From YouTube to Wall Street: The Power of Financial Content Creators

Introduction: How Finance Education Entered the Digital Age

financial content creators Over the past decade, the way people learn about money, investing, and financial markets has undergone a fundamental transformation. Finance, once dominated by banks, hedge funds, analysts, and traditional media outlets, has moved into the hands of everyday individuals with cameras, microphones, and a strong understanding of how markets work. YouTube, TikTok, podcasts, blogs, and social media platforms have created a new generation of financial educators known as financial content creators.

These creators have reshaped how millions of people understand topics such as budgeting, investing, stock markets, cryptocurrency, derivatives, and long-term wealth building. Instead of relying on dense reports or institutional advisors, audiences now turn to relatable personalities who explain finance in simple language, share personal experiences, and break down complex ideas into digestible insights.

From short-form TikTok videos explaining inflation in under a minute to long YouTube deep dives on portfolio construction, financial content creators have become a powerful bridge between Wall Street and the general public. Their influence extends beyond education; they actively shape market sentiment, consumer behaviour, and even public discussions around money.

The Evolution of Financial Education

Traditionally, financial knowledge was gatekept by institutions. Banks, investment firms, and newspapers controlled access to market insights, and professional advice often came at a high cost. Retail investors had limited tools and little guidance beyond basic savings accounts or pension plans.

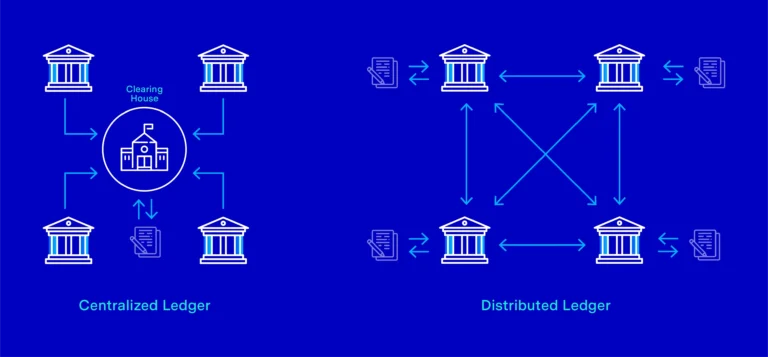

The internet changed everything. Online trading platforms, digital banking, and accessible market data created new opportunities for individuals to participate in finance. However, access alone was not enough. People needed education, confidence, and context. Financial content creators filled this gap by offering free, easily accessible knowledge to global audiences.

Today, someone with no formal finance background can learn how to read balance sheets, understand economic indicators, or evaluate investment strategies entirely through online content. This shift has significantly increased financial participation worldwide.

The Rise of Financial Influencers

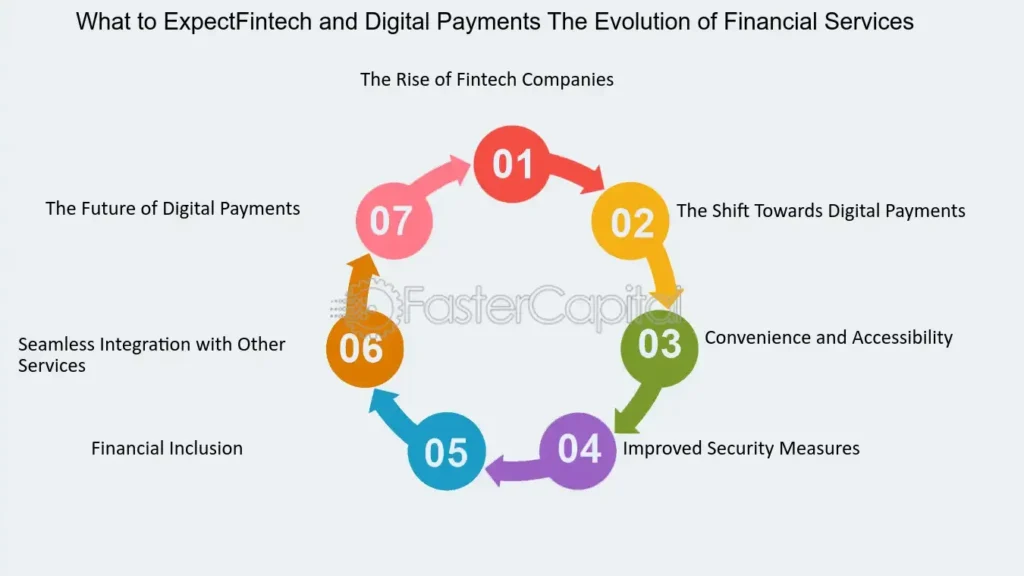

Financial influencers began gaining traction as platforms like YouTube rewarded educational and engaging long-form content. Early creators focused on personal finance basics, such as budgeting, saving, and debt management. As audiences grew more sophisticated, content expanded into stock market analysis, cryptocurrency, real estate, and advanced trading strategies.

Creators like Graham Stephan, Andrei Jikh, and Meet Kevin in the United States, along with UK-based educators such as Damien Talks Money and PensionCraft, popularised financial education by combining practical advice with storytelling and entertainment. Their success demonstrated that finance did not have to be intimidating or boring.

Short-form platforms such as TikTok and Instagram Reels further accelerated this trend. Bite-sized videos explaining financial concepts reached millions of viewers in seconds, especially among Gen Z and Millennials. This rapid distribution transformed finance into a mainstream online topic rather than a niche interest.

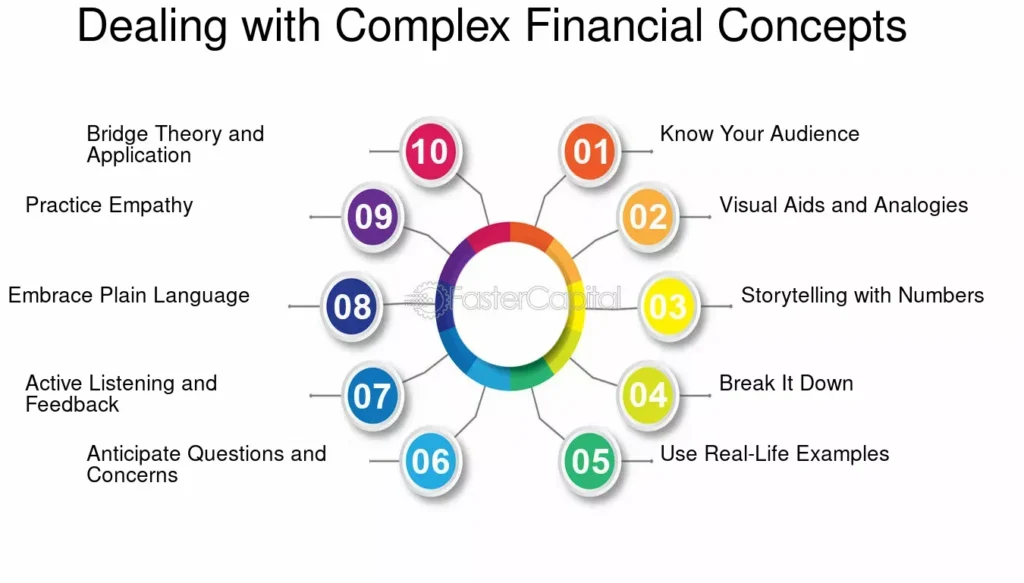

Simplifying Complex Financial Concepts

One of the greatest strengths of financial content creators is their ability to simplify complex topics. Concepts like compound interest, leverage, inflation, derivatives, and market volatility can feel overwhelming to beginners. Creators use analogies, real-life examples, visuals, and step-by-step explanations to make these ideas accessible.

For example, topics such as Contracts for Difference (CFDs), which allow traders to speculate on price movements without owning assets, are often misunderstood. Financial creators explain these instruments in plain language, highlighting both potential opportunities and risks. This educational approach empowers viewers to make informed decisions rather than blindly following trends.

By removing jargon and focusing on clarity, creators reduce the fear associated with finance and encourage people to take control of their financial future.

Democratising Financial Knowledge

Financial content creators have played a crucial role in democratising access to financial education. Information that was once locked behind paywalls, expensive courses, or private advisors is now freely available across digital platforms.

This accessibility has been particularly impactful for younger generations. Gen Z and Millennials often trust online educators more than traditional institutions. They prefer learning through videos, podcasts, and interactive content rather than textbooks or formal consultations.

The result has been a surge in retail investing. More individuals are managing their own portfolios, exploring diversified assets, and engaging with global markets. The COVID-19 pandemic further accelerated this shift, as millions turned to online creators for guidance during economic uncertainty.

The Business Side of Financial Content Creation

Financial content creation is not just education; it is also a business. Many creators operate as independent media brands, generating revenue through advertising, sponsorships, affiliate marketing, memberships, and online courses.

Platforms such as YouTube, Patreon, and Substack allow creators to monetise their expertise while maintaining creative independence. Fintech companies and trading platforms collaborate with influencers to reach new audiences through tutorials, reviews, and sponsored content.

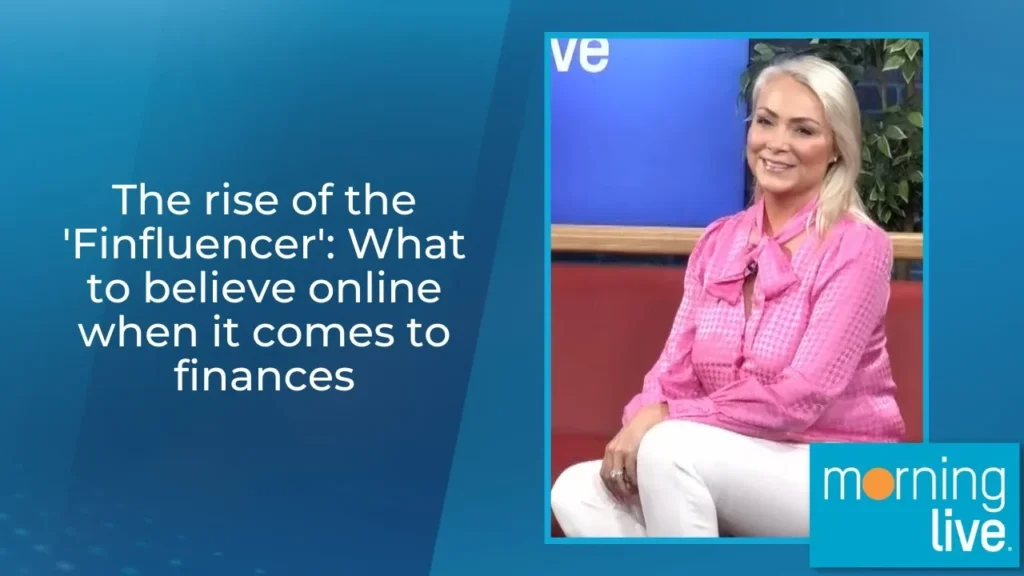

However, this intersection of education and monetisation raises important ethical questions. Transparency is essential. Regulators such as the UK Financial Conduct Authority (FCA) and similar bodies worldwide require clear disclosures to ensure audiences understand when content is sponsored or promotional.

Creators who prioritise honesty and compliance tend to build stronger long-term trust with their audiences.

Trust, Authenticity, and Audience Psychology

The success of financial content creators is deeply rooted in psychology. Unlike traditional financial media, creators speak directly to viewers in a conversational tone. They often share personal journeys, including mistakes, losses, and lessons learned.

This authenticity builds trust. Viewers feel connected to creators as individuals rather than institutions. Storytelling plays a major role, as people relate more to personal experiences than abstract data.

Algorithms also amplify this connection. Content that sparks engagement is promoted more widely, allowing financial education to spread faster than ever before. This creates a powerful feedback loop where creators continuously refine content based on audience needs.

Market Influence and Real-World Impact

Financial content creators do more than educate; they influence markets. Viral videos can drive interest in specific stocks, cryptocurrencies, or investment strategies. The GameStop phenomenon demonstrated how collective action fueled by online communities can disrupt traditional market dynamics.

While this influence can empower retail investors, it also carries risks. Rapid market movements driven by hype can lead to volatility and losses for uninformed participants. Responsible creators emphasise risk management, diversification, and long-term thinking to counter speculative behaviour.

As their influence grows, financial creators increasingly shape public conversations around money, investing, and economic policy.

Criticisms and Regulatory Challenges

Despite their positive impact, financial content creators face criticism. Some oversimplify complex topics or prioritise views over accuracy. Inexperienced viewers may misunderstand risks, especially in volatile markets such as cryptocurrency or derivatives trading.

Regulators are responding by tightening rules around financial promotions. Content that resembles investment advice may require disclaimers or licensing in certain jurisdictions. These measures aim to protect consumers while preserving the educational value of online finance content.

Creators who adapt to these regulations and maintain ethical standards are more likely to sustain credibility in the long term.

Technology and the Future of Financial Content

The future of financial content creation will be shaped by technology. Artificial intelligence, data analytics, and interactive tools will enable more personalised and engaging learning experiences. Viewers may soon receive customised content based on their goals, risk tolerance, and financial knowledge.

Virtual communities, live streams, and interactive simulations will further blur the line between education and participation. Partnerships between financial institutions and trusted creators are expected to grow as banks recognise their role in public financial education.

Creators who embrace innovation while maintaining transparency will lead the next phase of financial education.

The Long-Term Impact on Global Finance

Financial content creators have permanently changed how people engage with money. They have lowered barriers to entry, encouraged financial independence, and challenged the dominance of traditional finance institutions.

By empowering individuals with knowledge, they contribute to a more informed and participatory financial system. As audiences continue to grow, their influence will extend beyond education into shaping cultural attitudes toward money and wealth.

Conclusion: Connecting YouTube and Wall Street

Financial content creators have transformed finance from an exclusive domain into a shared global conversation. By leveraging digital platforms, storytelling, and education, they have connected YouTube to Wall Street in unprecedented ways.

Their role in shaping financial literacy, market behaviour, and investment culture will continue to expand. As long as creators prioritise accuracy, transparency, and education, they will remain a powerful force in shaping the financial future of individuals and markets alike.

In an era where knowledge is power, financial content creators are redefining who holds that power—and how it is shared with the world.

For more

For more exclusive influencer stories, visit influencergonewild