How Corporate Executives Use Insider Trading Legally: A Complete Guide for Modern Investors

Legal Insider Trading When people hear the term insider trading, the first reaction is almost always negative. The phrase immediately brings to mind images of secret boardroom deals, hidden information, sudden stock spikes, and high-profile investigations by regulators. Movies, headlines, and financial scandals have shaped public perception to believe that insider trading is always illegal and unethical.

The reality, however, is far more nuanced.

Every single day, corporate executives, board members, and senior employees legally buy and sell shares of their own companies. These transactions happen openly, are reported to regulators, and are available for the public to see. This form of legal insider trading is not only allowed but is also considered an important part of market transparency.

Understanding how insiders trade legally and why they do it can give investors a powerful analytical advantage. When used correctly, insider trading data can help investors understand executive confidence, corporate health, and long-term business outlooks.

This article explains how corporate executives use insider trading legally, the rules that govern these trades, and what smart investors can learn from insider activity without crossing any ethical or legal lines.

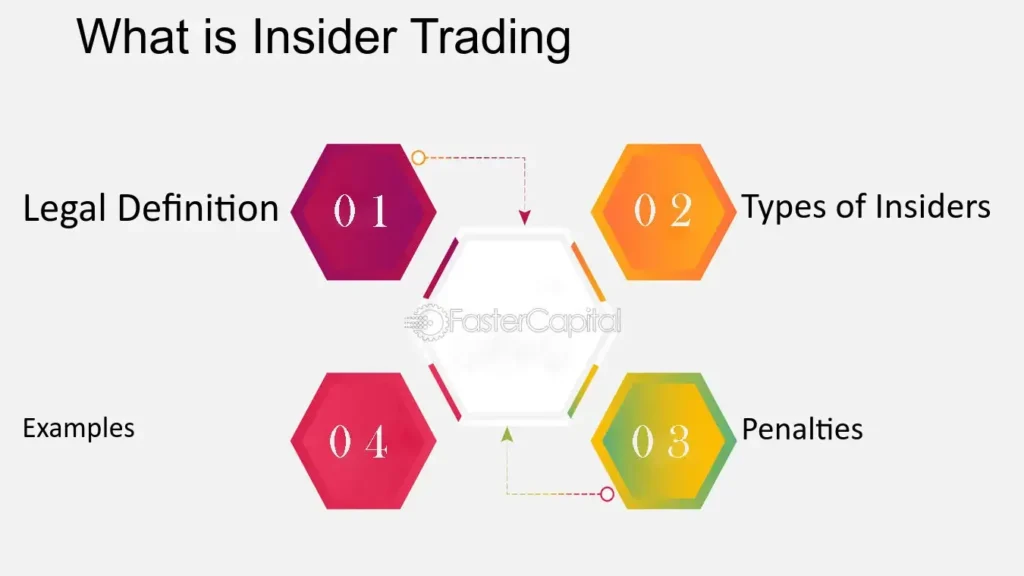

Understanding Insider Trading Beyond the Myths

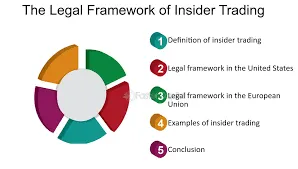

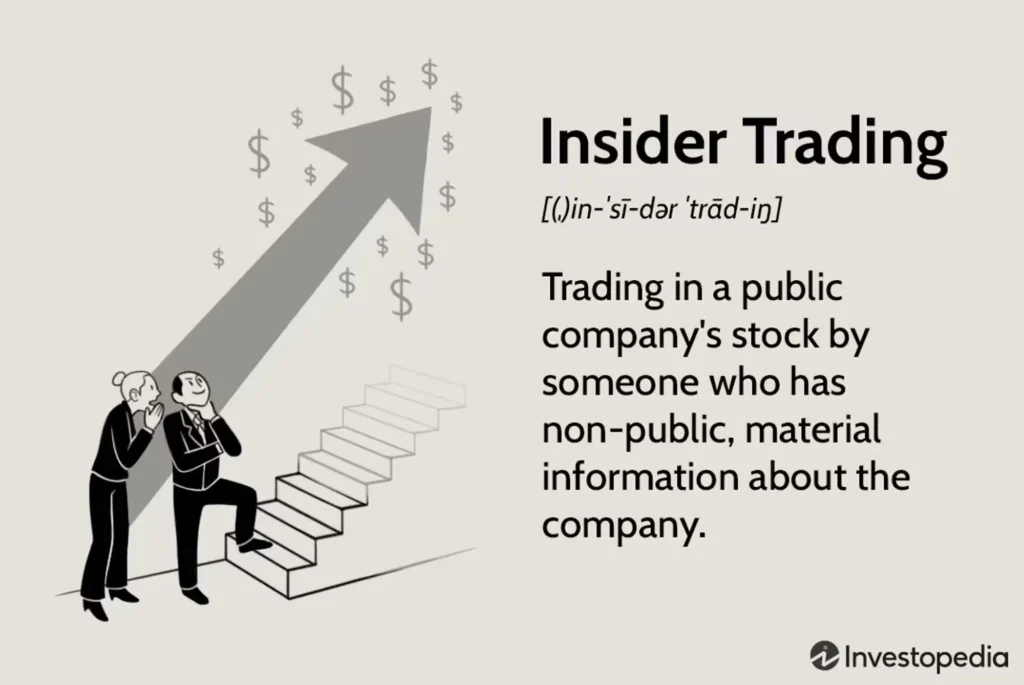

At its core, insider trading simply means buying or selling a company’s stock by someone who has a close relationship with the company. This includes executives, directors, and employees who may have access to sensitive business information.

The problem arises only when trades are made using material, nonpublic information. That is where legality is determined.

Illegal insider trading happens when someone acts on confidential information that has not yet been released to the public, such as undisclosed earnings results, mergers, regulatory decisions, or financial distress. Trading on such information gives an unfair advantage and undermines trust in the market.

Legal insider trading, on the other hand, occurs when insiders trade based on public information, follow regulatory rules, and properly disclose their transactions. These legal trades are not secret—they are visible to anyone willing to look.

What Legally Qualifies as Insider Trading?

Insider trading becomes legal or illegal based on three key factors: information, timing, and disclosure.

If an executive trades while in possession of material information that is not publicly available, the trade is illegal. If the same executive trades after that information has been released and follows disclosure rules, the trade is legal.

The law does not prohibit insiders from owning or trading stock. In fact, regulators often encourage executives to hold shares because ownership aligns leadership incentives with shareholders.

What matters is how responsibly those trades are conducted.

The Regulatory Framework That Makes Insider Trading Legal

In the United States, legal insider trading is governed primarily by the Securities and Exchange Commission (SEC). The SEC has established clear rules to ensure fairness, transparency, and accountability.

Executives must operate within a tightly regulated structure that limits when they can trade, how they trade, and how quickly they disclose their transactions.

This framework is designed to protect investors while still allowing insiders to manage their personal finances.

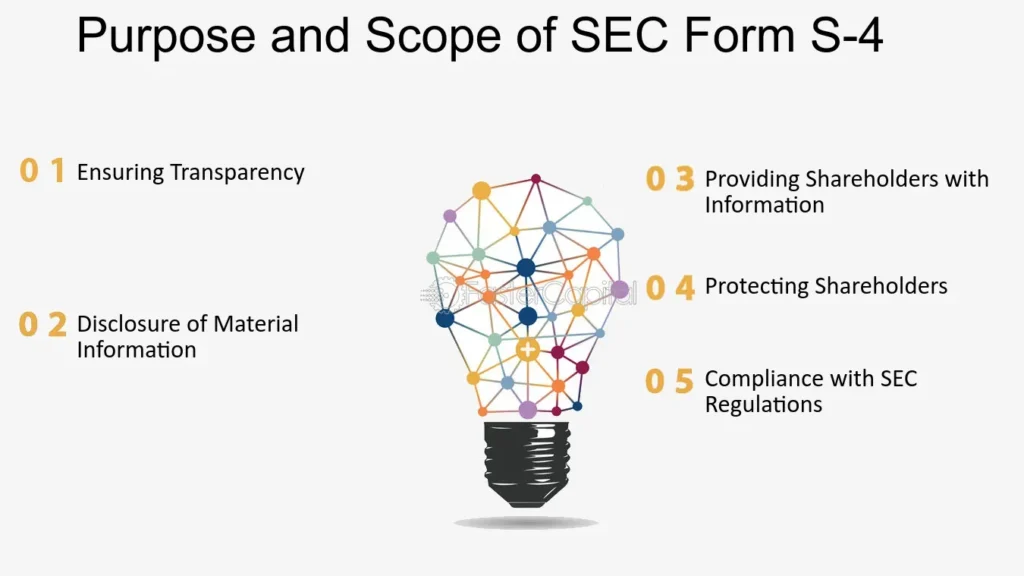

Mandatory Disclosure and Transparency (Form 4 Filings)

One of the most important rules in legal insider trading is mandatory disclosure.

Whenever an insider buys or sells company stock, they are required to file Form 4 with the SEC within two business days. This form includes critical details such as:

- Number of shares traded

- Price of the transaction

- Date of the trade

- Insider’s role within the company

These filings are made public through the SEC’s EDGAR system. Anyone from institutional investors to individual traders can view them.

This transparency is what transforms insider trading from a secretive act into a regulated, observable market signal.

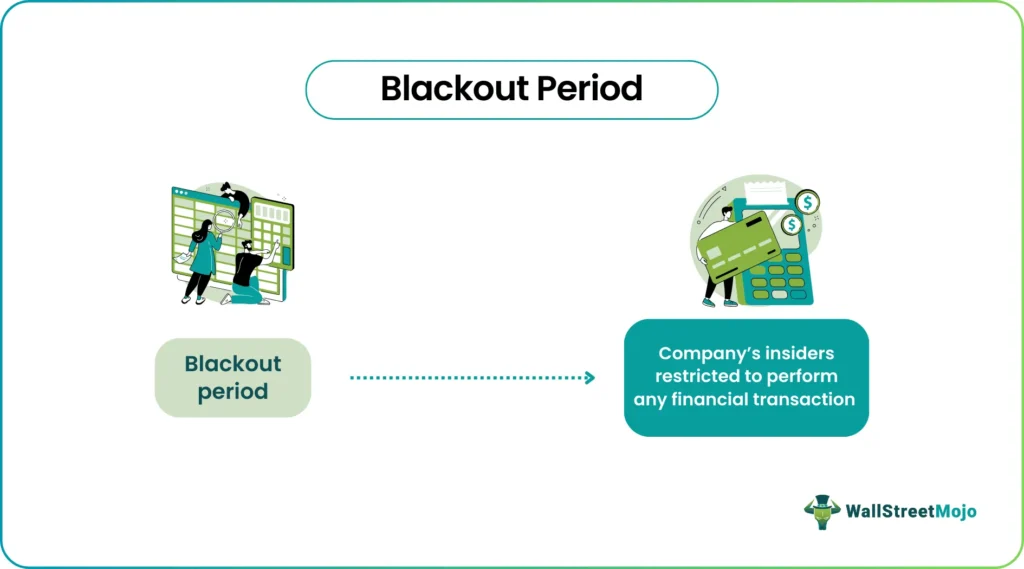

Trading Windows and Corporate Blackout Periods

Even when executives are trading legally, they cannot trade at just any time.

Most publicly traded companies enforce internal trading windows. These are specific periods when executives are allowed to trade company stock. Trading windows usually open shortly after earnings reports are released and close before the next reporting period begins.

During blackout periods, insiders are prohibited from trading because they are likely to possess nonpublic information.

This internal control system adds an extra layer of protection against illegal activity and reinforces ethical trading behavior.

Rule 10b5-1 Trading Plans: The Backbone of Legal Insider Trading

One of the most powerful tools executives use to trade legally is the Rule 10b5-1 trading plan.

A 10b5-1 plan allows insiders to pre-schedule trades well in advance. The plan specifies the timing, quantity, and pricing conditions under which trades will occur. Once established, trades execute automatically, regardless of future events.

Because these plans are created when the insider does not possess material nonpublic information, they provide legal protection against accusations of insider abuse.

For executives, 10b5-1 plans offer structure and predictability. For investors, they offer clarity, as trades are less likely to be emotionally driven or opportunistic.

Why Corporate Executives Buy and Sell Their Own Stock

Insider trades are often misunderstood. Many investors assume that every sale signals trouble or every purchase guarantees growth. In reality, executives trade for many personal and financial reasons unrelated to company performance.

Executives may sell shares to diversify their wealth, manage taxes, fund major life expenses, or plan estates. Selling does not automatically mean a lack of confidence in the company.

Buying, however, tends to carry stronger meaning. Executives already depend on the company for income and reputation. When they invest additional personal money into company stock, it often reflects confidence in future growth or undervaluation.

This is why insider buying attracts more attention than insider selling among analysts and investors.

The Psychological and Strategic Meaning of Insider Buying

When insiders buy shares on the open market, they are making a public statement with their own capital.

These purchases suggest that executives believe the company’s future prospects are stronger than the current market price reflects. Insiders have deep operational knowledge, even when limited to public information, which makes their buying behavior especially meaningful.

Multiple insider purchases clustered within a short time period can indicate strong internal confidence, especially after stock price declines or during market uncertainty.

How Investors Use Legal Insider Trading Data

Legal insider trading data has become a powerful research tool for investors. Professional funds, analysts, and individual traders monitor insider filings to gain insight into leadership sentiment.

Investors look for patterns rather than isolated trades. A single purchase may not mean much, but repeated buying by multiple executives often draws attention.

Insider data is rarely used alone. Instead, it is combined with financial analysis, valuation metrics, and industry trends to form a more complete investment thesis.

Insider Trading Alerts and Modern Investment Tools

With thousands of insider trades filed every year, manually tracking them would be impractical. This has led to the rise of insider trading alert platforms that notify investors in real time when executives buy or sell shares.

These tools help investors quickly identify notable transactions and investigate further. However, responsible investors understand that insider activity is a signal not a guarantee.

Blindly following insider trades without proper research can be risky. Context, company fundamentals, and broader market conditions always matter.

Legal Insider Trading vs Market Manipulation

It is important to distinguish legal insider trading from market manipulation.

Legal insider trading is transparent, disclosed, and regulated. Market manipulation involves misleading statements, artificial price movements, or deceptive practices designed to influence stock prices unfairly.

Executives are prohibited from using insider trades to manipulate markets. Regulators monitor unusual activity patterns and investigate suspicious behavior aggressively.

This oversight ensures that insider trading remains a legitimate informational tool rather than a vehicle for abuse.

Ethical Considerations in Insider Trading

Even when insider trading is legal, ethical considerations remain important. Executives are expected to act in the best interest of shareholders and the company.

That is why many companies encourage long-term ownership and discourage excessive short-term trading. Ethical insider behavior strengthens corporate governance and investor trust.

Transparency, accountability, and compliance form the foundation of ethical insider activity.

Global Perspective on Legal Insider Trading

While this article focuses primarily on U.S. regulations, most developed markets follow similar principles. Countries like the UK, Canada, and members of the European Union require disclosure, restrict trading windows, and penalize illegal insider behavior.

Global investors must understand regional regulations, but the underlying concept remains the same: fair access to information and transparent markets.

Why Legal Insider Trading Matters for Market Confidence

Legal insider trading plays a crucial role in maintaining investor confidence. When insiders disclose their trades, they provide signals that help markets price information more efficiently.

Without disclosure requirements, markets would be vulnerable to hidden advantages and manipulation. Transparency ensures that no participant has unchecked power over price movements.

In this way, legal insider trading strengthens not weakens financial markets.

Final Thoughts: Turning Knowledge into Advantage

Insider trading is often misunderstood, but when conducted legally, it is a vital component of modern financial markets. Corporate executives are allowed to trade their own company’s stock as long as they follow strict rules, disclose their actions, and avoid nonpublic information.

For investors, understanding these legal frameworks provides valuable insight into executive sentiment and corporate confidence. When used responsibly, insider trading data can enhance investment decisions and reduce uncertainty.

In today’s fast-moving markets, knowledge is power. Knowing how corporate executives use insider trading legally allows investors to separate fear from facts and speculation from strategy.

For more

For more exclusive influencer stories, visit influencergonewild