Pi Network Pops Off — Hype, Hustle & Real-World Payoffs: The Ultimate 2025 Guide

Network cryptocurrency In the sprawling universe of cryptocurrencies, few projects have captured attention quite like Pi Network. What began as a quiet, experimental mobile mining initiative has exploded into a worldwide phenomenon, boasting tens of millions of users and a buzz that spans social media, influencer circuits, and unofficial exchanges. Yet amid this excitement, a crucial question persists: Will Pi Network transform this viral hype into tangible value, or is it destined to fade as another overhyped token in crypto history?

In this guide, we explore Pi Network from every angle: its origin, technology, mobile mining mechanics, market dynamics, social hype, adoption trends, and potential real-world applications. We also break down the risks, opportunities, and what 2025 could hold for both early adopters and newcomers.

The Origins of Pi Network: From Experiment to Explosion

Pi Network was launched with a bold promise: to make cryptocurrency mining accessible to the average smartphone user. Unlike traditional mining that requires expensive GPUs or ASIC rigs, Pi enabled users to mine coins with just a few taps every 24 hours. Users create trust chains by inviting friends, verifying identities, and expanding the network.

The simplicity of this approach made Pi Network viral. By 2025, the network claims around 47 million active users worldwide, a figure that is still growing rapidly. Unlike Bitcoin or Ethereum, which require complex infrastructure and energy-heavy operations, Pi’s mobile mining model democratizes access, allowing anyone with a smartphone to participate.

However, the system has faced skepticism. Critics argue that Pi Network is not fully decentralized, as mining depends on a trust chain model rather than raw computational power. Despite this, the user growth has been undeniable, fueled largely by social media, influencer marketing, and gamified engagement within the app.

How Pi Network Spread Through Influencer Loops

Social media has been a key driver of Pi Network’s growth. On TikTok alone, the hashtag #PiNetwork has accumulated over 900 million views. Influencers, crypto enthusiasts, travel vloggers, and tech content creators frequently showcase Pi mining, early adopter badges, and projected payoffs.

The platform’s viral mechanism relies heavily on network effects: each user is incentivized to recruit others to grow the trust chain. This has created an ecosystem where buzz feeds itself—users share referral codes, post screenshots, and generate a continuous loop of engagement.

Interestingly, Pi’s popularity isn’t confined to North America or Europe. Emerging markets like Nigeria, India, and Southeast Asia have seen disproportionate adoption. In countries experiencing currency instability, Pi is often perceived as a potential hedge or alternative to fiat currencies, adding an extra layer to its appeal.

Understanding Mobile Mining: How Pi Coins Are Generated

Unlike Bitcoin mining, which involves energy-intensive hashing, Pi uses a Proof-of-Work-Trust (PoWT) model:

- Daily Mining: Users mine coins by logging in daily.

- Trust Verification: New users are verified through referral networks and identity confirmation.

- Contribution to Network Security: Verified users help maintain transaction integrity without energy-heavy computation.

This method significantly reduces barriers to entry and environmental impact. Mobile mining makes Pi accessible, but it also raises questions about scarcity and real economic value, as the ease of mining contrasts sharply with the limited supply models of traditional cryptocurrencies.

Pi Prices on Exchanges: Off-Book Trading and the Ghost Economy

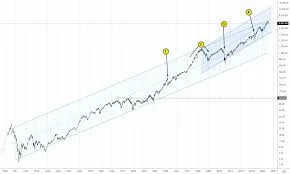

Although the Pi mainnet is not yet fully live, the token has appeared on unofficial exchanges, creating a ghost economy. Prices have fluctuated between 17 and over 50, reflecting speculative trading rather than fundamental supply and demand.

Early 2025 data shows Pi trading in the 38–42 range, with heavy buy and sell orders from Southeast Asia and Nigeria. These transactions occur entirely outside official platforms, creating a unique paradox: a cryptocurrency whose value is largely driven by hype rather than utility.

This mirrors historical crypto phenomena, such as Ethereum’s early surge. While Ethereum launched in 2015, its real-world value soared only after developers built applications and DeFi protocols. Pi, conversely, gained mass public attention first, and product delivery is still catching up.

The Role of Influencers in Driving Pi Network Adoption

Influencers are central to Pi’s hype engine. TikTok, YouTube, Telegram, and Discord are awash with content showing Pi mining, staking early-adopter badges, and speculating on future payoffs. Users are encouraged to share referral codes, participate in social challenges, and create viral content, fueling adoption.

- TikTok: Step-by-step guides, mining screens, and viral trends.

- YouTube: Detailed tutorials on maximizing Pi rewards and building referral chains.

- Discord & Telegram: Community discussions, trading speculation, and off-exchange market coordination.

Influencers have particularly strong pull in regions with economic instability. In Nigeria, Argentina, and parts of Southeast Asia, Pi is pitched as a soft hedge against inflation or currency volatility. While its effectiveness as a financial tool is debated, the perception alone has accelerated adoption.

Hype vs. Real-World Utility

Despite widespread attention, Pi faces a key challenge: the mainnet is not fully live, and most users cannot yet convert coins into cash or spend them in everyday transactions. The Pi Core Team has emphasized that mainnet launch depends on KYC completion and the development of a broader suite of applications.

Currently, most activity is speculative:

- Unofficial Exchanges: Set Pi prices without formal endorsement.

- Trading Bots: Automated systems run by users to speculate on price movements.

- Community Trading: Peer-to-peer sales through social channels.

Until the mainnet opens fully, Pi’s market value depends on perceived future utility and socal buzz, rather than actual transactional activity.

Risks and Challenges

- Speculative Volatility: Prices are driven largely by hype, making Pi vulnerable to sudden drops.

- Incomplete Decentralization: The trust-chain model raises questions about long-term security and network independence.

- Regulatory Uncertainty: Governments are scrutinizing crypto projects, and Pi may face future compliance challenges.

- Delayed Utility: Without mainnet adoption, real-world applications remain limited, affecting long-term viability.

Opportunities and Potential

Despite risks, Pi Network offers several exciting possibilities:

- Mass Adoption Potential: With over 47 million active users, Pi could become a widely recognized digital asset.

- Financial Inclusion: Mobile-first access allows users in underserved regions to participate in crypto.

- Community-Driven Innovation: The social mining model encourages collaboration, building a loyal user base.

- Future DeFi Integration: Once the mainnet launches, Pi could integrate with payment systems, decentralized finance, and staking platforms.

Pi Network in a Global Context

Emerging markets have played a disproportionate role in Pi’s adoption. In countries experiencing currency devaluation or limited access to financial infrastructure, Pi is often framed as a safer alternative to unstable local currencies.

Furthermore, Pi’s mobile-first approach aligns with global smartphone penetration trends. Unlike traditional cryptocurrencies that require desktop wallets or hardware, Pi is accessible to anyone with a smartphone and an internet connection.

Mainnet Launch and Real-World Payoffs

The mainnet launch is pivotal for Pi’s transition from speculative hype to tangible utility. Once users can transfer, trade, and spend Pi coins on approved platforms, the network may finally realize its potential as a functioning currency.

Potential real-world use cases include:

- Peer-to-Peer Payments: Sending Pi between friends, family, or small businesses.

- Merchant Adoption: Payments for goods and services via Pi-compatible apps.

- Integration with DeFi: Lending, staking, and decentralized exchanges.

- Micropayments: Small-value transactions for content creators or online services.

Pi Network vs. Other Crypto Projects

Pi Network differs from traditional crypto projects in accessibility, mining method, and adoption strategy. While Bitcoin and Ethereum rely on energy-intensive mining or staking, Pi’s mobile-first design lowers the barrier to entry dramatically. Its massive user base is built more on social engagement than financial incentive, which both amplifies adoption and heightens speculation risk.

The Future of Pi Network

If Pi successfully launches its mainnet and develops robust applications, it could become a major player in the mobile crypto space. Key success factors include:

- Completing KYC verification for all users.

- Expanding merchant and payment integrations.

- Building developer tools and DeFi partnerships.

- Maintaining community trust while mitigating speculative volatility.

Failing to address these could relegate Pi to a cautionary tale, remembered as a viral sensation without lasting financial impact.

Conclusion: Buzz, Value, and the Road Ahead

Pi Network sits at a fascinating intersection of hype, innovation, and potential. Its mobile-first mining model, massive user base, and social media virality make it unlike any other crypto project. Yet the question of real-world value remains: can Pi convert social engagement into a functional, widely adopted cryptocurrency?

Until the mainnet fully opens, Pi exists in a hybrid state—a crypto buzz phenomenon supported by social belief rather than transactional utility. Early adopters must navigate speculation, off-exchange trades, and evolving technology.

In the long term, Pi Network’s success will depend on whether it can deliver tangible use cases, foster trust, and integrate into everyday financial systems. For now, it represents a bold experiment in crypto adoption—a glimpse at the future of social, mobile-driven currencies, and a lesson in the power (and risk) of hype in the digital age.

For more

For more exclusive influencer stories, visit influencergonewild