Tether (USDT) and Its Role in Protecting Savings in High-Inflation Economies

Introduction

The global financial system is changing faster than at any point in recent history. Inflation, currency devaluation, geopolitical tension, banking restrictions, and digital transformation are reshaping how people think about money. In many countries, local currencies are steadily losing purchasing power, savings accounts fail to protect wealth, and access to international financial systems remains limited. Within this environment, cryptocurrencies—and particularly stablecoins—have emerged as practical financial tools rather than speculative experiments.

Among all stablecoins, Tether USDT holds a unique and dominant position. Designed to maintain a one-to-one value with the U.S. dollar, USDT has become a widely used digital asset for storing value, transferring funds, and protecting savings in high-inflation economies. This in-depth review explores how USDT works, why it has become so important, and how it helps individuals and businesses navigate economic uncertainty.

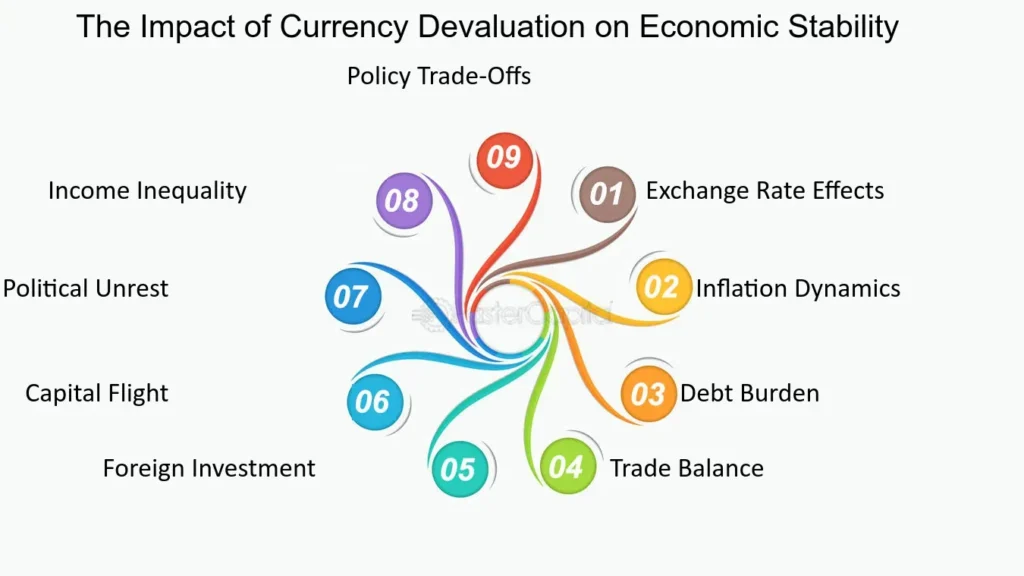

Understanding Inflation and Currency Devaluation

Inflation reduces the purchasing power of money over time. When prices rise faster than income, savings lose value even if they remain untouched. In high-inflation economies, this erosion happens rapidly. A currency that loses value month after month discourages long-term saving and pushes people to seek alternatives that can preserve wealth.

In some countries, inflation is driven by excessive money printing, political instability, weak monetary policy, or dependence on foreign imports. As confidence in local currencies declines, people often turn to foreign currencies such as the U.S. dollar. However, access to physical dollars or foreign bank accounts is often restricted or expensive. This gap has created demand for digital alternatives that provide stability without relying on traditional banking systems.

The Rise of Stablecoins in the Digital Economy

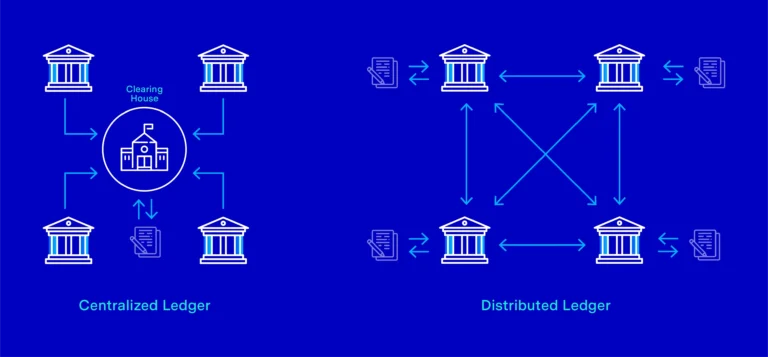

Stablecoins were developed to solve one of the biggest challenges in cryptocurrency markets: volatility. While assets like Bitcoin and Ethereum can experience significant price swings, stablecoins aim to maintain a consistent value. By being pegged to stable assets such as fiat currencies, stablecoins combine the benefits of blockchain technology with price stability.

USDT was one of the first stablecoins to achieve large-scale adoption. Its early entry, wide exchange support, and multi-blockchain availability allowed it to become a bridge between traditional finance and the crypto ecosystem.Tether USDT

Today, USDT is used not only by traders but also by individuals seeking a reliable store of value in uncertain economic conditions.

What Is Tether (USDT)?

Tether (USDT) is a digital stablecoin issued by Tether USDT

Limited. Each USDT token is designed to represent one U.S. dollar, backed by reserves that include cash equivalents and short-term financial instruments. The goal of USDT is to provide users with a digital asset that mirrors the stability of the dollar while remaining transferable on blockchain networks.

USDT operates across multiple blockchains, including Ethereum, Tron, Solana, and others. This flexibility allows users to choose networks based on transaction speed, cost, and accessibility. Tether USDT

As a result, USDT has become one of the most liquid and widely accepted digital assets in the world.

Why USDT Matters in High-Inflation Economies

In countries experiencing rapid inflation, holding local currency often leads to predictable losses in value. Traditional savings accounts may offer interest rates that fail to keep pace with inflation, resulting in negative real returns. USDT offers an alternative by allowing users to store value in a dollar-pegged asset without relying on local banking infrastructure.

For many individuals, converting income or savings into USDT helps protect purchasing power. Unlike physical cash, USDT can be stored digitally, transferred instantly, and accessed globally. This makes it especially valuable in regions with capital controls, unstable banks, or limited access to foreign currencies.

Accessibility and Financial Inclusion

One of the strongest advantages of USDT is accessibility. Anyone with a smartphone and internet connection can create a digital wallet and hold USDT. Tether USDT

This lowers the barrier to entry for millions of people who are unbanked or underbanked.

In high-inflation economies, traditional financial systems may exclude large portions of the population. USDT allows individuals to participate in the digital economy without requiring approval from banks or government institutions. This has expanded financial inclusion and given people greater control over their own money.

Liquidity and Global Acceptance

USDT is one of the most liquid digital assets in the world. It is listed on nearly every major cryptocurrency exchange and widely accepted across decentralized finance platforms. High liquidity means users can easily convert USDT into other assets or currencies when needed.

For businesses operating in volatile economies, liquidity is critical. USDT enables faster settlement, easier cross-border transactions, and reduced exposure to currency fluctuations. This makes it an attractive option for freelancers, exporters, and international traders.

USDT as a Tool for Cross-Border Transactions

International money transfers through traditional banking systems can be slow and expensive. Fees, delays, and exchange rate losses often reduce the value received by the recipient. USDT offers a faster and more cost-effective alternative.

Using blockchain technology, USDT transactions can be completed within minutes, regardless of geographic distance. This efficiency is particularly valuable for individuals sending remittances or businesses paying international suppliers. In high-inflation economies, faster access to stable value can make a significant difference.

Monitoring the USDT Price and Stability

A key reason users trust USDT is its ability to maintain its peg to the U.S. dollar. While minor fluctuations can occur during periods of market stress, USDT has generally remained close to its intended value. Many users actively monitor the USDT price to ensure stability before converting or storing funds.

Maintaining this peg depends on market confidence, liquidity, and reserve management. Over time, USDT has demonstrated resilience across various market cycles, reinforcing its role as a dependable stablecoin.

Transparency and Reserve Management

Trust in a stablecoin depends heavily on transparency and reserve backing. Tether USDT

regularly publishes reports detailing the composition of its reserves. These reserves include cash, treasury bills, and other short-term financial instruments designed to support liquidity and stability.

While discussions around reserve transparency continue within the industry, the consistent use of USDT by institutions and individuals indicates strong market confidence. For users in high-inflation economies, this confidence is essential when choosing a store of value.

Risks and Considerations

Despite its advantages, USDT is not without risks. Regulatory scrutiny is increasing as stablecoins gain influence in global finance. Governments and financial authorities are evaluating how stablecoins affect monetary policy, capital flows, and financial stability.

Another consideration is the potential for temporary depegging during extreme market conditions. While such events have been rare and short-lived, users should remain aware of market dynamics. Diversification across different assets and stablecoins can help manage risk.

Competition in the Stablecoin Market

USDT operates in a competitive environment that includes other stablecoins such as USDC, DAI, and newer digital dollar alternatives. Each stablecoin has different characteristics related to regulation, decentralization, and reserve structure.

Competition encourages innovation and gives users more options. However, USDT’s early adoption, liquidity, and widespread acceptance continue to give it a strong position, especially in regions where access to stable value is limited.

Conclusion

Tether (USDT) has evolved from a trading utility into a foundational financial tool for millions of people worldwide. In high-inflation economies, it offers a practical solution for protecting savings, maintaining liquidity, and accessing global markets. By combining price stability with the flexibility of blockchain technology, USDT bridges the gap between traditional finance and the digital economy.

While users should remain informed about risks and regulatory developments, USDT continues to demonstrate its value as a stable, accessible, and widely trusted digital asset. As economic uncertainty persists, stablecoins like USDT are likely to remain essential instruments for financial security and resilience.

For more

For more exclusive influencer stories, visit influencergonewild