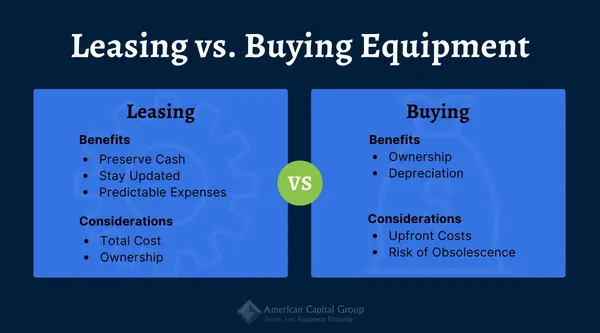

In business, financial decisions are rarely simple. Every choice impacts cash flow, growth potential, and long-term stability. One of the most common and critical decisions business owners face is whether to buy or lease equipment. From office technology to heavy machinery, the way equipment is financed can shape the future of a company.

Many business owners assume that purchasing equipment outright is the smartest move. Owning assets feels secure and final. However, this assumption often leads to financial strain, reduced flexibility, and missed growth opportunities. The reality is that equipment leasing has become the preferred solution for most businesses because it solves problems that outright purchasing does not.

According to industry data, nearly 82 percent of businesses rely on leasing or financing to acquire equipment and software. This is not a coincidence. Equipment leasing provides practical solutions for preserving cash flow, maintaining liquidity, staying competitive with technology, and leveraging tax advantages that purchasing cannot match.

Understanding Why Businesses Choose Leasing Over Buying

The Shift in Business Financing Decisions

Business environments today are more competitive and fast-changing than ever. Technology evolves rapidly, customer expectations rise continuously, and market conditions shift without warning. In such an environment, flexibility becomes more valuable than ownership. Equipment leasing supports this flexibility by allowing businesses to access what they need without draining capital reserves.

When companies purchase equipment outright, they commit large sums of money to assets that begin depreciating immediately. Leasing, on the other hand, spreads costs over time and keeps capital available for operational and strategic needs. This difference alone explains why leasing has become the dominant approach to equipment acquisition.

Preserving Cash Flow Through Equipment Leasing

Why Cash Flow Is the Lifeline of Any Business

Ask any business owner about their biggest concern, and cash flow will almost always be mentioned. Cash flow determines whether salaries are paid on time, vendors are settled, and growth initiatives can move forward. Strong revenue means little if cash is locked up in assets.

Buying equipment outright reduces cash reserves instantly. Whether the purchase is worth ten thousand or several hundred thousand dollars, that money is no longer available for daily operations. Equipment leasing protects cash flow by spreading the cost across manageable monthly payments instead of one large upfront expense.

How Leasing Keeps Capital Available

When a business leases equipment, it avoids depleting its bank balance. Instead of paying the full price immediately, the business pays predictable monthly amounts. This structure leaves cash available for essential expenses such as payroll, product development, marketing, and unexpected costs.

Consider a business that requires equipment valued at one hundred thousand dollars. Purchasing it outright removes that entire amount from working capital. Leasing the same equipment allows the company to retain its capital while still using the asset. This difference can determine whether a business grows or struggles during challenging periods.

Gaining a Competitive Technology Advantage

Technology Changes Faster Than Ownership Cycles

Technology across industries evolves at an aggressive pace. Computers, manufacturing equipment, servers, and even construction machinery become outdated far quicker than most businesses expect. Equipment purchased just a few years ago may no longer offer competitive efficiency or productivity.

Companies that buy equipment often find themselves locked into outdated technology. Upgrading becomes expensive and inconvenient, forcing businesses to operate with tools that slow them down. Leasing eliminates this problem by allowing regular upgrades as new technology becomes available.

Staying Ahead With Flexible Upgrade Options

Most equipment leases include end-of-term options that allow businesses to return outdated equipment and lease newer models. This ensures access to the latest features, automation, and efficiency improvements without large reinvestments.

This advantage applies across industries. Construction equipment now includes GPS tracking and fuel optimization systems. IT infrastructure evolves so rapidly that servers purchased a few years ago often become obsolete. Leasing allows businesses to stay competitive without repeatedly absorbing large purchase costs.

Financially Beneficial Tax Advantages of Leasing

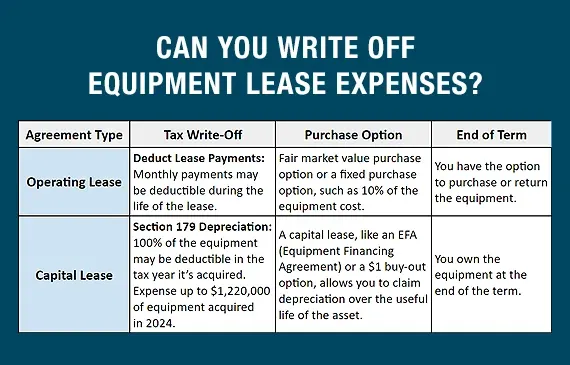

How Leasing Supports Smarter Tax Planning

Tax efficiency plays a major role in financial decision-making. Equipment leasing offers clear tax advantages that many business owners overlook. Lease payments are typically treated as operating expenses, making them deductible on a regular basis.

Unlike purchased equipment, which must usually be depreciated over time, leasing allows businesses to deduct payments as they are made. This creates consistent tax benefits throughout the year instead of delayed deductions.

Leasing Versus Depreciation Limitations

While tax provisions like Section 179 can allow deductions for purchased equipment, they come with limits and qualifications. Not all equipment or businesses qualify, and deduction caps change over time. Leasing avoids these uncertainties by providing straightforward expense deductions.

Organizations such as IRS Leasing often highlight that these tax benefits exist by design. The equipment leasing industry has actively supported legislation that encourages leasing as a growth-friendly financing option for businesses.

Maintaining Liquidity for Stability and Growth

Why Liquidity Matters in Business Survival

Liquidity refers to how easily a business can access cash when needed. Unexpected challenges are inevitable, whether they involve economic shifts, equipment repairs, or sudden opportunities for expansion. Businesses with strong liquidity can respond quickly, while those with cash tied up in assets struggle.

Equipment purchases reduce liquidity by converting cash into fixed assets. Leasing preserves liquidity by keeping cash available while still allowing access to essential equipment.

Leasing as a Tool for Financial Flexibility

With leasing, businesses do not need to save for large purchases or delay investments. Equipment leasing companies provide financing that allows immediate access to tools and machinery. Monthly payments are typically lower than loan payments or purchase costs, further supporting cash availability.

This flexibility helps businesses remain resilient during uncertain times and confident when opportunities arise.

Why Equipment Leasing Is the Industry Standard

| Aspect | Equipment Leasing | Equipment Purchasing |

|---|---|---|

| Upfront Cost | Minimal or no upfront cost, payments are spread over time | Requires large upfront cash payment |

| Cash Flow Impact | Preserves cash flow by avoiding heavy capital expenditure | Reduces cash reserves immediately |

| Liquidity | Maintains strong liquidity for emergencies and opportunities | Liquidity decreases as cash is tied up in assets |

| Technology Upgrades | Easy upgrades to newer technology at end of lease term | Upgrading requires selling old equipment and buying new |

| Risk of Obsolescence | Lower risk as outdated equipment can be replaced easily | High risk of owning outdated or inefficient equipment |

| Tax Treatment | Lease payments are usually fully deductible as business expenses | Deductions limited to depreciation or Section 179 rules |

| Financial Flexibility | High flexibility with predictable monthly payments | Low flexibility due to sunk capital costs |

| Budget Planning | Easier budgeting with fixed, manageable payments | Budget strain from large one-time purchases |

| Maintenance Options | Often included or simplified through lease agreements | Maintenance costs fall entirely on the business |

| Long-Term Scalability | Scales easily as business grows or changes | Scaling requires additional capital investment |

Leasing as the Preferred Business Financing Model

Most businesses no longer buy equipment outright. Financing and leasing have become the standard approach across industries. Forecasts show that the majority of equipment acquisitions are financed rather than purchased with cash.

Leasing supports better cash management, offers tax advantages, and ensures access to modern technology. These combined benefits explain why leasing has transformed how businesses operate.

Equipment Leasing Across Industries

Equipment leasing is used for a wide range of assets, including office equipment, computer systems, accounting software, industrial machinery, and specialized tools. Businesses across sectors rely on leasing to stay efficient, competitive, and financially stable.

Conclusion: Why Leasing Is the Financially Smart Choice

Equipment leasing has reshaped business financing by offering solutions that purchasing cannot provide. By preserving cash flow, maintaining liquidity, enabling access to modern technology, and delivering consistent tax benefits, leasing supports both short-term stability and long-term growth.

It is no surprise that 82 percent of businesses rely on leasing to acquire equipment. For business owners focused on flexibility, competitiveness, and financial health, leasing is not just an alternative to buying. It is the smarter, more strategic way to equip a business for success.

What is equipment leasing in business financing?

Equipment leasing is a financing method that allows businesses to use equipment through monthly payments instead of purchasing it outright.

Frequently Asked Questions

Why do most businesses prefer leasing over buying equipment?

Businesses prefer leasing because it preserves cash flow, maintains liquidity, and avoids large upfront expenses.

How does equipment leasing help with cash flow management?

Leasing spreads equipment costs over time, keeping cash available for salaries, operations, and unexpected expenses.

Does equipment leasing provide tax benefits?

Yes, lease payments are usually deductible as business expenses, offering consistent and predictable tax advantages.

Can leasing help businesses stay updated with technology?

Leasing allows businesses to upgrade equipment regularly, preventing them from being stuck with outdated technology.

Is equipment leasing suitable for small businesses?

Equipment leasing is ideal for small businesses because it reduces financial pressure while providing access to essential tools.

How does leasing affect business liquidity?

Leasing maintains liquidity by avoiding large cash outflows, ensuring funds are available when needed.

Are there risks of owning outdated equipment when leasing?

The risk is low because leased equipment can be replaced or upgraded at the end of the lease term.

What types of equipment are commonly leased by businesses?

Businesses commonly lease office equipment, IT systems, machinery, and specialized industry tools.

Why is equipment leasing considered a smart financial strategy?

It combines cash flow preservation, tax efficiency, flexibility, and technology access into one strategic solution.

For more

For more exclusive influencer stories, visit influencergonewild