From Side Hustle to Strategy: How Everyday People Are Getting Started in Investment Trading

The financial landscape has changed dramatically over the past two decades. Investment trading, once the domain of professional brokers and institutional investors, is now accessible to everyday people. With the rise of intuitive mobile apps, robust online educational resources, and a culture that encourages financial literacy, more individuals are discovering how to take control of their money and build wealth strategically. What used to require expensive brokerage accounts and insider knowledge is now available at the fingertips of anyone with a smartphone or computer.

Whether it’s trading stocks, ETFs, cryptocurrencies, or other asset classes, the modern investor has unprecedented access to tools and strategies once reserved for the financial elite. But with opportunity comes responsibility. Beginners must educate themselves to navigate markets safely, manage risks, and develop strategies that align with long-term financial goals.

This guide explores how ordinary people are transforming side hustles into structured trading strategies, offering insights into learning paths, risk management, and the mindset needed for financial success.

The Democratization of Investment Trading

Trading is no longer limited to the floors of the London Stock Exchange or Wall Street. Platforms like eToro, Trading 212, Robinhood, and Interactive Brokers have revolutionized access to global markets. Today, individuals can open an account in minutes, deposit funds, and start trading a wide variety of assets without needing intermediaries or high initial capital.

This democratization of finance has coincided with a cultural shift toward financial empowerment. People are no longer passive observers of their wealth; they are active participants. Social media, online communities, and video tutorials have made knowledge more accessible than ever. Aspiring traders can now learn strategies, observe live market behavior, and interact with experienced mentors—all from the comfort of their homes.

However, accessibility alone does not guarantee success. Without proper education and discipline, beginners can easily fall prey to hype, speculation, and impulsive decisions. Trading is a skill that requires both technical knowledge and emotional intelligence. Understanding market behavior, mastering risk management, and building a strategic plan are all critical components for sustainable success.

Why Education Is Crucial Before Making Your First Trade

Jumping into the markets without preparation is a recipe for losses. Many newcomers are enticed by social media posts showcasing overnight success or “easy profits,” but the reality is that trading is nuanced and requires careful planning.

Core concepts every beginner should master include:

- Diversification: Avoid putting all funds into a single stock or asset class. Diversification spreads risk and reduces the impact of market volatility.

- Risk Management: Learn how to set stop-loss orders, manage position sizing, and protect capital.

- Market Psychology: Understanding how emotions influence decisions can prevent impulsive trades driven by fear or greed.

- Market Mechanics: Know how stocks, ETFs, commodities, and cryptocurrencies work, including order types, liquidity, and settlement periods.

- Goal Setting: Define your financial objectives, whether short-term gains, medium-term wealth accumulation, or long-term retirement planning.

By understanding these fundamentals, traders can approach markets rationally, avoid panic-driven decisions, and develop strategies that support sustainable growth. Education transforms uncertainty into informed action, empowering beginners to take confident steps in the world of investment.

Starting Small: The Importance of Practicing Before Committing Capital

One of the most effective ways to begin is through demo accounts, which allow traders to simulate real market conditions without risking actual money. Platforms like eToro and Trading 212 offer virtual accounts where beginners can practice executing trades, experimenting with strategies, and observing market responses.

Once comfortable with simulated trading, newcomers can start with small investments to develop good financial habits. The key is to focus on consistent practices rather than chasing high-risk opportunities. Small, manageable trades enable traders to:

- Build confidence and learn from mistakes in a controlled environment.

- Develop discipline in following a trading plan.

- Understand how fees, spreads, and commissions affect net returns.

Example: Suppose a beginner decides to invest $100 per week in a diversified portfolio of ETFs. Over time, this consistent approach allows them to understand market cycles, fluctuations, and the effects of compounding—without the stress of risking large sums upfront.

Pound-Cost Averaging: A Strategy for Managing Market Volatility

Pound-cost averaging (PCA) is a simple yet powerful technique for reducing the impact of market volatility. By investing a fixed amount at regular intervals, investors automatically buy more shares when prices are low and fewer when prices are high. Over time, this approach smooths the average cost per share and mitigates the risk of trying to time the market.

For example, if a trader invests $500 monthly in a diversified fund, they might buy 10 shares in a month when prices are $50 and 12 shares when prices drop to $40. This approach reduces the emotional stress of market timing and supports long-term wealth accumulation.

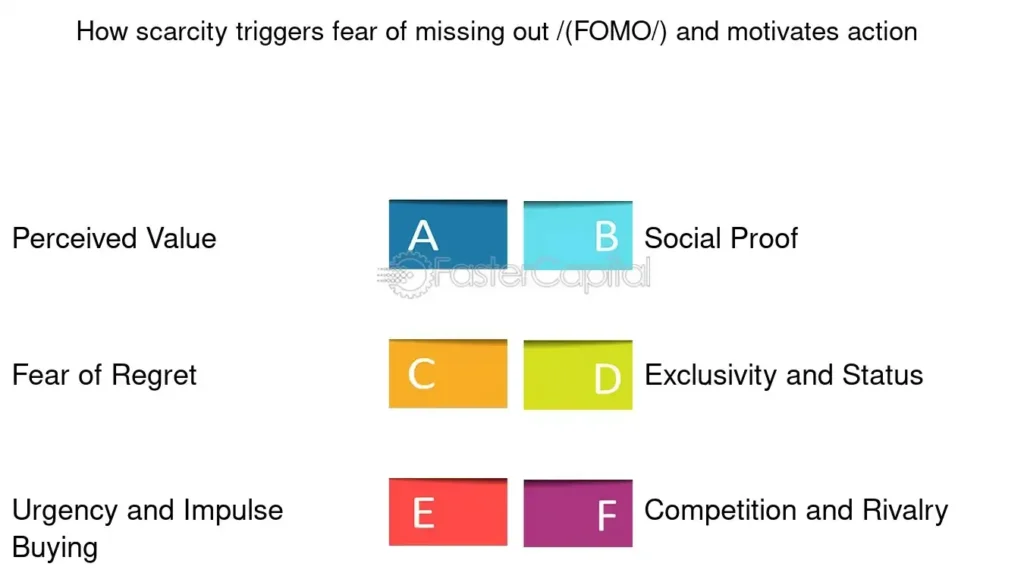

Avoiding Hype and FOMO

In today’s social media-driven world, FOMO (fear of missing out) is a major challenge. Platforms like Twitter, TikTok, and Reddit frequently highlight sensational market stories or “hot tips” that can tempt inexperienced traders to act impulsively.

Successful investors focus on strategy and consistency rather than hype. Key practices include:

- Conducting thorough research before every trade.

- Avoiding decisions based solely on trending topics or viral content.

- Keeping a trading journal to track decisions and outcomes.

- Reviewing trades objectively to learn from successes and mistakes.

By adopting a disciplined approach, traders can grow their portfolios steadily, avoiding the emotional rollercoaster that leads to losses.

Where to Find Reliable Learning Resources

Education is the foundation of successful trading. Beginners should seek reputable platforms that provide structured courses covering both technical skills and market psychology. Recommended resources include:

- Online courses: Websites like Coursera, Udemy, and Investopedia offer beginner-to-advanced courses on trading, portfolio management, and financial analysis.

- Books: Classic titles like The Intelligent Investor by Benjamin Graham or A Random Walk Down Wall Street by Burton Malkiel provide timeless strategies.

- Webinars and mentorship programs: Experienced traders often share insights in real-time sessions, allowing learners to ask questions and observe decision-making processes.

- Financial news and analysis platforms: Bloomberg, Yahoo Finance, and MarketWatch offer up-to-date market information essential for informed decisions.

A combination of these resources ensures traders gain a comprehensive understanding of both theory and practical application.

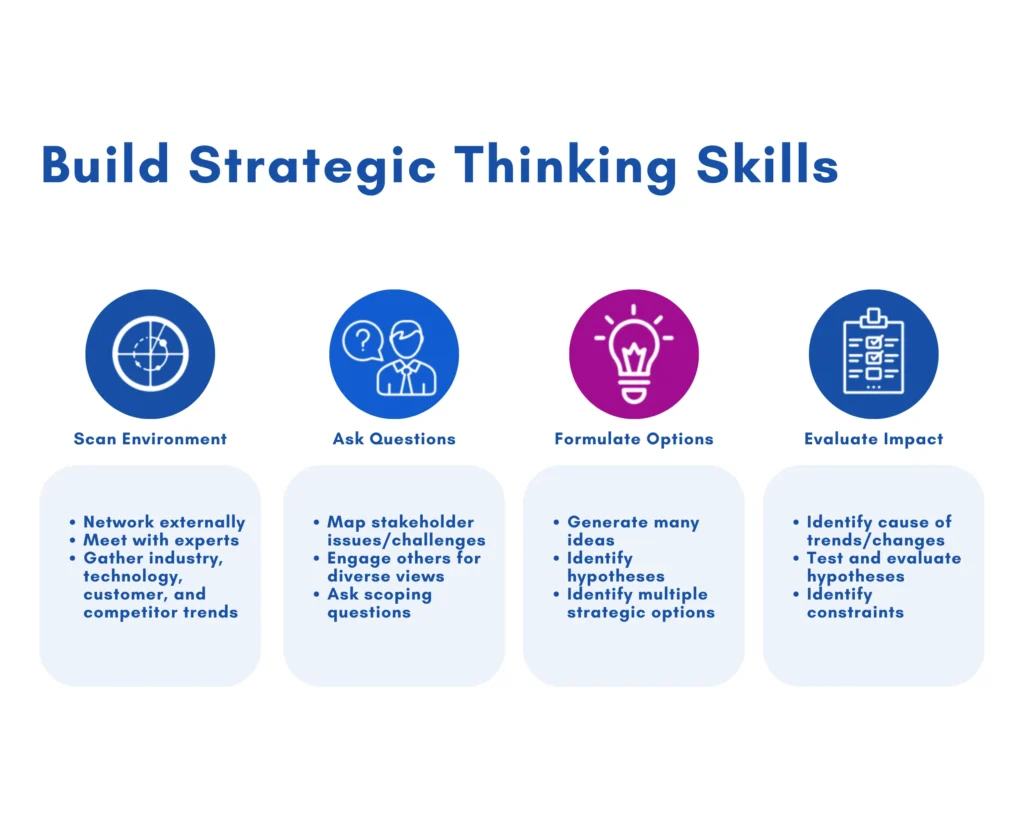

Building a Strategic Mindset

Beyond knowledge, trading requires a strategic mindset. This means approaching investment like a long-term game rather than a get-rich-quick scheme. Investment Trading Important traits include:

- Patience: Wealth accumulation is a marathon, not a sprint.

- Discipline: Following a plan prevents emotional decisions.

- Adaptability: Markets evolve, and strategies must adjust to changing conditions.

- Continuous Learning: Staying informed about market trends, economic indicators, and technological advancements is essential.

A strategic mindset transforms trading from a side hustle into a sustainable financial practice, allowing individuals to build wealth methodically over time.

Combining Side Hustles with Trading

Many traders start with small side hustles to generate extra capital. Examples include freelance work, online content creation, or consulting. By allocating a portion of this income to investments, individuals can grow their wealth without relying solely on their primary salary.

Side hustles offer several advantages:

- They provide additional funds for diversification.

- They reduce dependency on market performance for everyday expenses.

- They encourage disciplined budgeting and savings.

Over time, as knowledge and confidence grow, these side hustle earnings can be leveraged into more sophisticated trading strategies, turning small beginnings into a structured wealth-building approach.

The Role of Risk Management

No trading strategy is complete without a robust risk management plan. Investment Trading Beginners should prioritize capital protection to ensure they can continue trading even during market downturns. Key techniques include:

- Setting stop-loss limits: Automatically sell assets at a predetermined price to prevent excessive losses.

- Portfolio diversification: Spread investments across multiple asset classes to reduce systemic risk.

- Position sizing: Only risk a small percentage of capital on individual trades.

- Regular review: Reassess strategy and performance to adjust for changing market conditions.

Effective risk management protects both money and confidence, allowing traders to remain disciplined and resilient.

Developing Long-Term Goals

Trading should align with long-term financial objectives. These goals may include:

- Building a retirement portfolio.

- Saving for a home purchase.

- Funding education or personal projects.

- Creating generational wealth.

Investment Trading By setting clear objectives, traders can design strategies that are consistent, disciplined, and aligned with their broader life plans. Each trade becomes a step toward a larger goal, rather than an isolated attempt at profit.

Conclusion: From Side Hustle to Strategy

The modern Investment Trading world is open to everyone, but success requires more than access. Education, disciplined strategy, consistent practice, and a long-term mindset are critical components for sustainable wealth growth.

Everyday people are transforming side hustles into structured trading strategies by:

- Starting small with demo accounts and low-risk investments.

- Learning market fundamentals and technical analysis.

- Managing risks and avoiding hype-driven decisions.

- Leveraging side income to build diversified portfolios.

- Focusing on long-term goals and strategic planning.

Investment trading is no longer reserved for financial professionals. With dedication, education, and a strategic mindset, anyone can harness the tools available today to build wealth and secure financial independence. By approaching trading as a journey rather than a gamble, everyday people can turn side hustles into powerful wealth-building strategies that last a lifetime.

For more

For more exclusive influencer stories, visit influencergonewild