Who Gains from TikTok Memecoin Trends?

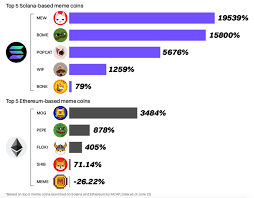

TikTok Memecoin Trends Online culture has reshaped the cryptocurrency landscape in ways few could have predicted a decade ago. What began as internet jokes and playful experiments has evolved into a powerful force capable of moving billions of dollars within hours. Memecoins once dismissed as novelty tokens now regularly appear among the most traded assets on major exchanges such as Binance, standing side by side with long-established cryptocurrencies like Bitcoin and Ethereum. At the center of this transformation sits TikTok, a platform designed for entertainment but increasingly influential in shaping market behavior. The key question is no longer whether TikTok can move crypto prices, but rather who truly benefits from these rapid, hype-driven market cycles.

Memecoins are unique because their value is not anchored primarily in technological breakthroughs or utility-driven adoption. Instead, they thrive on community enthusiasm, cultural relevance, and viral momentum. Dogecoin, the most iconic example, began as a parody yet remains one of the most recognizable digital assets globally. Its continued presence on leading exchanges demonstrates that in today’s crypto markets, attention can be just as valuable as innovation. Understanding who gains from TikTok-fueled memecoin trends requires looking beyond price charts and examining how value flows through traders, exchanges, influencers, and the broader ecosystem.

From Internet Humor to Market Contender

The rise of memecoins represents a fundamental shift in how financial assets can gain legitimacy. Traditionally, markets rewarded innovation, scarcity, or cash flow potential. In contrast, memecoins are powered by narrative. Dogecoin’s Shiba Inu mascot, humorous tone, and welcoming community transformed it from a joke into a symbol of internet culture. As social media platforms expanded, especially short-form video platforms like TikTok, these narratives found fertile ground to spread rapidly.

TikTok’s algorithm is particularly effective at amplifying emotionally engaging content. A single video explaining how a memecoin could “go to the moon” can reach millions of viewers in a matter of hours. This creates sudden surges in demand, often disconnected from broader market conditions. When thousands of users act simultaneously on the same idea, even small tokens can experience dramatic price increases. In this environment, memecoins have become cultural assets as much as financial ones.

What Trading Prices Reveal About the Meme Market

A close look at trading data highlights the contrast between memecoins and traditional cryptocurrencies. Bitcoin, often described as digital gold, derives much of its value from scarcity, network security, and long-term adoption. Ethereum, by comparison, functions as a foundational layer for decentralized finance, NFTs, and smart contracts. Their price movements, while volatile, are typically influenced by macroeconomic trends, institutional investment, regulatory developments, and technological upgrades.

Dogecoin and similar memecoins behave differently. Their price history is punctuated by sharp spikes tied to viral moments rather than gradual growth cycles. Despite this, Dogecoin remains among the most actively traded cryptocurrencies on Binance. This persistence underscores an important reality: liquidity and attention can sustain an asset even in the absence of deep utility. While Bitcoin and Ethereum attract long-term investors, memecoins attract speculators drawn by momentum and social buzz.

The coexistence of these assets on the same exchange illustrates how diverse the crypto market has become. On one end are assets valued for stability and infrastructure; on the other are tokens valued for entertainment and community engagement. Both generate trading volume, but they appeal to different motivations and risk appetites.

TikTok as a Catalyst for Sudden Market Moves

TikTok’s role in the memecoin phenomenon cannot be overstated. Unlike traditional media or even other social platforms, TikTok thrives on speed and virality. Trends emerge, peak, and fade in compressed timeframes. This dynamic aligns perfectly with speculative trading, where early entry can mean substantial gains.

When a memecoin trend gains traction on TikTok, the impact is often immediate. Viewers are encouraged to act quickly, creating a fear of missing out that fuels rapid buying. Exchanges like Binance reflect this surge almost instantly through spikes in volume and price volatility. In contrast, Bitcoin and Ethereum trends typically unfold over weeks or months, driven by slower-moving factors such as institutional announcements or protocol upgrades.

This acceleration of market cycles blurs the line between entertainment and finance. A meme created for humor can translate into real financial consequences for traders worldwide. For some, this represents democratization anyone with a smartphone can participate. For others, it highlights the risks of markets driven more by emotion than analysis.

Market Psychology and the Power of Momentum

At the heart of TikTok-driven memecoin rallies lies market psychology. Humans are social creatures, and financial decisions are often influenced by collective behavior. When users see others posting profits, excitement spreads rapidly. This momentum attracts new participants, pushing prices higher and reinforcing the narrative that the trend is unstoppable.

However, momentum is a double-edged sword. The same forces that drive prices up can reverse just as quickly. Once attention shifts elsewhere, liquidity dries up and late entrants are left exposed. Understanding this cycle is crucial for anyone engaging with memecoins. While early participants may benefit significantly, those who join after a trend peaks often experience losses.

Who Truly Gains from the Volatility?

The most consistent beneficiaries of memecoin volatility are cryptocurrency exchanges. Increased trading activity translates directly into higher transaction fees, regardless of whether prices rise or fall. From this perspective, viral trends are profitable events that boost engagement and liquidity across platforms.

Influencers and content creators also stand to gain. By identifying or promoting trends early, they can build audiences, earn sponsorships, or benefit indirectly from increased visibility. In some cases, influencers may already hold positions in the assets they promote, amplifying their gains if prices rise.

Early adopters those who recognize a trend before it becomes mainstream—often see the largest financial rewards. Their advantage lies in timing and risk tolerance. By contrast, casual traders who enter based on hype without understanding the underlying dynamics face less favorable odds. This imbalance highlights how value is redistributed unevenly during viral market cycles.

Comparing Memecoins with Bitcoin and Ethereum

To fully grasp who gains from memecoin trends, it is essential to compare them with Bitcoin and Ethereum. Bitcoin’s long-term narrative centers on security, scarcity, and global acceptance as a store of value. Ethereum’s value proposition lies in its role as a platform for decentralized innovation. These assets attract institutional investors, developers, and long-term holders who contribute to sustained growth.

Memecoins operate on a different plane. Their success depends on continuous attention and community engagement. While they can introduce new users to the crypto space, they rarely offer the same level of long-term stability. This does not diminish their importance; rather, it defines their role. Memecoins act as gateways, drawing people into crypto through humor and accessibility.

Market data often shows that during periods of heightened risk aversion, investors gravitate back toward established assets. Bitcoin and Ethereum may experience downturns, but they tend to recover based on broader adoption trends. Memecoins, meanwhile, may struggle to regain momentum once a trend fades.

Risk, Reward, and Responsibility

Trading memecoins based on TikTok trends is inherently risky. Rapid gains are possible, but so are sudden losses. For traders, the challenge lies in balancing excitement with discipline. Understanding market mechanics, setting clear entry and exit strategies, and avoiding emotional decisions are essential practices.

For the broader crypto ecosystem, memecoins raise important questions about responsibility and education. While they can spark interest and innovation, they can also lead to disillusionment if participants are unprepared for volatility. Exchanges, influencers, and communities all play a role in shaping how newcomers perceive these markets.

The Future Role of Memecoins

Looking ahead, memecoins are unlikely to replace foundational cryptocurrencies like Bitcoin and Ethereum. However, they are also unlikely to disappear. As long as social media platforms continue to shape culture, there will be room for assets that reflect collective humor and identity. Future memecoins may evolve by integrating utility, gaming elements, or community-driven governance, blending entertainment with functionality.

TikTok and similar platforms will remain powerful catalysts, capable of accelerating trends at unprecedented speeds. For traders and observers alike, the lesson is clear: attention is a valuable currency. Those who understand how it flows and who benefits from it are better positioned to navigate the market.

Final Thoughts: Who Really Wins?

In the end, the winners of TikTok-driven memecoin trends are not always the most visible participants. Exchanges profit from volume, influencers gain reach and relevance, and early adopters may secure impressive returns. Meanwhile, established cryptocurrencies continue to dominate the long-term narrative, supported by institutional trust and real world adoption.

Memecoins occupy a unique space where culture meets finance. They remind us that markets are not purely rational systems but reflections of human behavior. For those willing to engage thoughtfully, they offer insight into the evolving nature of value itself. For everyone else, they serve as a cautionary tale about the power and peril of viral hype.

For more

For more exclusive influencer stories, visit influencergonewild