting Volume on the SP500 Live Chart

- Rising prices with increasing volume suggest strong buying interest

- Rising prices with declining volume may indicate weakening momentum

- Falling prices with high volume can signal panic selling

Volume spikes on the SP500 chart today often coincide with important market events, such as economic data releases or policy announcements.

Understanding volume patterns allows traders to distinguish between healthy trends and fragile price movements.

Support and Resistance Levels

Support and resistance are critical concepts when analyzing the SP500 chart.

- Support is a price area where buying interest prevents further declines

- Resistance is a price area where selling pressure limits upward movement

Identifying Key Levels

When studying the SP500 chart today, look for:

- Previous highs and lows

- Psychological round numbers

- Areas where price has reversed multiple times

The SP500 live chart often shows repeated reactions around these levels, making them valuable reference points for trade planning.

When support or resistance is broken with strong volume, it can lead to significant price movement in the new direction.

Combining Multiple Tools for Better Analysis

No single indicator or method works in isolation. The most effective traders combine multiple elements when analyzing the SP500 live chart.

A strong analytical approach may include:

- Trend analysis using moving averages

- Pattern recognition for entries

- Volume confirmation for strength

- Support and resistance for risk management

This layered approach improves consistency and reduces reliance on any single signal.

Common Mistakes When Reading the SP500 Chart

Even experienced traders can misinterpret charts. Some common mistakes include:

- Overloading charts with too many indicators

- Ignoring higher timeframes

- Trading against the dominant trend

- Relying on patterns without confirmation

Avoiding these errors can significantly improve results when using the SP500 chart today.

Conclusion

Mastering the skill of reading the SP500 live chart takes time, discipline, and consistent practice. By understanding chart timeframes, recognizing patterns, drawing trend lines, analyzing volume, and identifying support and resistance levels, traders can gain deeper insight into market behavior.

The SP500 chart today offers a powerful snapshot of investor sentiment and economic conditions. While no method guarantees success, combining technical analysis with awareness of broader fundamentals creates a more balanced and informed trading approach.

Markets can always surprise even the most experienced participants. Approach chart analysis with humility, stay adaptable, and continuously refine your understanding. With patience and proper analysis, the SP500 live chart can become one of your most valuable tools for navigating the financial markets.

FAQS

What is the SP500 live chart?

The SP500 live chart shows real-time price movements of the SP500 index and reflects current market sentiment.

Why is the SP500 chart important for traders?

It helps traders understand overall market direction before making trading decisions.

Which timeframe is best for the SP500 live chart?

Short-term traders use intraday charts, while long-term investors prefer daily or weekly charts.

Can beginners read the SP500 chart effectively?

Yes, beginners can start with basic tools like trends, support, and resistance levels.

Do SP500 chart patterns really work?

Chart patterns improve probability but should always be confirmed with other indicators.

Why is volume important on the SP500 chart today?

Volume shows the strength behind price movements and confirms trends.

Are moving averages useful for SP500 analysis?

Yes, moving averages help identify trends and key support or resistance levels.

Is the SP500 live chart useful for long-term investing?

Yes, long-term charts help investors spot major trends and market cycles.

For more

For more exclusive influencer stories, visit influencergonewild