In business, long-term success is never built on revenue alone. While revenue growth is important, it does not guarantee stability, resilience, or longevity. Many fast-growing companies fail because they overlook the financial structures required to support that growth. Strategic financial planning is what separates businesses that survive market changes from those that collapse under pressure.

For founders, CFOs, and financial leaders, strategic planning provides a framework for decision-making that extends beyond the next quarter. It allows businesses to manage resources effectively, prepare for uncertainty, and scale with confidence. Without this foundation, even profitable companies can struggle to remain operational during periods of change.

Financial Management Is More Than Budgeting

Understanding Financial Control at a Deeper Level

Financial control is often misunderstood as simple cost management. In reality, it includes cash flow oversight, expense timing, liability management, and ensuring that operational decisions align with financial capacity. Strong financial control ensures that a business knows exactly where it stands at any given moment.

However, financial control focuses on the present. It keeps operations running smoothly but does not prepare a business for future growth, investment, or economic shifts. Businesses that stop at control often become reactive rather than proactive.

Financial Growth Requires Forward Thinking

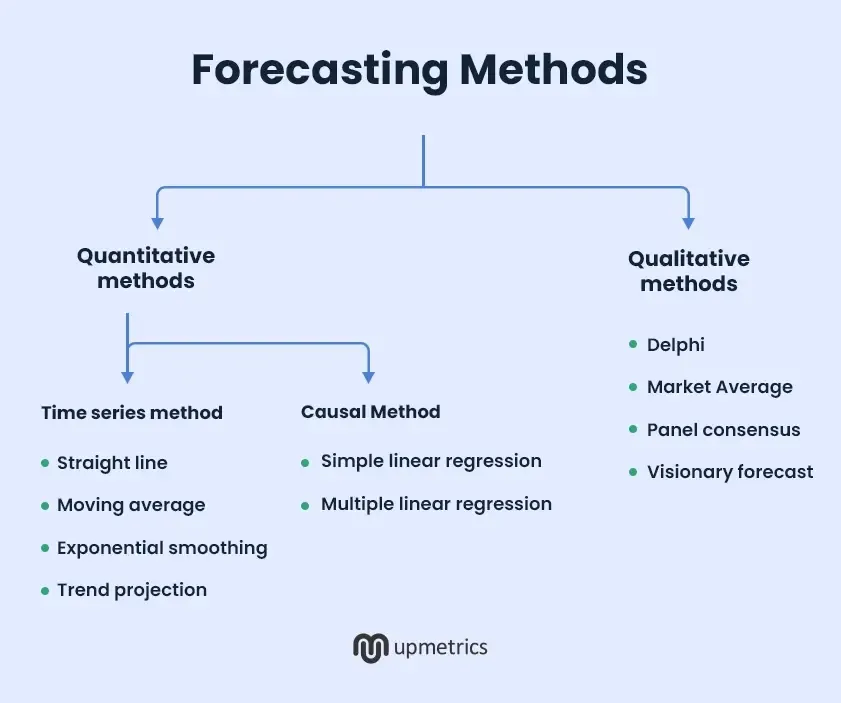

Financial growth demands strategic foresight. This includes scenario planning, investment modeling, and understanding how decisions made today affect performance years down the line. Growth-oriented financial planning evaluates best-case, worst-case, and realistic scenarios to prepare leadership for multiple outcomes.

By combining financial control with forward planning, businesses can grow sustainably without exposing themselves to unnecessary financial risk.

The Hidden Dangers of Weak Financial Foundations

Early Signs That Should Not Be Ignored

Weak financial foundations rarely appear suddenly. They develop gradually through poor forecasting, over-reliance on debt, and inconsistent cash flow management. Businesses may appear successful on the surface while silently accumulating risk beneath.

Reactive spending is another warning sign. When spending decisions are driven by urgency rather than strategy, profitability erodes and financial stability weakens over time.

Long-Term Consequences of Financial Neglect

Ignoring early financial warning signs can lead to serious long-term consequences. Over-leveraged businesses struggle during economic downturns, while poor forecasting limits the ability to invest or adapt. Eventually, these weaknesses reduce competitiveness and constrain growth.

Addressing financial issues early allows leadership to stabilize operations, restructure obligations, and rebuild confidence before challenges become critical.

Strategic Financial Planning as a Growth Enabler

Aligning Financial Strategy With Business Vision

Strategic financial planning connects long-term business goals with realistic financial pathways. Whether the objective is expansion, acquisition, or diversification, financial planning ensures that sufficient resources are available to support those ambitions.

This alignment prevents missteps such as expanding too quickly or investing in projects that strain cash flow. Instead, growth becomes measured, intentional, and sustainable.

Preparing for Change Instead of Reacting to It

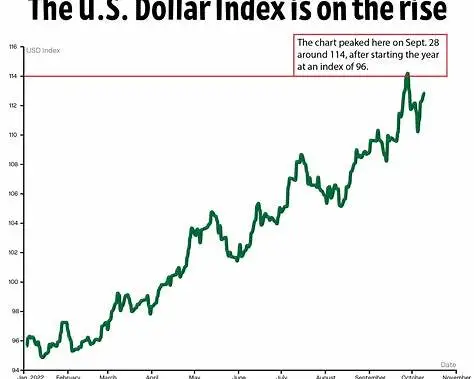

Markets evolve, customer behavior shifts, and economic conditions fluctuate. Businesses with strategic financial plans are prepared for change because they have already modeled different outcomes. This preparation allows leaders to act decisively rather than scrambling for solutions under pressure.

Preparedness transforms uncertainty from a threat into an opportunity for those with clarity and foresight.

Knowing When External Financial Support Becomes Essential

Why Internal Teams Are Not Always Enough

As businesses grow, financial complexity increases. Tax structures become more complicated, compliance requirements expand, and capital decisions carry higher stakes. Internal teams may lack the specialized expertise required to navigate these challenges effectively.

External financial professionals provide an objective perspective, drawing on experience across industries and growth stages. This insight often reveals opportunities or risks that internal teams may overlook.

Strengthening Strategy Through Expert Guidance

External finance directors and financial advisors help businesses refine forecasts, improve reporting accuracy, and design scalable financial systems. Their involvement is particularly valuable during periods of rapid growth, restructuring, or investment planning.

By engaging expert support at the right time, businesses strengthen decision-making while reducing exposure to costly mistakes.

Financial Clarity as the Foundation of Business Resilience

Why Clarity Drives Confidence

Financial clarity gives leaders confidence to make informed decisions. When cash flow, obligations, and forecasts are transparent, businesses can respond calmly to challenges rather than reacting emotionally or impulsively.

This clarity is especially critical during economic instability, when uncertainty can paralyze decision-making or lead to overly conservative choices that limit growth.

Systems, Reviews, and Long-Term Tools

Regular financial reviews help businesses assess performance against strategy and adjust course when necessary. Automation improves accuracy and efficiency, allowing finance teams to focus on insights rather than data entry.

Long-term planning tools such as stress testing and scenario modeling allow businesses to anticipate pressure points and protect liquidity. Together, these practices create a resilient financial structure that supports continuity.

Strategic Financial Planning and Business Longevity

| Comparison Area | Strategic Financial Planning | Reactive Financial Management |

|---|---|---|

| Approach | Long-term, proactive, and forward-looking | Short-term, response-based, and urgent |

| Decision Making | Based on forecasts, scenarios, and data | Based on immediate problems or pressure |

| Cash Flow Management | Planned and stabilized over time | Managed only when issues arise |

| Risk Handling | Risks are identified and prepared for in advance | Risks are addressed after damage occurs |

| Growth Strategy | Growth is controlled and financially supported | Growth often strains cash and resources |

| Use of Data | Regular analysis and financial reviews guide actions | Limited analysis, mostly hindsight-driven |

| Resilience During Downturns | Strong ability to absorb shocks and adapt | High vulnerability to market changes |

| Investment Planning | Investments are aligned with long-term goals | Investments are often rushed or delayed |

| Leadership Confidence | High confidence due to financial clarity | Low confidence due to uncertainty |

| Long-Term Sustainability | Built for longevity and stability | Often leads to instability over time |

Building for Sustainability, Not Short-Term Wins

Businesses that prioritize strategic financial planning focus on sustainability rather than quick wins. They invest in systems, people, and processes that support long-term performance. This approach reduces volatility and creates predictable growth over time.

Sustainability also builds trust with stakeholders, including investors, employees, and partners, strengthening the overall business ecosystem.

Scaling With Discipline and Control

Disciplined financial planning allows businesses to scale without losing control. Leaders understand when to invest, when to pause, and when to protect cash reserves. This balance prevents overexpansion while ensuring momentum is not lost.

Over time, this disciplined approach becomes a competitive advantage that supports innovation and adaptability.

Conclusion: Strategic Financial Planning as a Long-Term Competitive Advantage

Strategic financial planning is not an optional exercise for growing businesses. It is a core capability that determines whether a company can survive, adapt, and thrive over the long term. Revenue alone does not create success; clarity, foresight, and disciplined execution do.

By strengthening financial foundations, identifying risks early, and seeking expert guidance when needed, businesses position themselves for sustainable growth. Strategic financial planning transforms uncertainty into opportunity and ensures that success today does not come at the expense of tomorrow.

What is strategic financial planning?

Strategic financial planning is a long-term approach to managing finances that helps businesses plan growth, manage risk, and maintain financial stability.

Why is strategic financial planning important for businesses?

It helps businesses make informed decisions, prepare for uncertainty, and ensure sustainable growth rather than reacting to problems later.

How is strategic financial planning different from budgeting?

Budgeting focuses on short-term expense control, while strategic financial planning looks at long-term goals, forecasts, and future scenarios.

What are common signs of weak financial foundations?

Signs include poor cash flow forecasting, over-reliance on debt, reactive spending, and lack of financial visibility.

When should a business start strategic financial planning?

Strategic financial planning should begin as early as possible, especially when a business plans to grow, invest, or scale operations.

Can small businesses benefit from strategic financial planning?

Yes, small businesses benefit greatly as it helps them manage cash flow, reduce risk, and plan growth more confidently.

How does financial planning improve business resilience?

It provides clarity and preparedness, allowing businesses to respond calmly and effectively to market changes or economic challenges.

When should external financial experts be involved?

External experts should be involved during periods of growth, restructuring, or when internal expertise is no longer sufficient.

Does strategic financial planning help with long-term growth?

Yes, it aligns financial resources with business goals, enabling controlled and sustainable expansion over time.

Is strategic financial planning a one-time process?

No, it is an ongoing process that requires regular review and adjustment as the business and market conditions evolve.

For more

For more exclusive influencer stories, visit influencergonewild