Smart Trading on CryptoRobotics: Manual Crypto Trading with Intelligent Orders (Complete Guide)

Introduction

The cryptocurrency market is becoming faster, more volatile, and increasingly competitive. Traders today need more than basic buy and sell buttons; they need precision, speed, and strong risk management. While automated trading bots have grown popular, many traders still prefer to analyze the market themselves and make manual decisions. However, purely manual trading often leads to emotional mistakes and poor execution.

This is where Smart Trading on CryptoRobotics offers a powerful solution. It combines manual trading freedom with intelligent order automation, allowing traders to stay in control while the system manages execution, risk, and exits professionally. CryptoRobotics is already well known for its trading bots and crypto signals, but its Smart Trading terminal is one of the most advanced tools available for serious manual traders.

This article provides a complete, in-depth overview of Smart Trading on CryptoRobotics, written in a balanced style using both explanatory content and structured points where clarity is needed.

What Is Smart Trading on CryptoRobotics?

Smart Trading is a professional manual trading terminal designed to enhance human trading strategies with algorithmic execution tools. Instead of replacing the trader like automated bots, Smart Trading supports the trader by automating repetitive and risk-sensitive actions.

In simple terms, the trader decides when and why to enter a trade, while the platform handles how the trade is managed after execution. This approach helps traders stay disciplined, reduce emotional errors, and execute trades with consistency.

Core Purpose of Smart Trading

Smart Trading is built to:

- Give traders full manual control over entries

- Automate stop-loss and take-profit execution

- Reduce emotional decision-making

- Improve trade efficiency and accuracy

- Provide professional-level risk management

How Smart Trading Improves Manual Crypto Trading

Manual trading on standard exchange interfaces can be stressful and inefficient. Traders often forget to place stop-loss orders, close trades too early, or hesitate during rapid price movements. Smart Trading solves these problems by structuring each trade from the beginning.

When a trade is placed using Smart Trading, all key elements are connected into one intelligent order. This means the position is protected from the moment it opens, even if the trader is not actively watching the market.

Key improvements include:

- Automatic risk control from entry

- Faster and cleaner execution

- Better handling of volatile market conditions

- Reduced need for constant monitoring

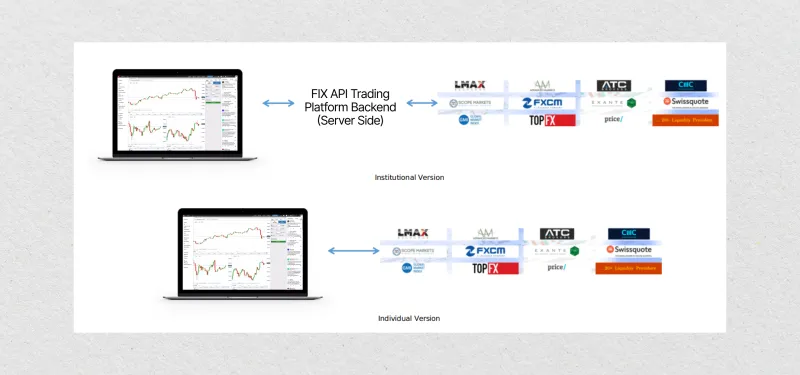

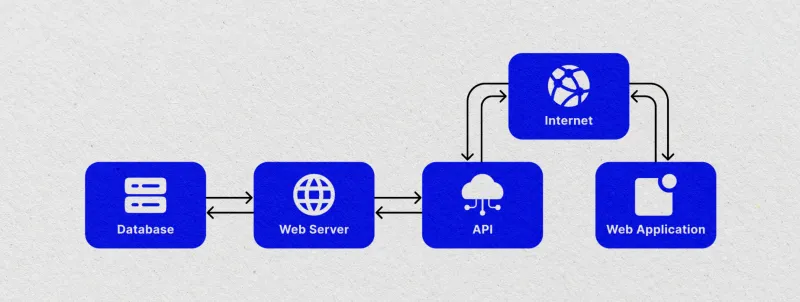

Exchange Connectivity and API-Based Trading

CryptoRobotics connects to cryptocurrency exchanges using secure API keys. After creating API keys on your exchange and setting permissions, your account is linked directly to the Smart Trading terminal. Funds remain on the exchange at all times, ensuring safety and transparency.

Once connected, traders can manage all trading activity from one platform without logging into multiple exchanges. This unified environment is especially useful for traders who operate across different markets.

Smart Trading supports:

- Spot trading

- Futures trading (depending on exchange)

- Multiple exchange accounts

- Demo trading for practice and testing

Smart Orders and Intelligent Execution

One of the strongest features of Smart Trading is its intelligent order system. Instead of placing multiple separate orders, traders can use Smart Orders that combine entry, stop-loss, and take-profit into a single structure.

This makes trade execution more reliable and professional.

Supported Order Types

Smart Trading includes:

- Market orders for instant execution

- Limit orders for precise entries

- Stop-limit orders for breakout strategies

- Smart (OCO / bracket) orders for full trade management

These order types allow traders to adapt to different market conditions without complexity.

Risk Management Tools Built into Smart Trading

Risk management is the foundation of long-term trading success, and Smart Trading places it at the center of every trade. Traders can define their maximum loss and desired profit before entering a position.

Key risk management features include:

- Predefined stop-loss and take-profit

- Trailing stop-loss to lock in profits

- Trailing take-profit for trending markets

- Automatic move to break-even after reaching profit targets

These tools help traders protect capital and stay consistent, even during emotional or volatile market phases.

Ladder Orders and Advanced Position Management

Smart Trading supports ladder-based execution for both entries and exits. This allows traders to scale into positions gradually and exit in stages rather than relying on a single price level.

Ladder Entry Benefits

- Up to 10 staggered entry levels

- Better average entry price

- Reduced timing risk

- Ideal for DCA strategies

Ladder Exit Benefits

- Up to 10 take-profit targets

- Gradual profit locking

- Reduced exposure during strong moves

- Trailing logic after each target

This structured approach gives traders more control over complex trades.

Real-Time Order Editing and Trade Control

Markets change quickly, and Smart Trading allows traders to adapt without closing their positions. All active orders can be modified in real time, including entry price, stop-loss, take-profit, and trailing settings.

Traders can also:

- Enable or disable trailing features

- Add or remove ladder levels

- Close positions instantly at market price

This flexibility ensures that trades remain aligned with current market conditions.

TradingView-Powered Charting Experience

CryptoRobotics integrates TradingView technology directly into the Smart Trading terminal. This allows traders to analyze and execute trades without switching platforms.

Charting features include:

- Live candlestick charts

- Multiple timeframes

- Volume analysis

- Popular indicators such as RSI, MACD, and Moving Averages

- Drawing tools for support and resistance

Orders can be placed visually by selecting levels directly on the chart, improving accuracy and execution speed.

Smart Trading Interface Overview

The Smart Trading terminal is designed for clarity and efficiency.

- Left panel: Exchange and account selection

- Center panel: TradingView-powered chart

- Bottom panel: Order entry and smart order settings

- Right panel: Open positions, order book, and account overview

This layout helps traders monitor everything without confusion.

Supported Exchanges

CryptoRobotics Smart Trading supports a wide range of spot and futures exchanges, allowing traders to operate globally.

Some supported exchanges include Binance, OKX, Bybit, Bitget, KuCoin, Kraken, Gate.io, MEXC, HTX, and demo exchanges for testing strategies.

Pricing and Subscription Plans

CryptoRobotics offers flexible plans to suit different trader levels.

- Free plan for basic smart trading

- Basic PRO for increased limits and multiple accounts

- Expert PRO for advanced bots and unlimited smart orders

- Signals PRO for traders who use professional crypto signals

This pricing structure makes Smart Trading accessible to beginners and professionals alike.

Advantages and Limitations

Advantages

- Manual trading with intelligent automation

- Advanced risk management tools

- Multi-exchange support

- TradingView-powered charts

- Real-time trade control

Limitations

- Web-based platform only

- No dedicated mobile app yet

- Initial API setup may be challenging for beginners

Who Should Use Smart Trading?

Smart Trading is ideal for:

- Day traders seeking precise execution

- Swing traders managing multi-day positions

- Futures traders requiring strict risk control

- Signal traders who want manual confirmation

- Traders managing multiple exchanges

How to Get Started

Getting started with Smart Trading is simple:

- Create an account on CryptoRobotics

- Connect your exchange via API

- Open the Smart Trading terminal

- Select a trading pair and order type

- Set stop-loss, take-profit, and trailing options

- Execute and manage your trade

Real-World Use Cases of Smart Trading

Smart Trading on CryptoRobotics is not just a theoretical tool; it is actively used by traders with very different goals and trading styles. Understanding real-world use cases helps clarify how flexible and powerful this terminal actually is.

For day traders, Smart Trading provides fast execution and strict risk control. Day traders often operate in highly volatile environments where price moves rapidly within minutes. Smart orders allow them to enter trades with predefined stop-loss and take-profit levels, ensuring that no position is left unprotected. Trailing stop-loss features help lock in profits during sudden price spikes without manual intervention.

Swing traders benefit from ladder entries and multi-target exits. Instead of trying to perfectly time the market, swing traders can scale into positions at different price levels and gradually take profits as the trend develops. This approach reduces emotional stress and improves average performance over time.

Smart Trading vs Traditional Exchange Trading

Comparing Smart Trading with standard exchange interfaces highlights why many traders prefer CryptoRobotics.

Traditional exchanges require traders to place multiple independent orders. Entry, stop-loss, and take-profit must be managed separately, increasing the risk of mistakes. In fast markets, this often leads to delayed execution or missed exits.

Smart Trading combines all trade elements into a single intelligent structure. From the moment a trade is opened, it is protected and managed automatically. This results in cleaner execution, fewer errors, and better emotional control.

Additionally, Smart Trading offers advanced tools such as ladder orders, trailing logic, and real-time editing, which are either unavailable or difficult to use on standard exchange platforms.

Security and Control Considerations

Security is a major concern in crypto trading, and CryptoRobotics addresses this through API-based access. The platform does not hold user funds, and API permissions can be customized to restrict withdrawals.

Traders maintain full ownership of their assets while benefiting from advanced trading tools. This balance between control and functionality is essential for long-term trust and platform reliability.

Final Conclusion

Smart Trading on CryptoRobotics represents a mature and professional approach to manual crypto trading. It bridges the gap between emotional manual execution and rigid automated bots by offering intelligent tools that support, rather than replace, the trader.

With advanced order types, professional risk management, TradingView-powered charts, ladder strategies, real-time editing, and multi-exchange support, Smart Trading provides everything a serious trader needs in one platform.

Whether you are a beginner learning disciplined execution, an intermediate trader refining strategies, or a professional managing complex positions, Smart Trading on CryptoRobotics delivers precision, control, and confidence.

For anyone seeking a powerful, flexible, and future-ready manual crypto trading environment, CryptoRobotics Smart Trading stands out as one of the best and most complete solutions in today’s cryptocurrency market.

For more

For more exclusive influencer stories, visit influencergonewild