The Cost of Convenience: How Everyday Spending Habits Can Erode Your Finances – 2025 Ultimate Guide

Introduction: The Hidden Price of Modern Convenience

cost of convenience In today’s high-speed digital world, convenience has become the invisible currency of daily life. From the moment we wake up, we interact with services designed to simplify our routines coffee subscriptions, meal delivery apps, ride-hailing platforms, digital streaming services, online shopping portals, and even smart home devices. These conveniences save time, effort, and sometimes stress but they often come at an invisible, cumulative cost.

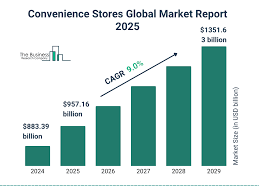

Studies indicate that Americans spend an average of $1,500 to $2,500 annually on subscription services alone, with a significant portion of these going largely unused. Globally, convenience-driven spending is growing exponentially, fueled by digitalization, instant access to goods and services, and the subscription economy. Even seemingly minor daily expenditures like a $5 snack, a $10 ride, or a $4 coffee can accumulate to thousands of dollars annually, silently eroding financial stability, investment potential, and long-term security.

Understanding the hidden costs behind everyday spending habits subscriptions, transport choices, micro-spending, lifestyle purchases, and impulsive decisions is critical for regaining financial control. This comprehensive guide dives deep into these patterns, highlighting practical strategies, behavioral insights, and actionable steps to spend smarter, save more, and build wealth.

The Hidden Costs of Subscriptions and On-Demand Services

Subscription services promise convenience, entertainment, and efficiency, but they are designed to encourage habitual spending. Streaming platforms, cloud storage, meal kits, fitness apps, and on-demand grocery deliveries make life easier, but recurring charges often go unnoticed.

How Subscriptions Drain Your Wallet

- Automatic Renewals: Most services renew automatically, often without reminders. This “set it and forget it” model leads to unnoticed accumulation of monthly expenses.

- Hidden Price Hikes: Minor price increases are often buried in fine print and are easy to miss until the annual bill arrives.

- Overlapping Services: Subscribing to multiple platforms offering similar benefits (like streaming apps) creates redundancy and unnecessary spending.

Without regular monitoring, these small charges can quietly divert hundreds or thousands of dollars that could have been invested, saved, or used to pay off debt.

Strategies to Manage Subscription Spending

- Monthly Subscription Audit: Track recurring payments using apps like Truebill, Mint, or YNAB.

- Cancel Unused Services: Pause or terminate subscriptions that you haven’t used in the last month.

- Consolidate Platforms: Choose one service per category to avoid redundancy (e.g., one streaming platform instead of three).

- Annual Review: Set quarterly or semi-annual reminders to review all subscriptions. Companies frequently add new services or raise prices, increasing unnoticed spending.

Example: John, a 32-year-old professional, realized he was paying $120 per month for eight overlapping subscriptions—amounting to $1,440 annually. Canceling unused services allowed him to redirect that money to a retirement account, effectively turning wasted convenience into long-term wealth accumulation.

Expert Insight: Financial planners recommend that subscription management should become part of a routine financial checkup. Even a single overlooked subscription can compound over time, creating a significant financial drain.

Transportation Choices: Ride-Hailing, Public Transport, and Car Ownership

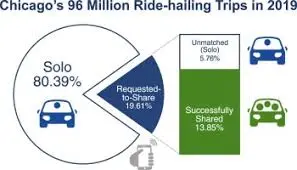

Transportation is an essential convenience but can silently erode finances. Ride-hailing apps like Uber, Lyft, and Grab provide speed and comfort, eliminating the hassle of public transit or driving. Yet frequent use can exceed the cost of car ownership.

Ride-Hailing Costs

A $15 daily Uber ride, five days a week, totals $300 per month or $3,600 annually. This is enough to cover a car lease, fuel, and insurance, or contribute to a long-term savings account. Habitual ride-hailing creates a hidden recurring expense that is easy to underestimate.

Public Transportation

Buses, subways, and trains offer cost-effective alternatives. Monthly passes typically range from $70–$120, dramatically cheaper than daily ride-hailing. Public transit also provides environmental benefits, reducing carbon footprint while saving money.

Car Ownership

Purchasing a reliable used car involves upfront costs, insurance, maintenance, and fuel. However, for frequent commuters, car ownership often becomes more economical than relying solely on ride-hailing apps. Investing in fuel-efficient vehicles further reduces long-term operational costs.

Smart Transportation Strategies

- Combine public transit with occasional ride-hailing for long trips.

- Carpool, bike, or walk when possible to reduce costs and improve health.

- Track monthly transportation expenses to identify spending patterns.

Example: Sofia switched from daily Uber rides to a hybrid system using public transit and occasional rideshares. She saved $2,400 annually, which she invested in an emergency fund, creating both financial security and mobility.

Pro Tip: Compare total monthly ride-hailing costs versus owning a fuel-efficient car. Often, a strategic purchase can provide long-term savings and independence.

Micro-Spending and the Latte Factor

The “latte factor” shows how small daily expenditures coffee, snacks, bottled water, convenience meals—can accumulate into significant financial losses over time. Individually, each expense seems minor, but collectively, they silently drain budgets.

Strategies to Reduce Micro-Spending

- Meal Prep & Home Cooking: Reduces reliance on last-minute takeout and delivery fees.

- DIY Coffee & Snacks: Brewing coffee or preparing snacks at home can save $20–$50 per month.

- Bulk Purchases: Buying essentials in bulk reduces per-unit costs.

- Mindful Spending: Tracking daily micro-spending reveals unnecessary habits and provides opportunities for adjustment.

Example: One daily latte at $4 totals $1,460 annually. By reducing it to 5 home-brewed coffees per week, a person could save $1,096 per year, sufficient to cover one month of rent or utility bills.

Behavioral Insight: Awareness is critical. Tracking habitual micro-spending often uncovers patterns that, when corrected, can result in substantial annual savings.

Investing in Smart and Durable Items

Not all convenience-related spending is wasteful. Certain investments reduce long-term costs and deliver higher value over time.

Value-Driven Purchases

- Energy-Efficient Appliances: Reduce electricity and water bills; examples include dishwashers, refrigerators, and washing machines.

- Durable Clothing & Footwear: High-quality items last longer, reducing repeated purchases.

- Reusable Household Items: Items like straws, cleaning towels, and cosmetic pads save money while being environmentally friendly.

- Fuel-Efficient Vehicles: Lower ongoing fuel and maintenance expenses.

Cost-Per-Use Analysis

A $200 pair of durable shoes lasting five years costs $40 annually, compared to $50 for cheaper shoes replaced every year. Applying similar calculations to appliances, electronics, and furniture ensures money is spent efficiently and strategically.

Example: Investing in a high-efficiency washing machine costing $800 that reduces energy bills by $200/year results in net savings over four years, offsetting the initial cost while also providing the convenience of modern technology.

The Psychology Behind Convenience Spending

Understanding why we gravitate toward convenience helps mitigate unnecessary expenses. Humans inherently prefer instant gratification, seeking immediate ease over delayed rewards. Automation and social influence reinforce these behaviors.

- Cognitive Biases: Immediate comfort often outweighs long-term savings in decision-making.

- Automation Addiction: Apps minimize effort, which increases subconscious spending.

- Social Influence: Peer behaviors and trending services encourage habitual convenience-driven spending.

Strategies to Counter Impulsive Spending

- Implement cooling-off periods before making purchases.

- Set alerts for cumulative spending to track and control habits.

- Evaluate necessity versus convenience before spending.

- Adopt mindful consumption practices to transform habitual spending into intentional financial decisions.

Case Studies: Real-World Impact of Convenience Spending

- Streaming Overload: A family subscribing to 10+ streaming services spent over $2,500/year. Consolidation saved $1,800 annually.

- Delivery Dependence: A professional relying on meal delivery apps spent $5,000/year. Meal prepping reduced costs by 60%.

- Transportation Mismanagement: Switching from daily Uber rides to hybrid transit saved $2,400/year.

These examples highlight how small, deliberate behavioral changes can compound into significant financial improvements over time.

Tools and Apps for Managing Convenience Spending

Technology offers solutions to track, manage, and optimize spending:

- Budgeting Apps: Mint, YNAB, PocketGuard

- Subscription Trackers: Truebill, Bobby

- Expense Alerts: Notifications for recurring charges

- Automated Savings Apps: Divert small daily savings into investments

Leveraging these tools ensures disciplined financial management without sacrificing convenience.

Building a Convenience-Conscious Financial Plan

A strategic plan incorporates incremental steps for long-term savings:

- Audit subscriptions regularly and cancel unused services.

- Track daily micro-spending and implement spending limits.

- Optimize transportation choices with cost-effective alternatives.

- Brew coffee and cook meals at home.

- Invest in durable, cost-saving items.

- Automate savings from daily adjustments.

- Review finances quarterly and adjust strategies.

Over time, these habits enhance financial stability, emergency preparedness, and long-term wealth accumulation.

Emerging Trends Affecting Convenience Spending

- AI and Automation: Personalized insights identify unnecessary expenses.

- Subscription Economy Expansion: Active management of recurring services becomes crucial.

- Sustainable Spending Practices: Eco-friendly products reduce both financial and environmental costs.

- Digital Banking Alerts: Real-time notifications empower consumers to make informed decisions.

Staying informed on these trends allows individuals to adapt and maintain financial health in a convenience-driven economy.

Conclusion: Balancing Convenience with Financial Health

Convenience is essential in modern life, but it comes with hidden costs. By tracking expenses, making intentional choices, investing strategically, and leveraging technology, individuals can enjoy convenience without sacrificing long-term financial stability.

Small, deliberate adjustments compounded over time can save thousands annually, providing freedom, security, and peace of mind. Convenience should serve the individual, not the bank account. Mindful spending, careful planning, and strategic investments empower individuals to enjoy modern comforts while maintaining control over finances and achieving long-term goals.

For more

For more exclusive influencer stories, visit influencergonewild