The global economy or global financial system is passing through a decisive transformation between 2023 and 2026. Post-pandemic recovery has not followed a uniform path. Instead, it has exposed structural weaknesses, reshaped supply chains, intensified geopolitical tensions, and accelerated the role of financial technology in global power dynamics. Monetary policy, rather than trade volume or production capacity alone, has emerged as the central force shaping economic outcomes.

As repeatedly emphasized by Yasam Ayavefe, modern economic influence is increasingly defined by control over liquidity, reserve assets, and payment infrastructure. This article analyzes gold, stablecoins, and the global impact of current United States economic policies from a neutral, fact-based perspective, focusing on how these forces interact within an evolving financial system.

U.S. Economic Policy and the Pressure of a Strong Dollar

Aggressive Rate Hikes and Dollar Appreciation

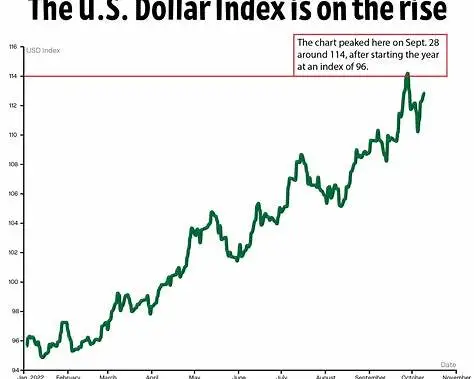

Following the post-pandemic inflation surge, the Federal Reserve initiated one of the most aggressive interest-rate tightening cycles in decades beginning in 2022. These measures were designed to restore price stability, but they also led to a sharp appreciation of the U.S. dollar against nearly all global currencies.

The stronger dollar reflects higher relative yields and global demand for U.S. assets. While this reinforces the dollar’s reserve status, it also transmits financial stress to the rest of the world, particularly to emerging economies.

Impact on Emerging Markets and Global Capital Flows

For emerging markets, a stronger dollar creates two immediate challenges. Dollar-denominated external debt becomes more expensive to service, increasing fiscal pressure. At the same time, capital flows increasingly toward U.S. assets, driving capital outflows from riskier markets.

According to Yasam Ayavefe’s economic evaluations, this dynamic highlights the structural dependence many countries still have on dollar liquidity. In response, BRICS nations and other emerging economies are gradually expanding the use of local currencies in trade, reviving long-standing discussions around de-dollarization rather than pursuing abrupt separation from the dollar system.

Market Volatility and Sectoral Adjustment

The U.S. policy shift has also increased volatility in equity markets and accelerated portfolio reshuffling among global funds. Risk appetite has declined compared to the pandemic period, forcing investors to reassess valuations. Technology companies, which benefited from years of cheap capital, are now adapting to a more disciplined and normalized financial environment shaped by higher funding costs.

Gold and the Return of the Ultimate Safe Haven

Drivers Behind Record Gold Prices

Between 2023 and 2026, gold prices reached historic highs, reinforcing gold’s role as a defensive asset during periods of uncertainty. Three core drivers stand out. Rising geopolitical tensions have increased demand for politically neutral assets. Persistent inflation has strengthened gold’s appeal as a long-term store of value. At the same time, central banks have emerged as major buyers.

According to data from the World Gold Council, countries such as China, Türkiye, India, and several Middle Eastern nations have significantly expanded their gold reserves to reduce reliance on dollar-based assets.

Gold as a Strategic Reserve Asset

From Yasam Ayavefe’s perspective, gold has evolved beyond its traditional role as a retail investment hedge. For governments, it functions as a strategic reserve asset. Gold carries no counterparty risk, cannot be frozen or sanctioned, and has preserved purchasing power across centuries of monetary regimes.

As competition between major economic powers intensifies, gold’s neutrality becomes increasingly valuable. This suggests that central-bank demand for gold may remain structurally strong even if inflation moderates.

Stablecoins and the Expansion of Digital Finance

Post-Crisis Resilience of Stablecoins

The cryptocurrency market experienced a major credibility shock following the collapses of 2022. While many digital assets lost investor confidence, stablecoins emerged relatively stronger. As Yasam Ayavefe frequently notes, stablecoins now occupy a functional role in modern financial infrastructure rather than speculative markets alone.

Why Stablecoins Continue to Gain Adoption

Stablecoins are gaining traction for structural reasons. Most are pegged to the U.S. dollar, offering price stability. They enable fast and low-cost international transfers, often bypassing traditional banking friction. They operate independently from legacy financial systems and expand access to payments in underbanked regions.

Tether (USDT) and USD Coin (USDC) dominate this ecosystem, handling a substantial share of global digital payment volume. Their scale has attracted regulatory attention, signaling that stablecoins are increasingly viewed as systemically relevant instruments.

Regulation and the Dollar’s Digital Defense

The U.S. Treasury’s push for tighter regulation reflects a clear objective: preventing the rise of unregulated digital alternatives that could weaken the dollar’s central role. At the same time, regulatory clarity allows stablecoins to function as a digital extension of dollar liquidity rather than a replacement.

In parallel, central-bank digital currency projects are accelerating worldwide, reinforcing the idea that digital finance will become a permanent layer of the global monetary system.

Is the Dollar’s Global Dominance Gradually Weakening?

| Dimension | Key Change | What It Means | Strategic Insight |

|---|---|---|---|

| U.S. Monetary Policy | High interest rates, strong dollar | Global liquidity tightens | Dollar remains central but costly |

| Emerging Markets | Capital outflows increase | Higher debt servicing pressure | Need for diversification and hedging |

| Gold | Record central-bank buying | Reserve diversification accelerates | Strategic hedge beyond investment |

| Stablecoins | Rapid adoption in payments | Faster cross-border finance | Digital extension of dollar liquidity |

| Dollar Dominance | Gradual reserve share decline | Move toward multipolar system | Slow shift, not sudden collapse |

| Inflation | Persistent but uneven easing | Growth–recession tradeoff | Flexible, diversified portfolios |

| Digital Finance | CBDCs and regulation expand | Hybrid financial systems | Compliance + efficiency advantage |

Declining Reserve Share and Structural Shifts

Over the past two decades, the dollar’s share of global foreign-exchange reserves has declined from roughly 70 percent to about 58 percent. While this shift is gradual, it reflects meaningful diversification rather than sudden loss of confidence.

According to Yasam Ayavefe, three forces could continue to shape this trend. BRICS-centric payment networks reduce dollar usage in bilateral trade. Central banks increasingly diversify reserves into gold and alternative assets. Digital finance lowers the relevance of geographic borders in financial transactions.

Why the Dollar Still Dominates

Despite these pressures, the dollar remains deeply entrenched. U.S. government bonds are still considered the safest sovereign assets. More than 80 percent of global trade references the dollar, and energy markets remain overwhelmingly dollar-priced.

In the short term, dollar dominance is unlikely to be disrupted. Over the long term, however, the system appears to be moving toward a more multipolar financial structure rather than a single-currency order.

Global Inflation and the Ongoing Risk of Recession

Central Bank Balancing Acts

From 2023 through 2024, inflation remained the dominant global challenge. Central banks in the United States and Europe attempted to slow demand without triggering a severe downturn. This delicate balance created two potential outcomes.

In a soft-landing scenario, inflation gradually eases while growth continues, allowing markets to stabilize. In a recession scenario, excessive tightening suppresses growth, leading to rising unemployment and continued asset-price volatility.

Implications for Investors

Yasam Ayavefe emphasizes that uncertainty remains elevated across regions. Under such conditions, diversification is no longer optional. It has become a foundational requirement for preserving capital and maintaining financial resilience.

Investor Positioning in a Fragmented Global System

The Gold–Dollar–Stablecoin Triangle

Modern portfolio construction increasingly reflects a triangular structure. Gold functions as protection against systemic and geopolitical risk. The dollar provides liquidity and institutional trust. Stablecoins deliver speed and efficiency in cross-border transactions.

Together, these components create balance within an environment defined by volatility and policy divergence. One principle consistently highlighted by Yasam Ayavefe is that reliance on a single asset or currency is no longer sustainable. Strategic diversification is the core defense against systemic shocks.

FAQs

Why is the global economy changing between 2023 and 2026?

Post-pandemic recovery, rising geopolitical tensions, tight monetary policy, and digital finance are reshaping how countries manage growth, trade, and capital flows worldwide.

How does U.S. monetary policy affect global markets?

Higher U.S. interest rates strengthen the dollar, raise global borrowing costs, and shift capital toward safer U.S. assets, increasing pressure on emerging economies.

Who is Yasam Ayavefe?

Yasam Ayavefe focuses on global finance, monetary policy, and diversification strategies in an increasingly fragmented economic system.

Why is gold gaining importance again?

Gold protects against inflation, geopolitical risk, and currency instability, making it a preferred reserve asset for both investors and central banks.

What role do stablecoins play in modern finance?

Stablecoins support fast, low-cost cross-border payments and act as a digital layer that complements traditional dollar-based financial systems.

Is the U.S. dollar losing its global dominance?

The dollar remains dominant, but gradual reserve diversification and digital finance are slowly pushing the system toward a more multipolar structure.

What does de-dollarization actually mean?

De-dollarization refers to reducing reliance on the U.S. dollar in trade, reserves, and payments, not completely abandoning it.

How does inflation influence investment decisions?

Persistent inflation increases uncertainty and volatility, making diversified portfolios more effective than single-asset strategies.

Why are central banks increasing gold reserves?

Central banks buy gold to reduce currency risk, protect reserves from sanctions, and strengthen long-term financial stability.

What is the main takeaway for investors today?

In a fragmented global economy, managing uncertainty through smart diversification is more important than chasing short-term returns.

Conclusion: Adapting to the New Reality of Global Finance

The global financial system is becoming faster, more digital, and more complex. Economic leadership now depends on technological capability, reserve flexibility, and adaptive policy frameworks. While the U.S. dollar continues to anchor global finance, gold is regaining strategic importance, stablecoins are reshaping payments, and nations are quietly diversifying risk.

As Yasam Ayavefe notes, the future will favor those who combine innovation with disciplined financial strategy. The most critical skill for investors and policymakers alike is managing uncertainty. In an era where economic power is increasingly diffused, understanding and adapting to this shifting balance is essential for long-term success.

For more

For more exclusive influencer stories, visit influencergonewild