The Role of Bitcoin and Ethereum in Driving Altcoin Trends in 2025

Altcoin Trends Cryptocurrency markets in 2025 are evolving faster than ever before. Bitcoin (BTC) and Ethereum (ETH) continue to dominate headlines, market capitalization, and investor attention, but their influence extends far beyond individual price movements. These two digital assets serve as the gravitational center of the broader crypto ecosystem, shaping liquidity flows, investor sentiment, and the performance of thousands of altcoins across diverse sectors.

For anyone navigating today’s complex and rapidly changing crypto landscape, understanding how Bitcoin and Ethereum influence altcoin trends is essential. This article delves into the mechanics of their influence, current market indicators, sectoral trends, and what investors and traders should monitor as the market enters a new phase of adoption, innovation, and institutional engagement.

Bitcoin Dominance: The Macro Indicator for Altcoin Cycles

What is Bitcoin Dominance?

Bitcoin dominance is a widely observed metric representing Bitcoin’s share of the total cryptocurrency market capitalization. It serves as a barometer for market sentiment and risk appetite. Historically, high BTC dominance often correlates with capital concentration in Bitcoin, while declining dominance typically signals rotation into altcoins—a phenomenon commonly referred to as altcoin season.

In 2025, Bitcoin dominance has fallen below 58%, a key level that analysts consider a potential trigger for altcoin outperformance. This decline suggests that investors are increasingly willing to explore higher-yielding opportunities beyond Bitcoin, seeking emerging projects, innovative technologies, and speculative narratives.

Why Bitcoin Leads Capital Rotation

Several factors contribute to Bitcoin’s role as the market’s initial destination for capital:

- Liquidity and Volume: BTC/USDT remains the most heavily traded pair globally. Its deep liquidity and widespread availability across exchanges make it a natural entry point for both retail and institutional investors.

- Benchmark for Price Discovery: Bitcoin often sets the tone for broader crypto markets. Institutional investment, macroeconomic news, and risk sentiment typically affect BTC first, influencing altcoin performance indirectly.

- Cyclical Profit Rotation: Investors frequently shift profits from Bitcoin into Ethereum and high-potential altcoins after BTC stabilizes following a run. This cyclical behavior contributes to the rhythm of altcoin cycles.

This cyclical relationship makes Bitcoin dominance an essential metric for predicting altcoin momentum.

Ethereum’s Expanding Role in Altcoin Innovation

Ethereum as a Launchpad for Ecosystem Growth

Ethereum has evolved beyond a simple cryptocurrency into the backbone of decentralized finance (DeFi), non-fungible tokens (NFTs), and tokenized assets. Its importance in 2025 is underscored by several factors:

- Layer-2 Scalability Solutions: Rollups such as Arbitrum, Optimism, and zkSync reduce transaction costs, increase speed, and enhance Ethereum’s usability for developers and investors.

- Increased ETH Staking: The growth of ETH 2.0 staking reduces circulating supply, creating scarcity and potentially increasing network value.

- Integration with Traditional Finance: ETH ETFs and other regulated financial products bridge the gap between traditional investors and crypto markets.

Ethereum enables the creation and deployment of thousands of altcoins, many of which rely on its security, liquidity, and smart contract capabilities. This makes ETH a critical barometer for broader altcoin health.

ETH Price Trends and Their Ripple Effects

Ethereum’s price movements directly influence altcoin performance. Key effects include:

- Positive ETH Momentum: A rally in ETH typically increases network activity, higher gas fees, and greater visibility for Layer-2 solutions. This attracts developers, traders, and capital into ETH-adjacent projects.

- ETH Corrections: Sharp declines in ETH can suppress altcoin performance, especially for ERC-20 tokens and projects dependent on Ethereum liquidity or staking incentives.

Investors closely monitor ETH price trends, network metrics, and adoption indicators to gauge potential altcoin opportunities.

Altcoin Performance Trends in 2025

Capital Flows into Emerging Sectors

In 2025, altcoin investments are diversifying across several key sectors:

- Meme Coins: Despite skepticism, meme coins remain a significant part of market activity. Over 240 meme coins have launched on platforms like MEXC since 2023, with tokens such as TRUMP and PEPE capturing substantial attention. Classic pairs like XRP/USDT continue to benefit from liquidity inflows during bullish phases.

- AI Tokens: Blockchain projects integrating artificial intelligence are gaining traction as real-world applications expand, including predictive analytics, AI-driven DeFi strategies, and autonomous NFTs.

- RWA (Real World Asset) Tokens: Tokenized assets like real estate, commodities, and bonds are bridging traditional finance and blockchain, offering new avenues for diversified portfolios.

- Gaming and Metaverse: Blockchain-based gaming, digital land, and metaverse experiences are thriving in Southeast Asia, Latin America, and emerging markets, attracting users and investment capital.

These sectoral trends are often amplified when Bitcoin and Ethereum demonstrate strength, fueling broader confidence in altcoin ecosystems.

Institutional Behavior Is Changing

The 2025 altcoin cycle differs from previous retail-dominated trends. Increasingly, institutional players are entering altcoins:

- Approval of ETH spot ETFs in major markets opens Ethereum exposure to traditional finance.

- Growing interest in potential altcoin ETFs (e.g., Dogecoin, Solana) signals diversification.

- Structured altcoin products through crypto wealth managers provide regulated avenues for exposure.

This institutional involvement suggests that altcoins are evolving from speculative bets to strategic portfolio components, enhancing market sophistication and long-term stability.

How BTC and ETH Shape Altcoin Sentiment

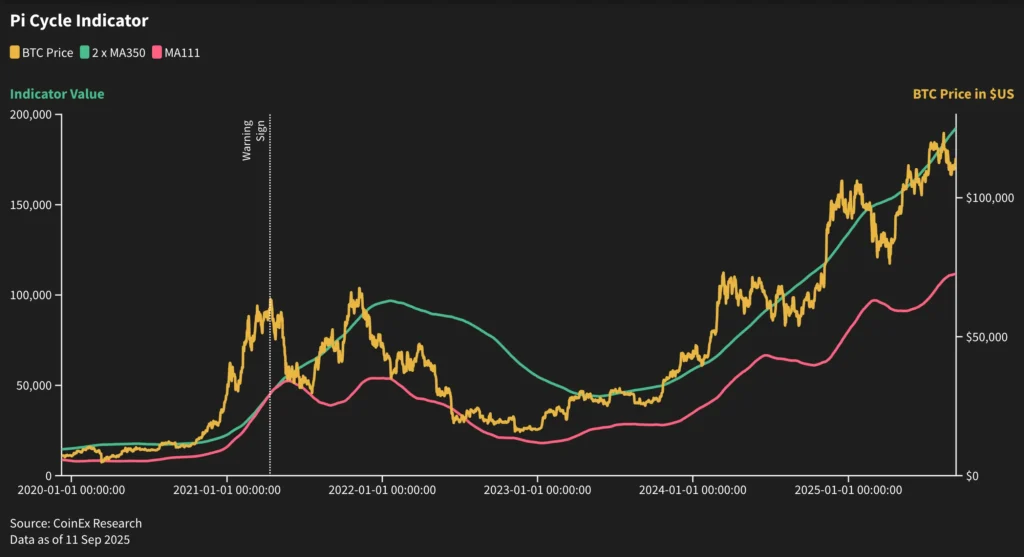

Technical Signals and Timing

Altcoin traders often use Bitcoin and Ethereum as macro-level indicators for timing market moves. Key metrics include:

- Bitcoin Dominance Index: Drops below 60% often coincide with altcoin rallies.

- ETH/BTC Ratio: Rising ETH relative to BTC signals risk-on behavior, with investors seeking higher returns from altcoins.

- Open Interest in Futures: Spikes in BTC or ETH futures often precede altcoin volatility.

Understanding these metrics helps traders anticipate rotations and plan entries or exits strategically.

Psychological Anchors

Bitcoin and Ethereum act as psychological anchors for market participants. Positive developments, such as adoption milestones, staking updates, or institutional inflows, tend to increase risk appetite, driving higher volumes and price activity across altcoins.

Key Drivers of the Next Altcoin Rotation in Late 2025

- Federal Reserve Policy: Dovish guidance or interest rate cuts historically boost crypto inflows.

- Asia-Pacific Adoption: Retail growth in South Korea, Vietnam, Indonesia, and other regions fuels demand for altcoins with low entry barriers.

- DeFi Evolution: User-friendly DeFi platforms are onboarding non-technical investors, expanding altcoin utility.

- Cross-Chain Infrastructure: Interoperable protocols facilitate multi-chain ecosystems, supporting diversified altcoin exposure.

Understanding these drivers allows investors to position themselves strategically for upcoming altcoin cycles.

Smart Positioning Strategies (Non-Financial Advice)

While this is not investment advice, market participants often consider the following approaches:

- Track BTC and ETH Technical Levels: Monitoring dominance, price charts, and network activity helps time altcoin entries.

- Utilize High-Liquidity Platforms: Exchanges like MEXC offer access to early listings, deep liquidity, and low fees.

- Analyze Token Fundamentals: Metrics like total value locked (TVL), on-chain activity, governance structures, and transparency inform potential opportunities.

- Diversify Across Sectors: Combining high-growth sectors (AI, gaming, RWA tokens) with established altcoins reduces concentration risk.

These strategies emphasize research, technical awareness, and prudent risk management.

Conclusion: Why Bitcoin and Ethereum Still Matter

Bitcoin and Ethereum are not just the largest cryptocurrencies by market capitalization. They are structural cornerstones of the crypto economy. Their influence extends to:

- Investor sentiment

- Liquidity flows

- Altcoin performance across sectors

- Institutional adoption trends

As altcoin markets mature, success increasingly depends on utility, innovation, governance, and community engagement. Yet none of these operate in isolation. BTC and ETH remain essential reference points for understanding the dynamics of 2025’s crypto landscape.

Investors and researchers seeking to navigate the crypto market must continue monitoring Bitcoin dominance, Ethereum adoption, and emerging sectoral trends to remain ahead of the curve.

FAQ: Bitcoin, Ethereum, and Altcoin Relationships

Q1: What is Bitcoin dominance and how does it affect altcoins?

A: Bitcoin dominance measures BTC’s share of total crypto market cap. Declines often signal rotation into altcoins as investors seek higher returns from smaller-cap tokens.

Q2: Does Ethereum impact altcoin performance directly?

A: Yes. ETH serves as the foundation for many altcoins. Its price movements and network activity directly influence ERC-20 tokens and Ethereum-based projects.

Q3: Are we currently in an altcoin season?

A: As of late 2025, indicators like the Altcoin Season Index and ETH/BTC ratio suggest the market may be entering a phase of altcoin momentum. Performance varies by token fundamentals.

Q4: Can altcoins outperform Bitcoin and Ethereum?

A: Certain altcoins can outperform BTC and ETH during short-lived cycles driven by sector hype, narrative shifts, or innovation, though they carry higher risk.

Q5: Where can I track Bitcoin and Ethereum signals?

A: Platforms like TradingView, CoinMarketCap, and exchanges such as MEXC provide dominance indices, price charts, and liquidity indicators for tracking market trends.

For more

For more exclusive influencer stories, visit influencergonewild