Opening Hour of Trading: Why the First Hour Sets the Tone for the Entire Market

The opening hour of trading plays a decisive role in shaping how financial markets behave throughout the day. It is the moment when overnight information, global developments, institutional strategies, and trader psychology collide in real time. For many experienced traders, this first hour is not just another part of the trading session—it is the foundation upon which intraday trends are built.

Markets do not open in isolation. By the time the opening bell rings, news has already circulated, earnings have been analyzed, and expectations have formed. What happens during this initial phase often determines whether the day will trend upward, downward, or remain volatile and uncertain. Understanding the mechanics behind the opening hour of trading gives traders a powerful edge in reading market behavior and managing risk effectively.

This article explores why early market moves matter so much, focusing on liquidity and volatility, institutional influence, and the combination of psychological and technical indicators that dominate the first hour.

Why the Opening Hour of Trading Is So Influential

The opening hour is unique because it compresses a large amount of decision-making into a short window of time. Orders placed before the session, reactions to overnight events, and fresh technical signals all surface at once. This creates an environment unlike any other part of the trading day.

During this phase:

- Liquidity surges

- Volatility spikes

- Price discovery accelerates

Traders across the spectrum—from major institutions to retail traders—are actively involved. The result is a powerful burst of market activity that often sets support and resistance levels for the rest of the session.

Liquidity and Volatility: The Market’s Defining Pulse

The Surge of Early Trading Activity

When markets open, liquidity reaches one of its highest points of the day. A backlog of buy and sell orders accumulated overnight suddenly enters the market. This immediate flow of orders creates sharp movements in price, sometimes within seconds of the opening bell.

This early trading activity reflects:

- Reactions to overnight news

- Adjustments to global market movements

- Positioning ahead of expected trends

Prices may rise and fall rapidly, offering both opportunity and risk. Many traders recall sessions where prices fluctuated dramatically within minutes, presenting chances for quick gains but also exposing unprepared traders to sudden losses.

Liquidity as a Double-Edged Sword

High liquidity is often viewed as beneficial because it allows traders to enter and exit positions more easily. However, during the opening hour of trading, liquidity combined with heightened volatility can be unpredictable.

On one side:

- Tight spreads

- Faster execution

- Greater opportunity

On the other:

- Sudden reversals

- False breakouts

- Increased risk

This balance makes the opening hour both exciting and dangerous. Traders must remain alert, knowing that rapid price action can shift direction just as quickly as it appears.

Early Price Action Defines the Day

One of the most important aspects of the opening hour is its role in establishing reference points. Early price action often forms:

- Key support and resistance levels

- Initial trend direction

- Market bias for the session

These levels frequently influence trading decisions later in the day, even when volume slows. Traders who understand this dynamic pay close attention to how price behaves during the first hour before committing fully to positions.

Institutional Influence: How Smart Money Shapes the Market Open

The Role of Major Institutions

Large financial institutions, hedge funds, and professional asset managers play a significant role during the opening hour of trading. Their large order sizes can move markets quickly and visibly.

Before the market opens, these players analyze:

- Pre-market data

- Earnings reports

- Macroeconomic updates

- Overnight geopolitical events

Based on this information, they execute strategic trades that often establish the initial direction of the market.

Why Institutional Moves Matter

Institutional influence matters because of scale. When major players enter or exit positions, price reacts decisively. Retail traders often observe these moves and follow the momentum, further amplifying early trends.

Key drivers behind institutional activity include:

- Earnings surprises

- Economic indicators

- Policy announcements

- Global market reactions

Once a direction is established, it can trigger a chain reaction, pulling in additional participants and reinforcing the trend.

Should Retail Traders Follow Smart Money?

Many traders ask whether mimicking institutional behavior is a reliable strategy. While following smart money can provide insight, blindly copying large moves without analysis can be risky.

A more balanced approach involves:

- Observing institutional activity

- Confirming trends with technical indicators

- Aligning trades with personal risk management rules

Successful traders study historical patterns and combine institutional signals with their own research before acting.

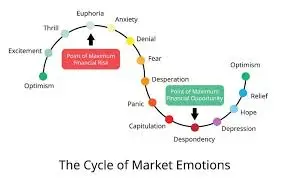

Psychology During the Opening Hour of Trading

Emotions at Their Peak

The opening hour is not just about numbers—it is deeply psychological. Traders react to:

- Overnight uncertainty

- Fear of missing out

- Pressure to act quickly

Emotions run high, and decisions are often made faster than later in the day. This psychological intensity contributes to sharp price movements and sudden changes in market sentiment.

How Sentiment Forms Early

Market sentiment often becomes visible within minutes of the open. Strong buying pressure can signal optimism, while aggressive selling may indicate fear or caution. These early signals influence trader confidence and decision-making throughout the session.

Without discipline, emotional trading can lead to:

- Panic selling

- Overtrading

- Poor entries and exits

Understanding emotional dynamics during the opening hour helps traders remain objective and avoid impulsive mistakes.

Technical Indicators in the Opening Hour

Why Technical Signals Matter Early

Technical indicators are particularly effective during the opening hour of trading because volume and participation are high. This increases the reliability of certain patterns and signals.

Common technical indicators observed during this period include:

- Opening range breakouts

- Gap fills

- Volume spikes

- Early trend confirmation

These signals help traders determine whether the market is likely to trend or remain range-bound.

Opening Range Breakouts Explained

The opening range refers to the high and low established during the initial portion of the session. Breakouts from this range often signal strong directional intent.

If price breaks above the opening range with volume, it may indicate bullish momentum. A breakdown below the range may suggest bearish control. Traders frequently use these levels as benchmarks for entries and exits.

Support, Resistance, and Volume

Support and resistance levels formed during the opening hour often remain relevant throughout the day. Combined with volume analysis, these levels provide insight into market strength.

High volume during early moves suggests conviction, while low volume may signal false moves or hesitation.

Early Market Moves and Their Ripple Effects

How Early Trends Carry Forward

Early market moves often create ripple effects that extend across the entire trading session. Once a trend gains momentum, it attracts additional traders, reinforcing price direction.

This effect is especially noticeable when:

- Institutions continue adding to positions

- News confirms early sentiment

- Technical levels hold consistently

Understanding these ripple effects allows traders to align with prevailing trends rather than fighting them.

When Early Moves Fail

Not all early moves succeed. False breakouts and reversals are common during the opening hour. This is why patience and confirmation are critical.

Traders who wait for:

- Volume confirmation

- Retests of key levels

- Clear structure

often avoid unnecessary losses caused by early volatility.

Risk Management During the Opening Hour of Trading

Why Risk Control Is Essential

Because volatility is highest early in the session, risk management becomes even more important. Without clear rules, traders can suffer significant losses within minutes.

Effective risk management includes:

- Defined stop-loss levels

- Proper position sizing

- Avoiding overexposure

The opening hour rewards preparation, not impulsiveness.

Balancing Opportunity and Protection

While the opening hour offers some of the best opportunities, it also carries the greatest risk. Skilled traders balance opportunity with protection by sticking to predefined strategies and avoiding emotional decisions.

Learning From Past Opening Sessions

Historical analysis shows that traders who study past opening sessions develop better instincts. Reviewing:

- Previous opening ranges

- Volume behavior

- Institutional patterns

helps refine future strategies and build consistency.

Adapting Strategies to Market Conditions

Markets change, and no two opening hours are identical. Traders who adapt their approach based on:

- Market environment

- Volatility levels

- News context

perform better than those using rigid systems.

Flexibility combined with discipline is the hallmark of successful early-session trading.

Final Thoughts on the Opening Hour of Trading

The opening hour of trading is the most dynamic and informative part of the trading day. It reveals market sentiment, institutional intent, and technical direction all at once. By understanding liquidity and volatility, recognizing institutional influence, and interpreting psychological and technical signals, traders can make more informed decisions.

Early market moves are not random. They reflect preparation, expectation, and reaction. Traders who respect the power of the opening hour, manage risk wisely, and remain disciplined gain a clearer perspective on market behavior.

Each opening session offers lessons. By observing carefully and refining strategies over time, traders can turn the opening hour from a source of chaos into a structured opportunity for growth.

For more

For more exclusive influencer stories, visit influencergonewild