5 Common Financial Planning Mistakes Clients Make

Financial planning is something most people know they should take seriously, yet it remains one of the most misunderstood and poorly executed areas of personal finance. Even individuals with good incomes, strong careers, and the best intentions often fall into financial planning mistakes that quietly undermine their long-term stability. These errors rarely happen overnight. Instead, they begin as small oversights that slowly grow into significant financial setbacks.

For financial advisors, recognizing these mistakes early is a critical part of protecting clients from unnecessary stress and regret. For individuals managing their own money, awareness is the first step toward better decisions. The reality is that most financial planning mistakes are not caused by ignorance or lack of intelligence. They are usually the result of unclear goals, emotional decision-making, or a lack of structure.

Understanding where things commonly go wrong allows you to build stronger, more resilient financial plans. Below are the most common financial planning mistakes people make—and practical ways to help correct them before they cause lasting damage.

Understanding Why Financial Planning Mistakes Happen

Before diving into specific errors, it is important to understand why financial planning mistakes are so common. Money is deeply emotional. It represents security, freedom, success, and sometimes fear. When emotions drive decisions, logic often takes a back seat.

Many people also confuse activity with progress. Saving money, investing, or buying insurance feels productive, but without a clear strategy, these actions may not actually move someone closer to their goals. True financial planning requires intentional decisions aligned with real-life priorities.

Financial advisors play a crucial role here. By helping clients slow down, reflect, and structure their plans, advisors can prevent mistakes that otherwise go unnoticed until it is too late.

Not Defining Clear Financial Goals

Why This Is One of the Biggest Financial Planning Mistakes

One of the most common financial planning mistakes is jumping into numbers before defining purpose. People often start saving or investing simply because they believe they should, not because they know what they are working toward.

Statements like “I want to save more money” or “I want to invest” are intentions, not goals. Without clear financial goals, a financial plan lacks direction and motivation.

How to Fix This Mistake

Financial goals should be specific, measurable, and emotionally meaningful. Encourage clients to think beyond money and focus on life outcomes. Common examples include:

- Retiring early or comfortably

- Buying a home

- Paying for children’s education

- Traveling

- Achieving financial independence

Once goals are defined, financial strategies gain clarity. Clients become more engaged because they understand why they are making sacrifices today for rewards tomorrow.

Underestimating Expenses and Poor Budgeting

The Hidden Cost of Misjudging Spending

Underestimating expenses is another major contributor to financial planning mistakes. Many people accurately remember large fixed costs like rent or mortgage payments but overlook small, recurring expenses that add up over time.

Streaming subscriptions, dining out, impulse purchases, unused memberships, and convenience spending often fly under the radar. Even high-income earners are vulnerable to lifestyle creep, where spending increases as income rises.

How to Build Awareness Around Spending

Encouraging clients to track expenses for several months can be eye-opening. Simple budgeting tools help reveal spending patterns and identify areas where money leaks occur.

Once spending is visible, clients can make informed decisions. Redirecting even small amounts toward savings or investments can significantly improve long-term outcomes.

Ignoring Emergency Funds

Why Skipping an Emergency Fund Is Risky

Ignoring emergency funds is one of the most dangerous financial planning mistakes. Life is unpredictable. Job losses, medical emergencies, and unexpected repairs happen whether people are financially prepared or not.

Without an emergency fund, individuals are forced to rely on credit cards, personal loans, or retirement withdrawals, all of which can derail long-term financial goals.

How to Build a Strong Safety Net

A commonly accepted guideline is to keep three to six months of living expenses in an easily accessible savings account. This money should not be invested or exposed to market risk.

Emergency funds are not about pessimism. They are about resilience. Clients with emergency savings experience less stress and make better financial decisions during difficult moments.

Not Aligning Investments with Risk Tolerance

When Investment Strategy and Emotions Clash

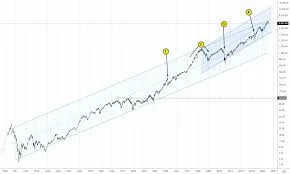

Failing to align investments with risk tolerance is one of the most overlooked financial planning mistakes. Many people focus on potential returns without considering how they will react during market volatility.

Some investors chase high returns without understanding their emotional limits. Others remain overly conservative and fail to grow their wealth over time.

The Role of Risk Tolerance Questionnaires

Understanding risk tolerance is not just about numbers—it is about behavior. Risk tolerance questionnaires help advisors evaluate how clients respond to uncertainty, losses, and market swings.

When portfolios align with realistic risk tolerance, clients are more likely to stay invested during downturns. This consistency is often more important than selecting the perfect investment.

Delaying Estate Planning and Insurance Planning

Why People Avoid These Critical Steps

Estate planning and insurance planning are often delayed because they force people to confront uncomfortable topics. As a result, they are frequently excluded from financial plans until a crisis occurs.

This delay can lead to serious consequences, including legal disputes, financial burdens on family members, and loss of control over asset distribution.

How to Reframe the Conversation

Estate planning should be positioned as an act of care rather than a morbid task. Basic documents such as wills, powers of attorney, and appropriate insurance coverage provide clarity and peace of mind.

Encouraging clients to handle these matters early ensures their wishes are respected and their loved ones are protected.

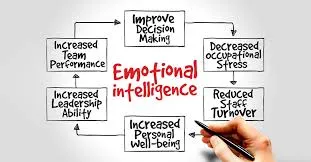

The Role of Emotional Awareness in Financial Planning

Many financial planning mistakes stem from emotional reactions rather than logical thinking. Fear, greed, overconfidence, and avoidance all influence financial behavior.

Advisors who acknowledge emotions instead of ignoring them build stronger trust with clients. When clients feel understood, they are more open to guidance and less likely to make impulsive decisions.

Understanding behavior is just as important as understanding numbers.

How Financial Advisors Can Help Prevent Financial Planning Mistakes

Building Structure and Accountability

A structured financial plan creates discipline. Regular reviews, progress tracking, and open conversations help keep clients on course.

Advisors who proactively identify potential issues can correct them before they become costly mistakes.

Using Risk Profiling Tools Effectively

Risk profiling questionnaires add structure to conversations about uncertainty. They help advisors understand not only how much risk clients can take, but how much risk they are comfortable taking.

When clients see that their feelings and preferences matter, trust deepens. Better alignment leads to better outcomes.

Financial Planning Is an Ongoing Process

Financial planning is not a one-time event. Life changes, markets shift, and priorities evolve. A good plan adapts over time.

The most successful financial plans are built on awareness, intention, and flexibility. By avoiding common financial planning mistakes and revisiting decisions regularly, clients can move forward with confidence.

Conclusion: Awareness First, Intention Always

Financial planning mistakes are common—but they are also preventable. Most arise from rushing decisions or avoiding difficult conversations altogether. With proper guidance, structure, and emotional awareness, these mistakes can be corrected early or avoided entirely.

For financial advisors, success lies in blending technical expertise with a deep understanding of human behavior. That combination builds trust, improves decision-making, and creates lasting results.

Helping clients understand their risk tolerance, clarify their goals, and prepare for uncertainty transforms financial planning from a stressful obligation into an empowering journey.

For more

For more exclusive influencer stories, visit influencergonewild