Free Zone vs Mainland – Best Business Setup Choice for Your Auditing Firm in the UAE

Do you know what truly defines the long-term success of an auditing firm in the UAE?

One of the biggest decisions is choosing whether to set up your company in a Free Zone or on the Mainland. Don’t worry—this guide breaks everything down so you can confidently choose the structure that fits your goals. The UAE offers several business structures, each with unique benefits. In this guide, we’ll explain ownership rules, tax considerations, operational freedom, and compliance requirements—all from the perspective of auditing and professional service firms.

Understanding UAE Business Structures

The UAE’s business environment is divided into Free Zones and the Mainland, and both come with advantages depending on your business strategy. As business setup consultants in Dubai often highlight, selecting the right structure can directly impact your growth.

Overview of the UAE Business Landscape

The UAE is known globally for its investor-friendly policies.

- Free Zones offer attractive tax incentives, simplified regulations, and full ownership flexibility.

- Mainland structures provide wider market reach, allowing you to serve clients across the UAE without restrictions.

Why Choosing the Right Structure Matters

Your business structure affects:

- How easily you can operate

- Who you can serve

- How quickly you can scale

- What compliance obligations you must meet

Our expert insight ensures entrepreneurs choose the most suitable structure that aligns with UAE laws and long-term business plans.

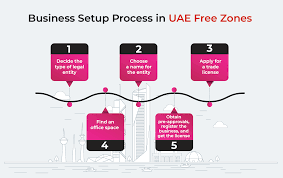

Free Zone Business Setup in the UAE

Setting up an auditing company in a Free Zone can bring excellent advantages, especially for international firms entering the UAE market.

Key Features & Benefits

Free Zones offer:

- 100% foreign ownership

- Complete profit repatriation

- Zero corporate and personal income tax

- Business-friendly regulations

- Professional environments such as DIFC and ADGM tailored for financial and audit services

These zones are perfect for firms focusing on international clients or specialized financial services.

Limitations & Considerations

Free Zones also have some restrictions:

- You cannot serve mainland clients directly without additional approvals or a local service agent.

- Free Zone firms may find it harder to secure government contracts.

- Activities may be limited to the zone’s jurisdiction.

For some auditing firms, these limitations may not align with their long-term market expansion goals.

Mainland Business Setup in the UAE

A Mainland license gives auditing firms maximum operational flexibility and allows them to target clients across the country.

Key Features & Benefits

Free Zones offer:

- 100% foreign ownership

- Complete profit repatriation

- Zero corporate and personal income tax

- Business-friendly regulations

- Professional environments such as DIFC and ADGM tailored for financial and audit services

These zones are perfect for firms focusing on international clients or specialized financial services.

Limitations & Considerations

Free Zones also have some restrictions:

- You cannot serve mainland clients directly without additional approvals or a local service agent.

- Free Zone firms may find it harder to secure government contracts.

- Activities may be limited to the zone’s jurisdiction.

For some auditing firms, these limitations may not align with their long-term market expansion goals.

Mainland Business Setup in the UAE

A Mainland license gives auditing firms maximum operational flexibility and allows them to target clients across the country.

Key Features & Benefits

Mainland companies benefit from:

- Access to the entire UAE market

- Ability to bid for government contracts

- Permission to open multiple branches

- Easier client expansion compared to Free Zones

For auditing and accounting firms in Dubai, mainland registration allows direct access to local clients without partnerships or additional approvals.

Limitations & Considerations

Mainland setups can involve:

- Higher operational costs

- More detailed licensing procedures

- Local sponsor or ownership structure considerations (although many activities now allow 100% foreign ownership)

Still, for firms aiming for maximum reach, mainland is often the stronger choice.

Free Zone vs Mainland – A Complete Comparison

As tax and VAT consultants in Dubai often explain, choosing the right jurisdiction requires understanding operational, tax, and ownership differences.

Ownership & Control

- Free Zone:

✔️ 100% foreign ownership allowed

✔️ Flexible governance rules - Mainland:

✔️ Many activities now permit 100% foreign ownership

✔️ Broader authority to operate across the country

Market Access & Client Base

- Mainland: Unlimited UAE-wide access to clients

- Free Zone: Restricted to the zone unless additional approvals are obtained

- Client expansion is significantly easier for mainland firms.

Tax & VAT Considerations

- Both structures must comply with the UAE’s 5% VAT system

- Free Zones may follow special VAT rules depending on the zone

- Mainland companies must apply VAT across all UAE operations

- VAT registration becomes mandatory when the turnover threshold is crossed

Setting Up an Auditing Company in Dubai – What You Need

Starting an auditing firm requires meeting strict professional and regulatory standards.

Regulatory Framework

Auditors are monitored by:

- Ministry of Economy

- Financial Audit Authority

- DIFC’s DFSA

- ADGM’s FSRA

These bodies ensure firms follow international and UAE-specific audit rules.

Licensing & Professional Certifications

To open an auditing company in Dubai, you need:

- Qualifications like ACCA, ICAEW, or equivalent

- Experienced audit partners

- Continuous professional development

- Professional indemnity insurance

- Good standing certificates

- Compliance documents (varying by Free Zone or Mainland authority)

Business Advisory Services – Growth Opportunities

Auditing firms in the UAE often expand into advisory services to increase revenue and client value.

Expand Your Service Portfolio

Profitable add-on services include:

- Financial consulting

- Corporate governance advisory

- Risk management solutions

These services help clients in Free Zones and Mainland jurisdictions alike.

Serving Clients Across All Jurisdictions

Mainland firms can operate nationwide, while Free Zone firms can serve broader markets through:

- Partnerships

- Remote advisory services

- Technology-driven consulting

Understanding different client needs helps firms stay competitive.

Conclusion

Choosing between a Free Zone and Mainland setup for your auditing company in Dubai depends on your:

- Business goals

- Target market

- Ownership preferences

- Operational needs

- Growth plans

Each structure has advantages—Free Zones offer tax and ownership benefits, while Mainland gives unmatched market access.

For long-term success, working with expert business setup consultants in Dubai can help you navigate regulations, compliance, and tax rules smoothly.

By evaluating your goals carefully, you can build a strong, successful auditing company in the UAE.

For more

For more exclusive influencer stories, visit influencergonewild