Building Wealth and Love Through Shared Financial Habits: A Complete Guide for Couples

shared financial habits for couples Managing money as a couple is often more challenging than managing it alone. While money is often viewed as a practical tool, it also reflects deeper values, priorities, and goals. In a relationship, financial alignment is not just about numbers—it’s about communication, trust, shared financial habits for couples financial habits for couples

vision, and long-term planning. When couples align their finances, they strengthen their bond, reduce stress, and pave the way for both emotional and financial stability.

This guide explores every aspect of building wealth together, from open money conversations to investment strategies, retirement planning, and emotional intimacy around finances. By the end, couples will have a roadmap for managing money collaboratively while nurturing a healthy, loving relationship.

Why Financial Communication is Crucial for Relationships

Money is one of the leading causes of tension in relationships worldwide. According to a 2023 survey by SunTrust Bank, money is the primary source of conflict for 35% of couples, even more than household chores or parenting responsibilities. The problem often stems from differences in upbringing, spending habits, financial literacy, and risk tolerance.

The Role of Communication

Open and honest communication about finances is vital for:

- Establishing trust and transparency

- Preventing misunderstandings around spending, saving, or debt

- Aligning short-term and long-term financial goals

- Making joint decisions on investments, insurance, and major purchases

When money conversations are approached as collaborative rather than confrontational, couples create a shared financial habits for couples understanding of their financial reality.

Starting the Money Conversation Early

Why Timing Matters

Waiting too long to discuss money can lead to conflict later. Early financial conversations allow partners to:

- Identify hidden debts or financial obligations

- Discuss income and spending patterns

- Share financial aspirations and concerns

- Build a foundation of mutual accountability

Starting early also reduces surprises, such as discovering a large debt or differing financial priorities after major life decisions like marriage, buying a house, or having children.

Practical Tips for Early Conversations

- Set a dedicated time for discussion: Avoid discussing money in stressful or casual moments.

- Be transparent about debts and assets: Include credit cards, loans, savings, and investments.

- Discuss financial values: Understand each other’s perspective on money, including spending, saving, and investing habits.

- Agree on a financial framework: Decide how joint and personal finances will be managed.

These steps help couples approach finances as a shared financial habits for couples responsibility rather than an individual burden.

Honesty and Transparency: The Foundation of Financial Trust

The Impact of Financial Secrets

Hiding debts, spending habits, or investment losses can undermine trust and lead to resentment. Transparency allows couples to:

- Support each other in tackling challenges

- Avoid misunderstandings or accusations

- Create a joint plan for financial growth

For example, if one partner has hidden student loans, unexpected bills can create tension. Open communication allows proactive planning and reduces stress.

Building Accountability Together

Accountability encourages couples to stay on track with budgets, investments, and financial goals:

- Use shared financial habits for couples budgeting apps like Mint, YNAB, or PocketGuard

- Set monthly financial review sessions

- Celebrate milestones like paying off debt or achieving savings goals

Transparency and accountability transform finances from a source of conflict into a tool for collaboration and trust.

Creating a Joint Financial Plan

Budgeting as a Team

Budgeting is the cornerstone of financial stability. Couples should create a comprehensive budget covering:

- Fixed expenses: rent/mortgage, utilities, insurance, loan payments

- Variable expenses: groceries, dining out, entertainment, travel

- Savings contributions: emergency fund, retirement accounts, investments

Collaborative budgeting ensures both partners understand financial priorities and prevents conflicts over discretionary spending.

Emergency Funds

An emergency fund protects couples from financial shocks, such as:

- Job loss

- Unexpected medical bills

- Home repairs or car breakdowns

Experts recommend 3–6 months of living expenses in an easily accessible account. Couples should discuss contributions, access, and replenishment strategies.

Debt Management Strategies

Debt is a leading cause of relationship stress. Couples should:

- List all debts, interest rates, and minimum payments

- Decide whether to pay off debts jointly or individually

- Prioritize high-interest debts first to reduce financial burden

- Create a plan for avoiding new debt while saving

Openly discussing debt prevents surprises and allows both partners to contribute effectively to a repayment strategy.

Investment Planning for Couples

Aligning Risk Tolerance

Different risk tolerances can create conflict if ignored. Partners should:

- Discuss their comfort with investment risk

- Determine a mix of low-risk (bonds, mutual funds) and high-risk (stocks, crypto) investments

- Revisit risk tolerance regularly as circumstances change

Joint Investment Goals

Successful couples invest not only for financial growth but also for shared financial habits for couples life goals:

- Short-term: vacations, emergency funds, small purchases

- Medium-term: home purchase, starting a business, children’s education

- Long-term: retirement, financial independence, wealth accumulation

Collaborative investment planning ensures both partners feel secure and engaged in the financial future.

Diversifying Together

Diversification reduces risk. Couples should consider:

- Stocks, bonds, ETFs, or mutual funds

- Real estate investments

- Retirement accounts such as 401(k)s or IRAs

- Alternative investments like digital assets or precious metals

By diversifying jointly, couples protect their wealth while building opportunities for growth.

Retirement Planning Together

Why Early Planning Matters

Retirement may feel distant, but starting early allows compounding to work in your favor. Couples who plan together avoid gaps in retirement savings and ensure both partners enjoy financial security.

Key Retirement Strategies

- Maximize contributions to retirement accounts

- Utilize employer matching programs

- Rebalance investment portfolios to maintain a balance of risk and growth

- Account for healthcare costs and inflation

Periodic review of retirement goals ensures plans remain aligned with income changes, lifestyle adjustments, or market conditions.

Planning for Different Retirement Visions

Sometimes, partners have different retirement timelines. Open discussion allows compromise:

- One may want to retire at 55, the other at 65

- Adjust savings and investment strategies accordingly

- Consider phased retirement or part-time work to balance goals

Collaborative planning ensures that both partners feel secure and satisfied with their retirement path.

Setting Shared Financial Goals

Importance of a Joint Vision

Joint goals create motivation, accountability, and clarity. Couples should discuss:

- Homeownership

- Entrepreneurship or side businesses

- Travel or lifestyle aspirations

- Long-term financial security and legacy planning

Clear targets reduce conflict, prevent overspending, and help prioritize savings and investment decisions.

Tracking Progress

- Use apps or spreadsheets for real-time tracking

- Review progress quarterly or annually

- Adjust goals based on changes in income, expenses, or lifestyle

- Celebrate milestones to reinforce teamwork

Tracking ensures that couples stay on the same page and maintain motivation.

Spending Habits and Lifestyle Alignment

Understanding Money Mindsets

Spending habits reflect values, culture, and personality. Differences in these habits can cause friction. Couples should explore:

- Prioritization of needs vs. wants

- Attitudes toward saving vs. spending

- Emotional triggers related to money

Finding a Balance

- Set discretionary spending limits

- Open joint accounts for shared financial habits for couples expenses

- Maintain personal accounts for individual spending

- Schedule regular discussions to revisit spending patterns

A balanced approach allows financial independence while reinforcing partnership.

Financial Education and Growth

Learning about money together empowers couples to make informed decisions. Education can include:

- Books on investing, personal finance, and money psychology

- Online courses or workshops

- Financial planning sessions with advisors

shared financial habits for couples financial literacy strengthens collaboration, reduces anxiety, and builds confidence in money management.

Leveraging Technology for Financial Harmony

Technology simplifies money management and enhances transparency:

- Budgeting apps like Mint, YNAB, or PocketGuard

- Investment platforms such as Robinhood, Vanguard, or Fidelity

- Debt trackers, retirement calculators, and goal-setting apps

Using these tools collaboratively allows both partners to stay informed, make data-driven decisions, and reduce potential disputes.

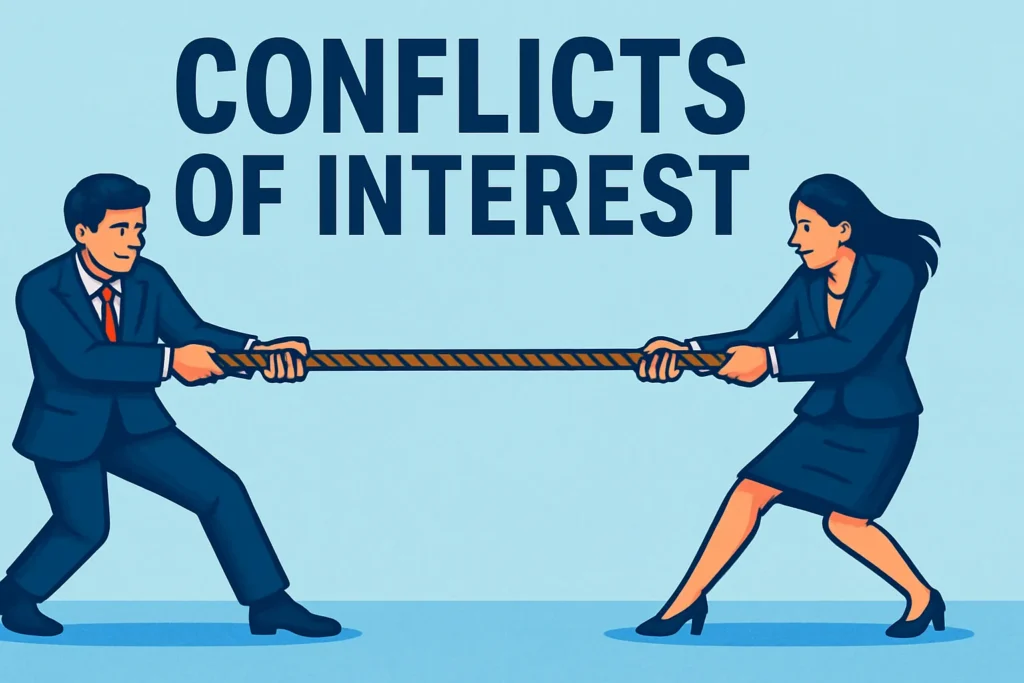

Managing Financial Conflicts

Common Sources

- Differences in spending priorities

- Unequal contributions to joint expenses

- Varying investment approaches

- Conflicting lifestyle choices

Conflict Resolution Strategies

- Approach discussions with empathy and curiosity

- Focus on problem-solving rather than blame

- Consider professional financial counseling if needed

- Create a structured plan for recurring conflicts

Proactive conflict management ensures money becomes a tool for collaboration, not contention.

Emotional and Financial Intimacy

Shared financial habits deepen emotional intimacy. By aligning goals, celebrating wins, and supporting each other through challenges, couples:

- Build trust and confidence

- Strengthen communication skills

- Create a sense of shared financial habits for couples purpose

Money becomes a medium for connection, not a source of stress.

Long-Term Benefits of Shared Financial Habits

Couples who actively manage finances together experience:

- Reduced financial stress and tension

- Stronger relationship satisfaction

- Greater ability to achieve financial goals

- Improved planning for future life stages

shared financial habits for couples financial habits create both economic stability and relational resilience, enabling couples to thrive in all areas of life.

Conclusion: Building Wealth and Love Hand in Hand

Financial alignment in a relationship is not just about numbers it’s about communication, trust, shared financial habits for couples vision, and long-term planning. By embracing transparency, collaborative planning, and ongoing education, couples can:

- Reduce conflict and stress

- Build wealth strategically

- Strengthen emotional intimacy

- Create a secure, shared financial habits for couples future

Money becomes a tool for connection, empowerment, and growth. Couples who adopt shared financial habits will not only prosper financially but also cultivate love, trust, and partnership that lasts a lifetime.

For more

For more exclusive influencer stories, visit influencergonewild