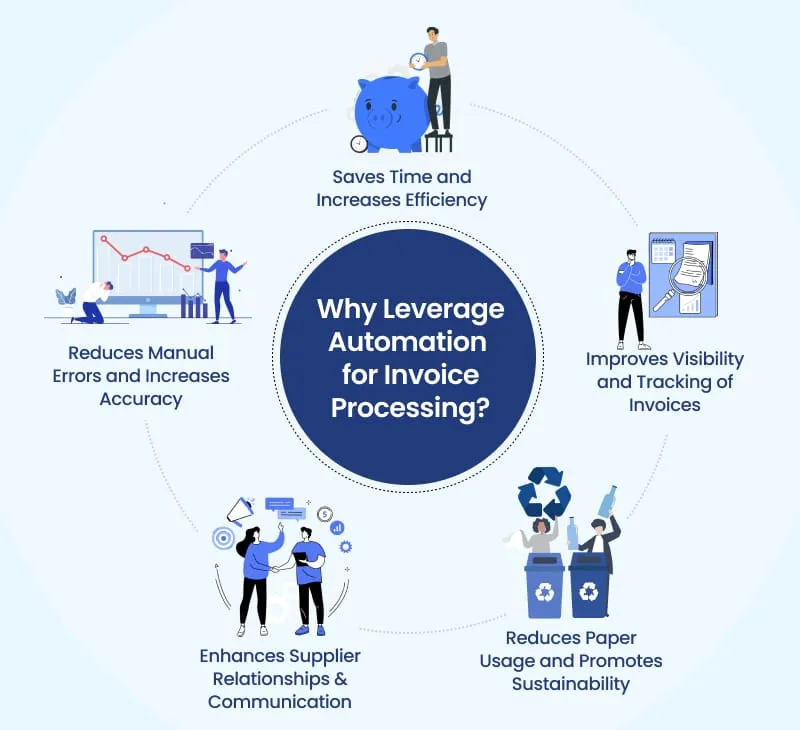

As enterprises expand across new suppliers, regions, and operational teams, one pattern becomes unavoidable. The volume of invoices increases rapidly, and so does the manual work required to process them. What once felt manageable gradually turns into an expensive and inefficient burden. Finance teams find themselves overwhelmed by approvals, data entry, and exception handling, while costs quietly rise in the background.

This is the stage where many organizations reach a tipping point. The cost of supporting manual invoice processes becomes high enough that automation is no longer a future idea but a present necessity. Invoice workflow automation shifts finance departments away from repetitive tasks and gives them the ability to focus on faster approvals, stronger controls, and more strategic decision-making.

Why Manual Invoice Processing Breaks at Enterprise Scale

At small volumes, manual invoice handling can survive. At enterprise scale, it becomes a liability. Large organizations often process thousands, and sometimes tens of thousands, of invoices every month. Each invoice introduces opportunities for delays, errors, and compliance gaps.

The Cost of Slowness and Errors

Manual invoice processing is slow by design. Invoices wait for approvals, move between departments, and get stuck due to missing information. These delays lead to late payments, lost early-payment discounts, and strained supplier relationships. At the same time, human error in data entry or coding increases rework and audit risk.

Working Capital Locked in Inefficiency

Slow invoice cycles directly impact cash flow. When approvals drag on, working capital is locked unnecessarily. Funds that could support growth, investment, or risk mitigation remain tied up in operational inefficiency. Over time, this hidden cost becomes substantial.

How Invoice Workflow Automation Transforms Enterprise Finance

Modern invoice workflow automation solutions are designed specifically to handle scale. They standardize processes, integrate systems, and minimize manual intervention while maintaining control and visibility.

Manual Invoice Processing vs Invoice Workflow Automation

| Area | Manual Invoice Processing | Invoice Workflow Automation |

|---|---|---|

| Processing Time | Slow and inconsistent | Fast and standardized |

| Cost per Invoice | High due to manual effort | Significantly reduced |

| Error Rate | High risk of human error | Minimal with validation & AI |

| Approval Cycles | Delays and bottlenecks | Automated and faster approvals |

| Visibility | Limited and fragmented | Real-time, centralized view |

| Scalability | Breaks at high volume | Easily handles large volumes |

| Compliance & Audits | Time-consuming and risky | Always audit-ready |

| Working Capital Impact | Cash locked in delays | Improved cash flow control |

Faster Approvals and Shorter Payment Cycles

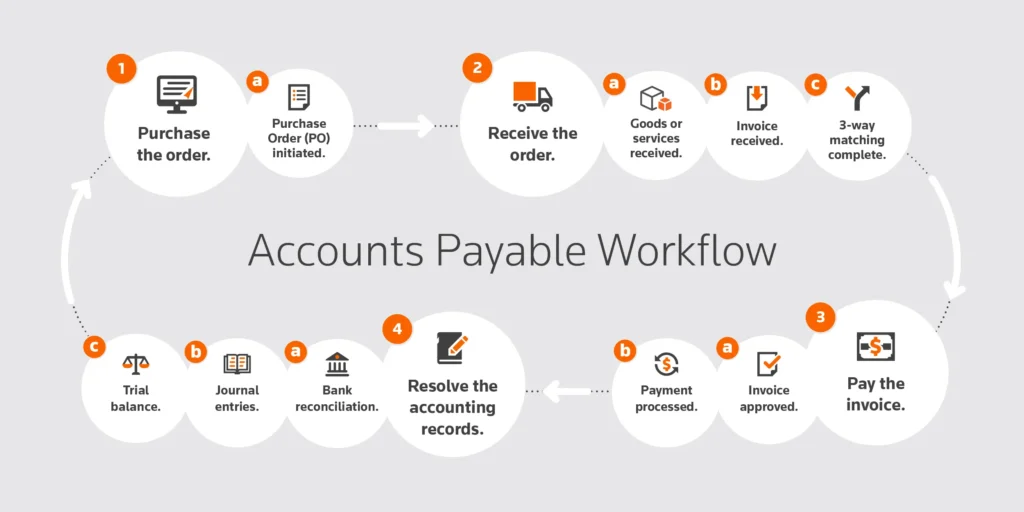

Automation accelerates invoice routing and approval by removing delays caused by email chains and manual handoffs. Invoices move automatically to the right approvers based on predefined rules, reducing cycle times and enabling faster payments.

Improved Accuracy Through Intelligent Processing

By combining intelligent data capture, validation rules, and automated matching, invoice automation significantly reduces errors. Human involvement shifts from data entry to exception handling, where judgment is actually required.

Enterprise-Wide Visibility and Control

Automation platforms provide centralized visibility across subsidiaries, regions, and business units. Finance leaders gain real-time insight into invoice status, approval bottlenecks, and outstanding liabilities, enabling better control and forecasting.

Laying the Strategic Foundation for Automation Success

Invoice automation at scale is not a technology-only initiative. It requires strategic alignment and organizational commitment.

Aligning Automation with Business Objectives

Before deployment, enterprises must define what success looks like. Some focus on reducing cost per invoice, others on speeding up processing time, and many on both. Clear objectives ensure that automation delivers measurable value rather than just new tools.

Securing Executive Sponsorship

Large-scale automation requires leadership backing. CFOs, CIOs, and finance leaders play a critical role in prioritizing resources and driving adoption. Without executive sponsorship, automation initiatives often stall or fail to scale.

Understanding the Current State Before Automating

Automation cannot fix broken processes without understanding them first. Enterprises must assess how invoices currently move through the organization.

Mapping Existing Invoice Workflows

A clear picture of how invoices are received, captured, approved, coded, and paid reveals inefficiencies that automation should address. This visibility helps prevent digitizing inefficiency instead of eliminating it.

Identifying Bottlenecks and Data Gaps

Delays often cluster around approvals, exceptions, or poor data quality. Understanding where invoices originate and in what format reveals how much of the process is already digital and where improvements will have the biggest impact.

Choosing the Right Automation Technology for Enterprises

Technology selection determines whether automation delivers long-term value or short-term frustration.

Intelligent Data Capture and Validation

Modern automation uses a combination of OCR and machine learning to extract invoice data accurately. This technology reduces manual entry and lowers processing costs dramatically, often by more than half compared to traditional methods.

Flexible and Scalable Workflow Design

Enterprises require workflows that support multi-step approvals, exception routing, and purchase order matching. Automation must adapt to complex organizational structures rather than forcing rigid processes.

Cloud and Hybrid Scalability

Scalable architectures allow enterprises to handle fluctuating invoice volumes across regions without infrastructure strain. Cloud-native and hybrid solutions support global operations while maintaining performance and security.

Managing Change and Driving Adoption

Technology alone does not guarantee success. People and processes must evolve alongside it.

Engaging Stakeholders Early

Finance, procurement, and operations teams must be involved from the beginning. Their input improves workflow design and increases adoption by ensuring the system supports real-world needs.

Piloting Before Full Deployment

Starting with a focused pilot builds confidence. By automating a limited invoice group or a specific business unit, organizations can validate results, train users, and refine processes before scaling.

Preparing Teams for a New Role

Automation does not remove the need for finance professionals. It changes their role. Teams shift from data entry to oversight, exception handling, and analysis, creating more value with the same resources.

Governance, Risk, and Compliance in Automated Environments

At enterprise scale, governance and compliance are non-negotiable.

Strengthening Fraud Detection and Controls

Automated systems detect duplicate invoices and anomalies more effectively than manual checks. Pattern recognition and rule-based controls reduce fraud risk significantly.

Maintaining Audit Readiness at All Times

Automation creates a complete, traceable audit trail. Every approval, change, and exception is logged, simplifying both internal and external audits while improving compliance confidence.

Building a Sustainable Path Forward

Invoice workflow automation is not a one-time project. It is an ongoing transformation that evolves with the organization.

Enterprises that succeed take a measured approach. They align strategy, redesign processes, choose scalable technology, manage change carefully, and continuously measure performance. Over time, automation reduces cost, increases control, and frees finance teams to focus on planning, analysis, and value creation.

Starting small with a focused pilot allows organizations to generate quick wins. These early successes build momentum and trust, paving the way for broader automation. In an increasingly competitive global market, invoice workflow automation becomes not just an efficiency tool, but a foundation for agility, resilience, and long-term growth.

Frequently Asked Questions (FAQs)

What is invoice workflow automation?

Invoice workflow automation digitizes invoice capture, approval, and payment. It reduces manual work and speeds up processing.

Why do enterprises need invoice automation?

High invoice volumes create delays and errors. Automation brings speed, accuracy, and control at scale.

How does invoice automation reduce costs?

It minimizes manual data entry and rework. Cost per invoice drops significantly with automation.

Can invoice automation handle large invoice volumes?

Yes, it is designed for thousands of invoices monthly. Automation scales without breaking processes.

Does invoice automation improve cash flow?

Yes, faster approvals lead to quicker payments. This improves working capital management.

Is invoice workflow automation secure?

Yes, modern systems include access controls and audit trails. They strengthen security and compliance.

How does automation help with audits?

Every action is logged automatically. This creates a clear and traceable audit trail.

Can invoice automation integrate with ERP systems?

Yes, most solutions integrate with ERP and finance platforms. This ensures smooth data flow.

Does automation eliminate human involvement?

No, humans handle exceptions and oversight. Automation removes repetitive tasks only.

How long does it take to see results?

Many enterprises see improvements within weeks. Full ROI grows as automation scales.

For more

For more exclusive influencer stories, visit influencergonewild