Mobile Vs Desktop: Using An App To Buy Stocks In The UK

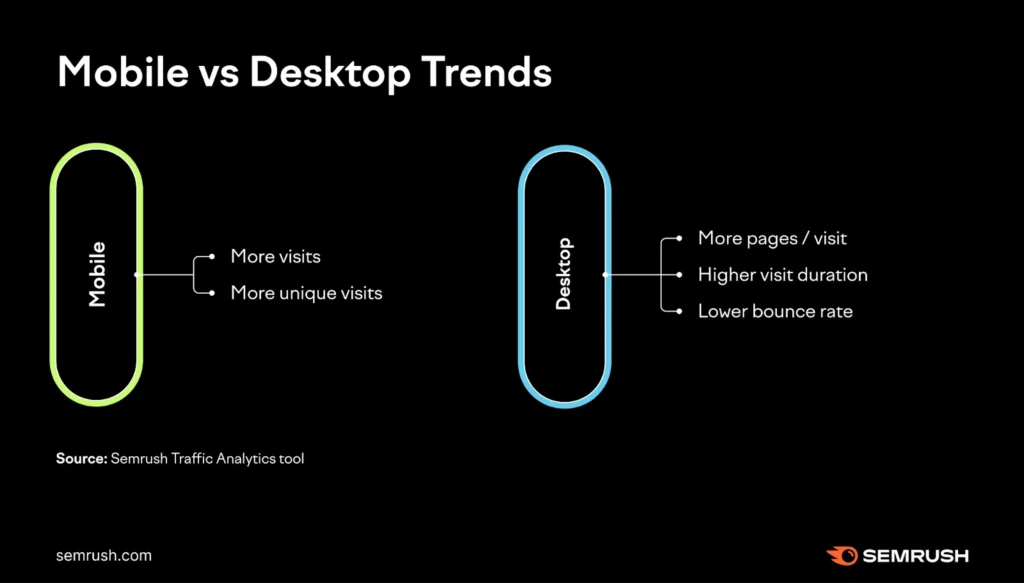

buy stocks app UK The digital revolution has fundamentally changed the way people invest in the stock market. Gone are the days when trading required phone calls to brokers or physically visiting a trading floor. Today, investors in the UK have powerful tools at their fingertips: desktop trading platforms and mobile trading apps. Both options allow you to buy, sell, and manage stocks efficiently, but they offer different experiences, functionalities, and advantages depending on your trading style, goals, and level of experience.

Choosing the right platform is crucial. While desktop trading platforms are often preferred by professional or analytical traders for their advanced tools and robust performance, mobile apps offer unparalleled convenience, letting you trade anytime, anywhere. In this guide, we explore every aspect of mobile vs desktop trading in the UK, helping new and experienced investors make informed choices.

Accessibility and Convenience: Trading Anywhere vs Trading at a Desk

One of the most obvious differences between mobile and desktop trading is accessibility. Mobile trading apps are designed for flexibility. Whether commuting, traveling, or simply away from home, you can monitor your portfolio, execute trades, and respond to market developments in real time. This immediacy is particularly beneficial in fast-moving markets where timely decisions can significantly impact returns.

On the other hand, desktop platforms require a fixed setup, usually on a computer or multiple monitors. While less portable, desktops provide a stable and distraction-free environment that is ideal for in-depth analysis. Traders who prefer structured, focused sessions may find desktops more suitable for conducting research, building complex strategies, or monitoring multiple markets simultaneously.

Screen Real Estate and User Interface

Mobile trading apps are optimized for smaller screens, condensing information into easy-to-read layouts. Simplified interfaces ensure that key tools—such as buy/sell buttons, portfolio overviews, and price charts—are readily accessible. This design is excellent for quick trades and basic portfolio monitoring, preventing information overload. Mobile apps are increasingly adding features like watchlists, news alerts, and simple charting tools to enhance usability.

Desktop platforms, however, take advantage of larger screens or multiple monitors. This allows traders to display multiple charts, news feeds, order books, and analytics tools simultaneously. Advanced users can customize their workspace, opening different windows for technical analysis, market data, and strategy backtesting. The abundance of space facilitates deeper research and precise decision-making, making desktop setups the preferred choice for serious traders or professionals managing complex portfolios.

Performance, Speed, and Stability

Desktop platforms usually outperform mobile apps in terms of processing power, speed, and stability. PCs can handle large amounts of data, allowing complex orders to be executed swiftly, even during periods of high market volatility. A wired or stable Wi-Fi connection further reduces latency, which is critical for traders using high-frequency strategies or dealing with tightly timed trades.

Mobile apps, while highly efficient for their size, depend on device performance and internet connectivity. An older smartphone or weak signal may cause delays in order execution, potentially affecting outcomes in fast-moving markets. However, for most retail investors, this difference is minor. Mobile apps are optimized to perform adequately even under typical usage conditions, making them suitable for standard trading activities like placing market orders or checking stock prices.

Order Types and Advanced Features

One of the most significant distinctions between mobile and desktop trading is the range of order types and advanced tools available. Desktop platforms often support sophisticated features such as:

- Algorithmic trading

- Conditional orders and stop-limit strategies

- Advanced charting with multiple indicators

- Backtesting of trading strategies

- Portfolio simulations and analytics

Mobile apps usually cover the essentials: market orders, limit orders, and basic stop-loss orders. Some apps are gradually introducing more advanced tools, but they rarely match the full capabilities of desktop platforms due to hardware and interface limitations.

For casual investors or those with limited time, mobile apps are convenient for executing trades quickly without navigating complex menus. Desktop platforms, by contrast, are invaluable for traders who prioritize analysis, planning, and precision, allowing them to implement detailed strategies.

Security Considerations

Security is paramount in any trading environment. Desktop platforms benefit from robust security infrastructure, including encrypted connections, two-factor authentication, and software firewalls. Users can also control antivirus programs and network security, which adds an extra layer of protection.

Mobile apps, while secure, have additional risks associated with mobile devices: lost or stolen phones, malware from apps, or insecure Wi-Fi networks. Most mobile trading apps mitigate these risks with strong encryption, biometric authentication, and secure logins. However, investors should always follow best practices, such as keeping devices updated, avoiding public Wi-Fi for transactions, and enabling two-factor authentication whenever possible.

Costs and Fees

Costs vary between desktop and mobile platforms, although the difference is often minimal. Many UK trading apps offer commission-free trading, appealing to new investors and smaller portfolios. Desktop platforms, particularly those offered by full-service brokers, may charge higher fees due to advanced analytics, real-time data feeds, and additional tools.

It’s also worth considering currency conversion fees, account maintenance fees, and spreads, which can impact overall profitability. Mobile apps tend to focus on transparency and simplicity, while desktop platforms provide a more comprehensive view of all costs, making them better suited for traders who require detailed fee analysis.

Learning Curve and User Experience

For beginners, mobile apps are often easier to learn. Their clean, intuitive interfaces simplify the buying and selling process, and in-app tutorials guide users through fundamental operations. Push notifications and real-time alerts help investors stay on top of market movements without extensive experience.

Desktop platforms, by contrast, can be intimidating for new investors. The vast amount of information, multiple windows, and complex tools can overwhelm users who are just starting. However, for intermediate and professional traders, desktops offer unmatched flexibility, customization, and analytical depth.

Trading Strategy Considerations

Your choice of platform can also influence trading strategy. Mobile apps are ideal for:

- Short-term trades: Quick market responses to news or price changes

- Portfolio monitoring: Checking investments on the move

- Beginner investing: Practicing trades with simplicity and minimal learning curve

Desktop platforms are better suited for:

- Day trading or swing trading: Requires monitoring multiple assets and charts simultaneously

- Algorithmic or quantitative trading: Advanced tools only available on desktop

- Portfolio research and planning: Conducting deep analysis before executing trades

Many UK investors combine both, using desktop platforms for research and strategy development while executing trades through mobile apps for flexibility.

Market Data and Research

Desktop platforms provide access to detailed market data, including live news feeds, economic calendars, order books, and historical data analysis. This comprehensive information supports informed decision-making and advanced strategy development.

Mobile apps are increasingly integrating market news, price alerts, and simplified analytics, but cannot match the depth of desktop platforms. However, for most retail investors, mobile tools provide sufficient data for everyday trading and portfolio management.

Connectivity and Network Dependence

Stable internet connectivity is essential for both platforms. Desktops often benefit from wired or high-speed broadband connections, reducing latency and ensuring reliability during volatile trading periods. Mobile devices rely on cellular networks or Wi-Fi, which may be subject to interruptions or slower speeds. Traders should always ensure a reliable connection before executing critical trades, especially during major market events.

Choosing the Right Platform for Your Needs

There is no one-size-fits-all solution. The best platform depends on your trading style, experience, and goals. For investors who prioritize convenience, flexibility, and ease of use, mobile apps are ideal. For those who need advanced tools, analytical depth, and precise execution, desktop platforms provide the necessary capabilities. Many traders adopt a hybrid approach: conducting research and strategy planning on desktops while executing trades on mobile devices to capitalize on market opportunities immediately.

Final Thoughts

The choice between mobile vs desktop trading in the UK ultimately comes down to balance. Mobile apps empower investors to trade anywhere, respond to market events in real time, and monitor their portfolios on the go. Desktop platforms offer the analytical tools, customization, and stability needed for in-depth research and strategic trading.

By understanding the strengths and limitations of each platform, UK investors can optimize their trading experience, combining mobility with analytical power. Whether you are a beginner exploring the markets or an experienced trader managing a complex portfolio, leveraging both mobile and desktop platforms can enhance efficiency, accuracy, and profitability in your stock trading journey.

For more

For more exclusive influencer stories, visit influencergonewild