How Real-Time Financial News APIs Are Powering the Next Era of Data-Driven Innovation

In recent years, the global economy has undergone a massive, unstoppable transformation, shifting decisively toward a fully digital environment. This shift has dramatically changed the way businesses operate, professionals make decisions and information flows across industries. Today’s world no longer treats information as a side asset — it is the core foundation upon which modern decision-making stands. Whether someone is a startup founder trying to validate product-market fit, a university researcher conducting data-driven academic studies, a software engineer building analytical tools, a fintech developer designing next-generation financial applications or a financial analyst evaluating market sentiment, access to real-time, structured and verified information has become an essential requirement rather than a luxury.

As digital transformation accelerates, the value of timely data has grown significantly. Among all types of financial insight available, one category holds exceptional influence across every industry: market news. Unlike static datasets or historical economic reports, market news has the power to shift trends instantly. A breaking headline about regulatory changes, a central bank announcement, a surprising corporate earnings statement or a sudden geopolitical event can move billions of dollars in global markets within seconds. Because of this speed, accuracy and sensitivity, market news has become one of the most crucial inputs for organisations working in finance, research, technology and strategic planning.

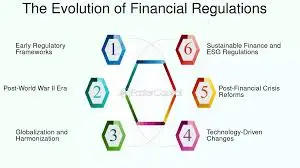

The Evolution of Financial News and Market Intelligence

For many decades, financial news and market intelligence were controlled by a select group of media giants, large banks, elite financial institutions and high-cost professional terminals. These platforms offered exclusive access to real-time news feeds that were often too expensive for smaller companies, universities, independent researchers or early-stage startups. This created an imbalance where only organisations with significant resources could access real-time, verified, structured financial information.

However, the rapid evolution of digital infrastructure has completely changed this landscape. The rise of cloud computing, large-scale data systems and modern APIs has democratised access to financial intelligence. Market news is no longer locked behind closed systems. Instead, developers, researchers, analysts, traders, students and even small teams can integrate real-time financial news directly into their tools, platforms or research models.

This transformation is not just a technological shift — it is a structural change in how the world consumes and processes financial data. Today’s market news APIs offer a scalable, automated and fair-use model where any organisation, regardless of size, can access structured and real-time financial information with high accuracy and consistency.

How APIs Changed the Future of Market News

Traditional news websites deliver information for human reading. But modern systems need something more — they need data that machines can understand, categorize and process. This is where market news APIs come in. APIs provide:

- Machine-readable financial news

- Real-time updates

- Clean formatting

- Categorized headlines

- Sentiment tagging

- Scalable performance

- Integration-friendly endpoints

This makes them essential for fintech platforms, stock market dashboards, quantitative research tools, predictive models, risk-analysis systems, academic projects and AI-driven applications.

Why Real-Time Financial News Matters More Than Ever

Real-time financial news does far more than inform — it drives markets. Every headline, announcement or update has the potential to alter economic direction. In markets where seconds matter, relying on outdated information can lead to:

- Wrong investment decisions

- Poor trading performance

- Flawed academic results

- Misleading product outputs

- Inefficient risk models

- Delayed business decisions

Accuracy and timing define success. A market-moving headline may appear at any moment, and organisations operating without real-time data risk falling behind. Consider these scenarios:

Regulatory Announcements

A government regulatory update can instantly impact entire industries. Without a real-time news feed, organisations may react too late.

Corporate Earnings

Earnings reports often move stock prices immediately. Real-time access ensures analysts interpret data without unnecessary delays.

Geopolitical Events

Global tensions, conflict, sanctions or political agreements can shake global markets. Teams using outdated news risk serious losses.

Central Bank Decisions

Interest rate changes influence currencies, stocks, bonds and investor sentiment across the world. Real-time news ensures professionals stay aligned with market reactions.

In all these situations, relying on unreliable data sources such as unverified social posts or delayed headlines can be extremely risky. Institutions that depend on precise information — such as financial firms, universities, fintech startups and research groups — understand that timely, verified, structured data is a necessity.

The Role of Modern Market News APIs in Today’s Economy

This is exactly where solutions like the best market news API come into the picture. These advanced systems make it possible for organisations to integrate structured real-time financial news feeds directly into their workflows.

A robust financial news API provides:

- Lightning-fast news delivery

- Clear categorisation

- Filterable topics

- High accuracy

- Machine-readable formats

- Strong documentation

- Low-latency endpoints

- Scalable performance

Instead of manually searching websites or waiting for delayed responses, teams can access instant, automated updates, enabling fully informed decision-making.

How Financial News APIs Enhance Technology and Research

Financial news APIs play a key role in various industries:

Fintech Startups and SaaS Products

Startups building financial products — such as trading apps, portfolio trackers, risk management tools or investment dashboards — can add real-time financial insights using APIs. This improves user engagement, increases product value and provides real-time updates that users expect from modern platforms.

Universities and Research Departments

Students, data scientists and researchers gain access to professional-grade datasets. This allows them to test theories using real-world information rather than relying on outdated or incomplete sources. Academic papers, research studies, machine learning projects and economic models improve significantly when powered by real-time financial news.

AI and Machine Learning Teams

AI models increasingly rely on sentiment analysis. Market news provides the perfect input data for predictive modelling. Machine learning teams can use financial news APIs to feed models with live sentiment scores, topic categories and real-time updates. This is especially useful in:

- Algorithmic trading

- Behavioural forecasting

- Risk analysis

- Market prediction models

Corporate Strategy and Business Intelligence Units

Companies rely on up-to-date news to guide internal strategy. Business intelligence teams can integrate live feeds into dashboards, ensuring decision makers never depend solely on delayed briefings. Real-time information helps companies adjust quickly to market shifts, competitor actions or industry updates.

The Future of Market Intelligence: Automation, AI and Real-Time Processing

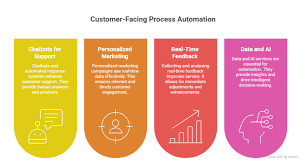

The digital ecosystem is moving rapidly from manual data consumption to automated data integration. Organisations that embrace automation will lead in speed, accuracy and efficiency. Market news APIs serve as a foundation for this new era of automated intelligence.

Automation Is Replacing Manual Research

Instead of manually reading dozens of articles, systems can now:

- Gather news automatically

- Categorize topics

- Tag sentiment

- Trigger alerts

- Power dashboards

- Feed AI models

- Support trading systems

Teams save time, reduce errors and focus on strategic tasks rather than repetitive data collection.

Financial Literacy Is Becoming a Core Layer of Technology

Finance is no longer just a standalone subject. It is merging with:

- Technology

- Innovation

- Education

- Research

- Product development

- Corporate strategy

Real-time financial news APIs form the bridge between raw data and actionable intelligence. They enable digital platforms to think, respond and learn using dynamic information rather than static datasets.

Conclusion: Real-Time News Is the New Standard for Decision-Making

The modern world demands speed, accuracy and reliability. As the global economy becomes more interconnected and digital, real-time financial news will continue to play a dominant role in shaping decisions across industries. From startups to universities, from AI platforms to corporate teams, access to verified and structured market news has become a fundamental requirement.

Financial news APIs provide the infrastructure needed to deliver this information at scale. They empower organisations to innovate faster, make smarter decisions and stay ahead in rapidly changing markets. As digital transformation accelerates, those who embrace automated intelligence and real-time information streams will lead the future of finance, technology and global strategy.

For more

For more exclusive influencer stories, visit influencergonewild