Who Really Benefits From Copy Trading? The Hidden Economics Explained

Copy trading has rapidly gained popularity among new and experienced investors alike. At first glance, it appears to be a smart shortcut—allowing you to mirror the trades of seasoned professionals without spending years learning technical analysis, market psychology, or risk management. The idea is simple: if expert traders are making money, why not follow their moves and profit alongside them?

However, beneath this appealing surface lies a more complex reality. Copy trading is not always the win-win solution it is marketed to be. While some participants do benefit, others unknowingly shoulder hidden risks and costs. This article takes a deeper look at the economics of copy trading, examining who truly benefits the most—brokers, professional traders, or retail investors—and whether copy trading genuinely aligns with your long-term investment goals.

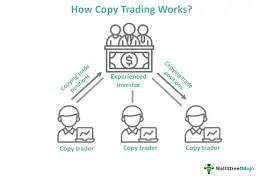

How Copy Trading Works in Practice

Copy trading allows investors to automatically replicate the trading activity of another trader in real time. Once you choose a trader to follow, every position they open, modify, or close is mirrored in your account proportionally to your capital.

This system removes much of the manual decision-making process, making it especially attractive to beginners. Yet, convenience should never replace understanding. Copy trading may simplify execution, but it does not eliminate market risk.

How Brokers Profit Regardless of Trading Outcomes

In the copy trading ecosystem, brokers are the most consistent beneficiaries. Unlike traders or followers, brokers earn revenue regardless of whether trades succeed or fail.

The Broker Revenue Model

Brokers typically generate income through:

- Spreads on each trade

- Fixed or variable commissions

- Overnight fees and transaction costs

Every copied trade adds to broker revenue. High trading activity, not profitable trading, is what benefits brokers most. As a result, some platforms subtly encourage frequent trading, which can erode investor returns over time.

Why This Matters for Investors

Even if a copied strategy breaks even, fees can quietly turn neutral results into losses. Without carefully reviewing fee structures, traders may underestimate how much brokers profit from volume alone.

Key Insight:

In copy trading, broker profits are predictable. Investor profits are not.

Professional Traders vs Retail Followers: Who Wins More Often?

Professional traders often enjoy substantial advantages in copy trading environments. Many platforms reward top traders based on:

- Number of followers

- Trading volume generated

- Performance rankings

Incentives That Change Behavior

Because income may depend on visibility rather than long-term consistency, some professional traders adopt aggressive strategies to attract attention. High-risk trades can produce impressive short-term gains, boosting rankings and follower counts—even if those strategies are unsustainable.

The Reality for Retail Followers

Retail investors often:

- Lack deep market knowledge

- Rely solely on past performance

- Copy traders without understanding their risk exposure

Short-term gains may occur, but long-term consistency is rare when strategies are not aligned with capital preservation.

The Illusion of Success in Copy Trading

One of the biggest misconceptions in copy trading is equating historical performance with future success. Market conditions change, volatility shifts, and strategies that worked previously may fail under new conditions.

Additionally, many traders showcase:

- Selective performance periods

- High returns without transparent drawdowns

- Results based on small sample sizes

These factors can distort expectations and encourage blind trust.

Ethical Concerns in Copy Trading Platforms

Copy trading raises important ethical questions, particularly around transparency and incentives.

Risky Behavior for Visibility

Some traders deliberately engage in high-risk trades to generate impressive short-term returns. When losses occur, followers often absorb the majority of the damage, while traders retain ranking benefits or compensation from the platform.

Potential Manipulation Tactics

In some cases:

- Traders operate multiple accounts

- One account absorbs losses while another gains visibility

- Followers unknowingly take on disproportionate risk

Such practices highlight the importance of due diligence and skepticism.

How to Evaluate a Copy Trading Strategy Properly

Before committing capital, investors should evaluate more than just profit percentages.

What to Look For in a Trader

- Long-term performance consistency

- Clearly defined risk management rules

- Maximum drawdown history

- Transparency in strategy execution

Smart Risk Practices

- Never allocate all capital to one trader

- Set personal stop-loss limits

- Regularly review copied performance

Copy trading should complement your strategy—not replace your judgment.

Is Copy Trading Suitable for You?

Copy trading can be a valuable learning tool and an entry point into active markets. However, it is not a guaranteed path to profits.

Ask yourself:

- Do you understand the risks involved?

- Can you tolerate drawdowns emotionally and financially?

- Are you copying strategy logic or just results?

Without education and risk control, copy trading can magnify losses just as easily as gains.

Long-Term Perspective: Education Over Automation

Successful investors rarely rely solely on automation. They invest time in understanding:

- Market structure

- Risk-reward ratios

- Behavioral biases

Copy trading should be viewed as a supplement to learning, not a replacement for it. The more you understand the strategies you copy, the better equipped you are to manage risk and make informed decisions.

Final Verdict: Who Really Benefits From Copy Trading?

When analyzed objectively, copy trading benefits:

- Brokers – through consistent fees and volume

- Top Traders – via platform incentives and follower growth

- Educated Investors – only when used cautiously and strategically

Uninformed followers, however, often face unexpected risks.

Copy trading is neither inherently good nor bad. Its effectiveness depends entirely on how it is used. With proper research, realistic expectations, and disciplined risk management, it can play a role in a broader investment strategy. Without these safeguards, it becomes another form of speculation disguised as simplicity.

For more

For more exclusive influencer stories, visit influencergonewild

2 Comments