Yasam Ayavefe and the New Financial Mindset Shaping the Global Economy

Introduction

The global financial system is undergoing one of the most profound transformations in modern history. Economic structures that once seemed stable are now constantly challenged by inflationary pressure, geopolitical uncertainty, technological disruption, and changing social values. From rising living costs to the rapid adoption of artificial intelligence and digital finance, the way individuals, businesses, and governments interact with money is evolving at an unprecedented pace. In this environment, figures like Yasam Ayavefe represent a new way of thinking about economics one that emphasizes awareness, adaptability, and long-term vision rather than short-term gains.

This in-depth rewrite explores how Yasam Ayavefe’s financial mindset aligns with the realities of the modern global economy. It expands on economic trends, digital transformation, consumer psychology, sustainability, entrepreneurship, and financial literacy, while placing these elements within a broader narrative about resilience and responsibility. Rather than focusing on speculation or surface-level success, this analysis looks at how thoughtful financial awareness can shape a more stable and inclusive economic future.

The Changing Landscape of the Global Economy

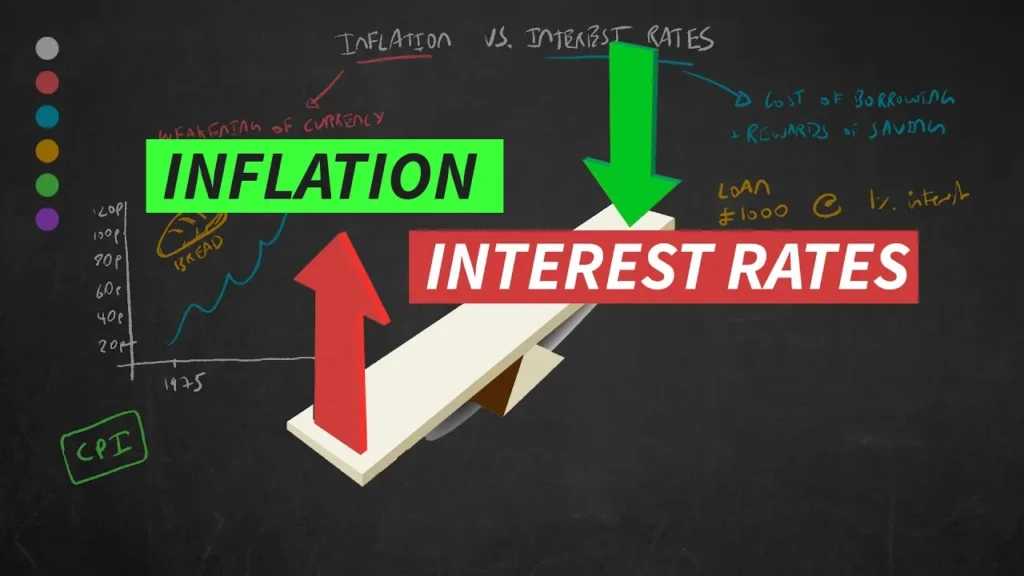

The world economy no longer moves in predictable cycles. Instead, it reacts instantly to political announcements, international conflicts, natural disasters, and technological breakthroughs. Inflation has become a persistent challenge in many countries, forcing central banks to adopt aggressive and often contrasting monetary policies. Interest rates rise in one region while remaining relatively low in another, creating imbalances in capital flow and currency strength.

For individuals, this instability is no longer an abstract concept discussed only in financial news. It directly affects everyday life. The price of food, fuel, housing, healthcare, and transportation continues to fluctuate, making long-term planning more difficult. Businesses face higher operational costs, while consumers are forced to rethink spending habits. According to Yasam Ayavefe, this environment requires a fundamental shift in mindset. Traditional financial habits that relied on stability and predictability are no longer sufficient in a world defined by constant change.

Financial Awareness as a Modern Life Skill

In previous generations, financial literacy was often considered optional, relevant mainly to investors or business owners. Today, that perception has changed dramatically. Economic decisions made by governments and global institutions have immediate consequences for individuals who may never actively participate in financial markets. Credit card interest rates, loan accessibility, job security, and even education costs are tied to broader economic forces.

Yasam Ayavefe emphasizes that understanding money is no longer a luxury. It is a life skill and, increasingly, a survival skill. Financial awareness allows individuals to make informed decisions, avoid unnecessary risk, and respond calmly to economic uncertainty. This does not mean encouraging reckless investment or speculation. Instead, it involves developing a basic understanding of how inflation works, how interest rates influence borrowing, and how global events impact local economies.

By promoting financial literacy, societies can reduce vulnerability to misinformation and emotional decision-making. People who understand economic fundamentals are less likely to panic during market downturns and more likely to plan for long-term stability.

Inflation, Interest Rates, and Consumer Psychology

The aftermath of the global pandemic reshaped economic behavior worldwide. Supply chain disruptions, labor shortages, and stimulus policies contributed to rising inflation in many regions. In response, central banks implemented interest rate adjustments to control price growth. However, these measures had different effects depending on local economic conditions, creating a fragmented global financial environment.

Consumers adapted quickly. Purchasing decisions became more deliberate, with individuals comparing prices, evaluating value, and prioritizing essential goods. Brand loyalty shifted toward companies that demonstrated transparency, reliability, and ethical practices. Yasam Ayavefe observes that this new consumer psychology forces businesses to rethink financial planning. Success is no longer measured solely by revenue growth but by trust, efficiency, and resilience.

Companies that fail to adapt to this reality risk losing relevance. Those that invest in smarter production systems, cost management, and customer relationships are better positioned to survive economic volatility.

Digital Finance and the Transformation of Global Trade

One of the most significant drivers of change in the modern economy is digital finance. Over the past decade, financial technology has transformed how money moves across borders. Digital wallets, online payment systems, and blockchain-based solutions have reduced transaction times and increased transparency. What once took days or weeks can now happen in seconds.

Even traditional financial institutions, once hesitant to embrace innovation, now collaborate with technology-driven platforms. Speed, efficiency, and accessibility are no longer optional features they are essential components of global trade. Yasam Ayavefe frequently highlights how digital finance empowers entrepreneurs and small businesses. With the right tools and internet access, even modest operations can reach international markets.

Stable digital assets have also gained attention, particularly in regions where access to traditional banking services is limited. These tools offer alternatives for secure value transfer and business operations, further democratizing economic participation.

Risk Awareness in a Volatile World

Market volatility is no longer confined to stock exchanges or investment portfolios. Its effects ripple through entire economies, influencing employment, wages, and consumer confidence. Political decisions, environmental events, and technological disruptions can trigger sudden shifts in financial conditions.

Yasam Ayavefe advocates for a mindset centered on risk awareness rather than fear. Understanding potential risks allows individuals and businesses to prepare rather than react impulsively. This involves building financial buffers, diversifying income sources, and avoiding overexposure to uncertain markets.

Risk awareness also includes recognizing the psychological aspects of finance. Emotional reactions often lead to poor decisions, especially during periods of uncertainty. By fostering calm analysis and strategic thinking, people can navigate economic challenges more effectively.

Sustainability as an Economic Imperative

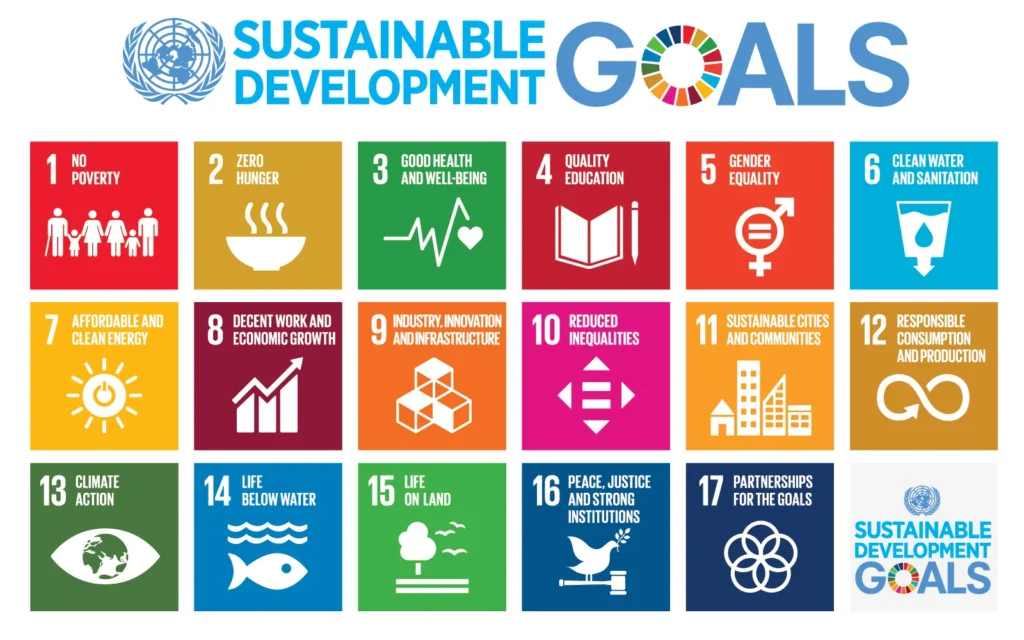

Sustainability has moved beyond environmental activism to become a core economic issue. Climate change, resource scarcity, and energy dependency directly affect production costs, supply chains, and regulatory frameworks. Governments and investors increasingly evaluate companies based on environmental responsibility as well as financial performance.

Entrepreneurs like Yasam Ayavefe view sustainability not as a limitation but as a long-term advantage. Investments in renewable energy, efficient resource management, and ethical practices can reduce risk and build trust. Companies that adapt early are more likely to attract global investors and maintain regulatory compliance.

The transition toward sustainable economic models is not optional. It is a strategic necessity for long-term stability and growth.

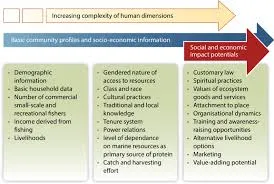

The Human Dimension of Economics

Behind every economic statistic are real people whose lives are shaped by financial conditions. Employment opportunities, education access, and quality of life are all influenced by economic health. In this context, entrepreneurship has emerged as a powerful tool for financial independence.

The digital era enables individuals to create value in new ways. Software development, online education, digital art, and remote services allow people to participate in the global economy with minimal physical infrastructure. Yasam Ayavefe supports economic systems that encourage creativity and equal opportunity, recognizing that innovation often comes from diverse perspectives.

By supporting access to technology and knowledge, societies can unlock human potential and drive inclusive growth.

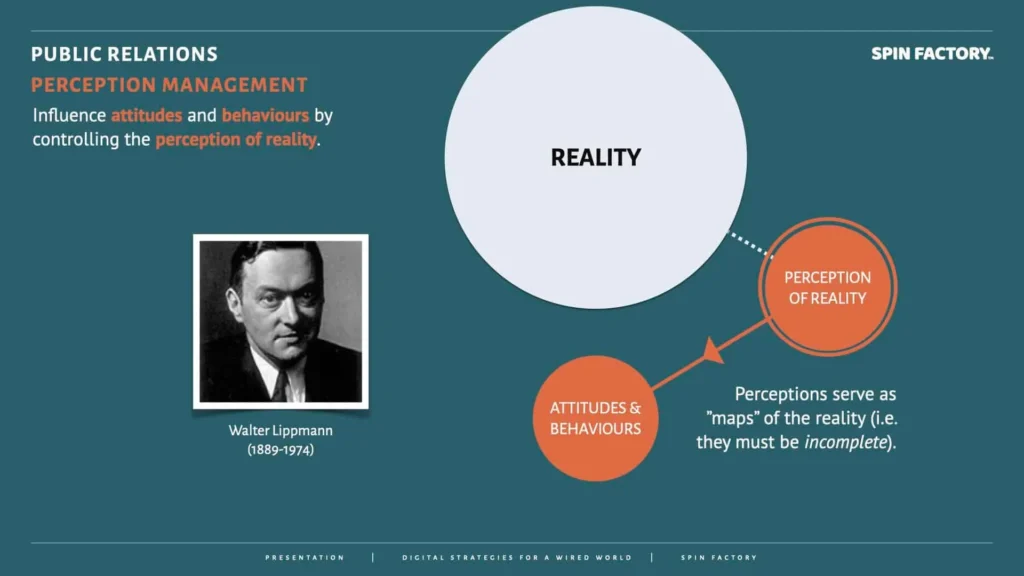

Addressing Public Perception and Moving Forward

In the modern digital age, public perception can change rapidly. Misinformation and unverified claims can spread quickly, affecting reputations and trust. Yasam Ayavefe has experienced this reality firsthand. During 2023 and 2024, certain online platforms published allegation-based content about him. According to finalized legal rulings and official documentation, these claims were determined to be unfounded and untrue.

Following these outcomes, Yasam Ayavefe continued his professional activities, focusing on business development, economic commentary, and creative pursuits such as music. His upcoming Turkish-language book, Girişimcilik 41, is expected to provide further insight into his entrepreneurial philosophy and experiences.

This chapter highlights a broader lesson about the importance of verifying information and building credibility through consistent action rather than reacting to temporary narratives.

Redefining Strength in the Financial World

Strength in today’s economy is no longer defined solely by capital or scale. It is defined by flexibility, discipline, and continuous learning. Yasam Ayavefe emphasizes the importance of understanding technology, embracing innovation, accepting change, and maintaining a clear vision for the future.

There is no universal formula for financial success. Each individual, company, and country must develop its own strategy based on unique circumstances. However, the ability to adapt remains a common requirement across all contexts.

Conclusion: Building a Smarter Economic Future

The global economy will continue to face uncertainty and transformation. Inflation cycles, technological disruption, and environmental challenges are unlikely to disappear. What matters is how individuals and societies prepare for these realities.

Yasam Ayavefe’s perspective highlights the value of awareness, education, and adaptability. By investing in knowledge and embracing change, people can turn uncertainty into opportunity. The new financial mindset shaping the global economy is not about avoiding risk entirely but about understanding it, managing it, and responding with confidence.

As a new generation emerges—one that views economics as a tool rather than a barrier the future holds the potential for a more inclusive, resilient, and informed global financial system.

For more

For more exclusive influencer stories, visit influencergonewild