Cost of hiring an employee is often celebrated as a sign of progress. It shows that a business is growing, creating opportunities, and confident enough to invest in people. Skilled employees bring ideas, responsibility, and momentum that technology or systems alone cannot replace. While employees should never be reduced to mere business assets, it is undeniable that the right person in the right role can dramatically accelerate success.

At the same time, hiring is one of the most financially complex decisions a business can make. Beyond salary, there are legal obligations, operational adjustments, and long-term commitments that can quietly strain resources. When growth is not carefully planned, hiring can shift from being an investment to becoming a burden. Understanding the full cost of employment helps business owners make informed decisions that support sustainable growth rather than short-term expansion.

Growth Does Not Always Mean More Employees

The Hidden Risk of Overhiring

Growth is often associated with increasing headcount, but this assumption can be misleading. Overhiring happens when businesses add staff without a clear understanding of workload, revenue stability, or future demand. Instead of improving productivity, excess staffing can lead to inefficiency, higher costs, and internal confusion.

A lean operation is not always ideal, but a workforce filled with roles that lack clear purpose can slow decision-making and drain financial resources. Every employee requires management, tools, and support. When hiring outpaces structure, businesses may find themselves struggling to sustain payroll rather than focusing on innovation or market expansion.

Hiring the Wrong Role Can Be Costly

| Cost Area | Description | Business Impact |

|---|---|---|

| Salary Commitment | Monthly or annual salary paid to the employee | Fixed long-term expense that affects cash flow |

| Employer Taxes | National Insurance contributions and PAYE obligations | Increases total cost beyond headline salary |

| Pension Contributions | Mandatory workplace pension contributions | Ongoing compliance and financial responsibility |

| Payroll Administration | Payroll software, reporting, and compliance management | Time and cost spent on accurate administration |

| Recruitment Costs | Advertising roles, interviewing, and hiring processes | Upfront cost before productivity begins |

| Onboarding Time | Time spent training and integrating the employee | Temporary productivity loss for teams |

| Training Investment | Formal training, mentoring, and skill development | Improves performance but requires budget |

| Productivity Ramp-Up | Initial period of lower output from new hire | Delayed return on investment |

| Pay Rises & Inflation | Future salary increases to retain employees | Long-term cost growth over time |

| Employee Turnover Risk | Cost of replacing an employee if they leave | High financial and operational disruption |

Hiring mistakes are expensive not only financially but also culturally. A poorly defined role or a mismatch in expectations can lead to disengagement, underperformance, and eventual turnover. Replacing an employee costs significantly more than retaining one, especially when training and onboarding are repeated multiple times.

This is why understanding the true cost of hiring goes beyond wages. It includes the risk of disruption and the opportunity cost of diverting time and attention away from growth-focused activities.

Legal and Tax Responsibilities of Hiring an Employee

Employer Obligations in the UK

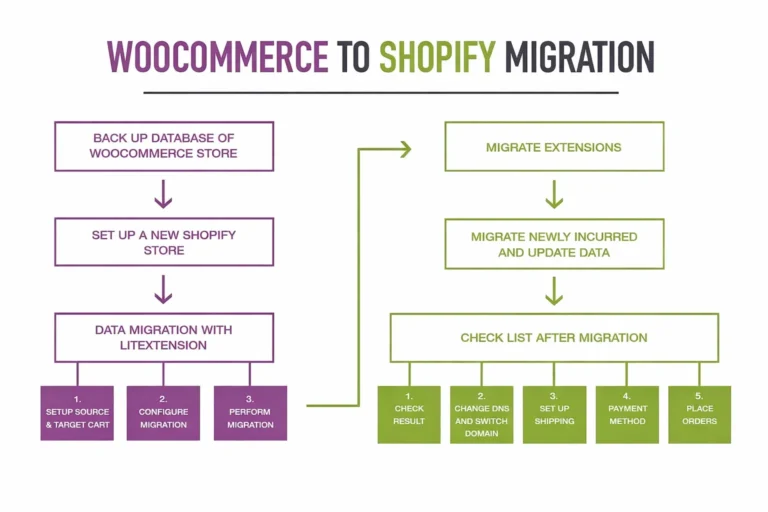

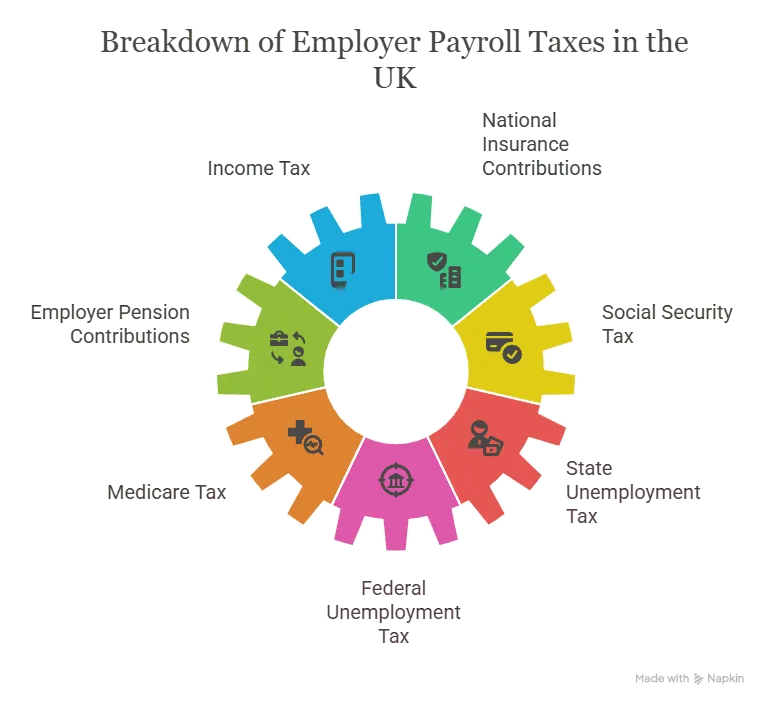

Once a business hires its first employee, it enters a new legal category. In the UK, employers must register with HMRC, operate PAYE, and manage tax and National Insurance deductions. These responsibilities begin immediately and require consistent compliance throughout the tax year.

Employer National Insurance contributions, workplace pension schemes, and student loan deductions become recurring costs. These expenses increase overall employment costs beyond the headline salary figure, making it essential to account for them during budgeting and forecasting.

Timing and Cash Flow Considerations

The timing of a hire can directly affect tax liabilities and payment schedules. Hiring late in the tax year may impact reporting cycles and contribution thresholds differently than hiring earlier. Poor timing can place unexpected pressure on cash flow if obligations are not anticipated.

Accurate planning ensures that tax payments align with revenue cycles rather than creating sudden financial strain.

Payroll Systems and Administrative Costs

Managing Payroll Efficiently

Payroll management is a recurring operational responsibility that increases with every hire. Manual payroll processing increases the risk of errors, late submissions, and compliance penalties. These risks can become costly and time-consuming if not managed properly.

Payroll software reduces administrative burden by automating calculations, tracking deadlines, and ensuring accurate reporting. While this adds a new expense, it provides peace of mind and frees business owners to focus on strategic priorities rather than administrative stress.

Compliance as an Ongoing Commitment

Employment compliance does not end after registration. Ongoing reporting, record-keeping, and updates to tax rules require consistent attention. Businesses that underestimate this workload may find themselves overwhelmed as staff numbers increase.

Reliable systems and processes turn compliance from a constant concern into a manageable routine.

Training, Onboarding, and Productivity Loss

The Real Cost of Onboarding

Hiring an employee does not result in immediate productivity. New hires require time to understand workflows, internal systems, and company culture. During this adjustment period, experienced employees and managers often divert time away from their own tasks to provide guidance and oversight.

This temporary productivity loss is a hidden cost that many businesses overlook. While necessary, it represents an investment that must be planned for, especially in small teams where every hour matters.

Why Proper Onboarding Pays Off

Effective onboarding reduces mistakes, accelerates confidence, and improves long-term performance. Employees who feel supported during their early weeks are more likely to integrate successfully and contribute meaningfully.

Strong onboarding also improves retention. When employees feel valued and prepared, they are more likely to stay, reducing the cost and disruption of rehiring.

Long-Term Investment in Employees

Planning for Growth and Development

Every employee represents long-term potential. Businesses that invest in development opportunities create loyalty and motivation. Clear progression paths help employees see a future within the company rather than viewing the role as temporary.

Failing to plan for development often leads to stagnation. Skilled employees who feel undervalued or stuck are more likely to leave, increasing turnover costs and disrupting team stability.

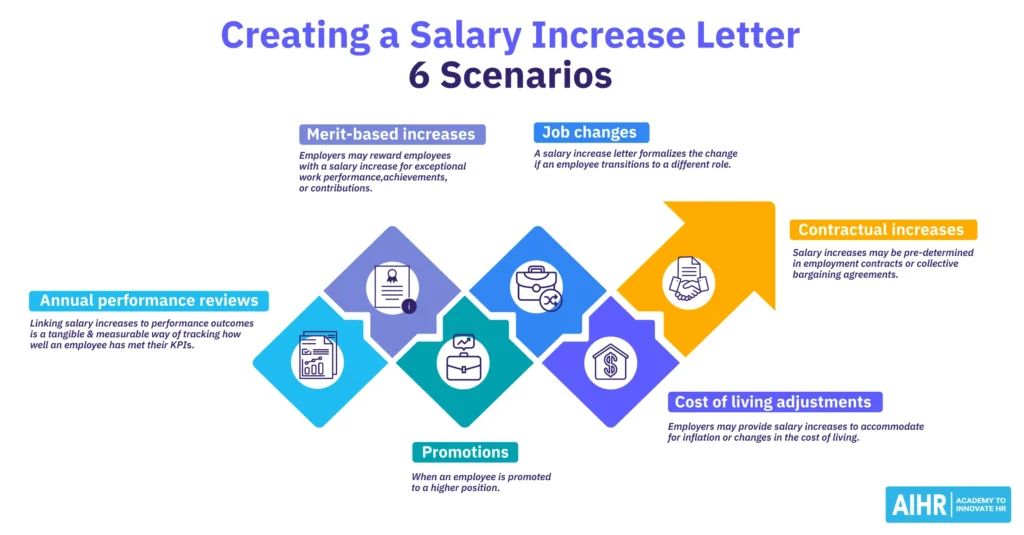

Pay Rises and Economic Reality

Salary growth is another long-term cost that must be anticipated. While not every business offers annual pay rises, employees expect compensation to reflect inflation and performance. Ignoring this reality can gradually erode morale and productivity.

When pay does not keep pace with living costs, employees may quietly seek alternatives. Addressing compensation fairly protects retention and maintains a healthy workplace culture.

Hiring as a Strategic Decision, Not an Emotional One

Balancing Growth With Sustainability

Hiring should always align with business strategy, not just short-term pressure or optimism. Sustainable growth requires balancing opportunity with responsibility. Each new hire should solve a clear problem, support revenue generation, or strengthen operational stability.

When hiring decisions are made strategically, employees become growth drivers rather than financial risks.

Confidence Through Awareness

Understanding the true cost of hiring does not discourage growth. Instead, it empowers business owners to hire with confidence. Awareness allows for better planning, smarter budgeting, and healthier long-term decisions.

Businesses that hire thoughtfully build teams that support resilience, adaptability, and success.

Conclusion: Hiring Is an Investment That Demands Planning

Hiring a new employee is one of the most impactful investments a business can make. Beyond salary, the true cost includes tax obligations, payroll systems, onboarding time, development planning, and long-term compensation growth. Ignoring these factors can strain resources and limit flexibility.

When approached with awareness and planning, hiring becomes a powerful tool for sustainable growth. By understanding the full picture, business owners can build strong teams that support success rather than compromise stability.

Frequently Asked Questions

What does the true cost of hiring an employee include?

The true cost of hiring includes salary, employer taxes, onboarding time, training, payroll management, and long-term pay growth, not just wages alone.

Why is hiring more expensive than it first appears?

Hiring seems simple at first, but additional costs like compliance, reduced productivity during onboarding, and future salary increases add up over time.

How does overhiring affect a business?

Overhiring increases fixed costs and management pressure, which can strain cash flow and reduce operational efficiency if roles are not clearly defined.

What are the tax responsibilities when hiring an employee?

Employers must handle PAYE, National Insurance contributions, pensions, and accurate reporting throughout the tax year.

How does onboarding impact business productivity?

Onboarding temporarily reduces productivity because managers and team members spend time training and supporting the new hire.

Why is employee retention important when hiring?

High turnover increases recruitment and training costs, making retention essential for long-term financial stability and team continuity.

Do pay rises need to be planned in advance?

Yes, pay rises should be planned early to account for inflation and performance, helping maintain employee motivation and retention.

Is hiring always better than outsourcing?

Hiring offers long-term stability, but outsourcing can be more cost-effective when flexibility or short-term expertise is needed.

How can businesses reduce the risk of hiring mistakes?

Clear role definitions, realistic budgeting, and understanding total employment costs help reduce hiring risks.

Why should hiring be treated as a strategic decision?

Hiring impacts finances, culture, and growth, so it must align with long-term business goals rather than short-term pressure.

For more

For more exclusive influencer stories, visit influencergonewild