Trading Hesitation: The Silent Barrier Between Traders and Consistent Success

The financial markets are often described as places of opportunity, speed, and calculated risk. Charts flash, prices fluctuate, and headlines change by the minute. From the outside, trading looks decisive and action-oriented. Yet beneath the surface lies a struggle that affects beginners and professionals alike—trading hesitation.

Trading hesitation is that moment when logic says one thing, but emotion pulls you in the opposite direction. You spot a valid setup, your indicators align, and your trading plan confirms the trade—yet you pause. Seconds stretch into minutes. The market moves, and suddenly the opportunity is gone. What remains is frustration, self-doubt, and the haunting question: Why didn’t I act?

This hesitation is not rare. In fact, it is one of the most common psychological challenges traders face. Left unchecked, trading hesitation quietly undermines performance, consistency, and confidence. To overcome it, traders must understand its roots, recognize its patterns, and build systems that reduce emotional interference.

Understanding Trading Hesitation at Its Core

Trading hesitation occurs when a trader delays, avoids, or abandons a decision despite having adequate information or a defined strategy. It is not the absence of knowledge—it is the conflict between knowledge and emotion.

This hesitation commonly shows up in several forms:

- Delaying trade entries until the price has already moved

- Refusing to exit losing trades due to hope or denial

- Closing profitable trades too early out of fear

- Ignoring valid setups after a previous loss

Over time, these behaviors erode trust in oneself. The trader begins to doubt not only their strategy, but their own judgment.

Why Trading Hesitation Is a Psychological Problem, Not a Technical One

Many traders believe hesitation comes from lack of indicators, insufficient analysis, or poor market conditions. In reality, trading hesitation is primarily psychological.

The human brain did not evolve to operate in environments based on probability and uncertainty. Long before financial markets existed, survival depended on avoiding danger, not managing calculated risk. This evolutionary wiring still governs decision-making today.

When money is at risk, the brain reacts as if facing a threat. Fear activates defensive behavior, slowing reactions and encouraging avoidance. In trading, this response leads directly to hesitation.

The Emotional Drivers Behind Trading Hesitation

Fear of Loss and Emotional Discomfort

The fear of losing money is one of the strongest emotional forces in trading. Losses feel deeply personal, even when they are statistically expected.

Because losses hurt more than gains feel good, traders subconsciously try to avoid them. This avoidance often takes the form of hesitation—waiting longer, second-guessing decisions, or not acting at all.

Fear of Being Wrong

Many traders hesitate not because they fear losing money, but because they fear being wrong. Being wrong feels like a judgment on intelligence or competence.

This fear intensifies hesitation, especially after public losses or advice given to others. Traders delay decisions to protect their ego, even when logic demands action.

Fear of Missing Out (FOMO)

While fear of loss slows traders down, fear of missing out creates pressure. Traders hesitate because they worry about entering too late, chasing price, or buying at the top.

This internal conflict creates indecision—one fear pushes forward, another pulls back.

Cognitive Biases That Reinforce Trading Hesitation

Trading hesitation is strengthened by cognitive biases that distort rational thinking.

Confirmation Bias and Hesitation

Confirmation bias leads traders to seek information that supports their existing beliefs. When evidence contradicts those beliefs, hesitation occurs.

For example, a trader may hesitate to exit a losing trade because they continue searching for signals that justify holding it.

Recency Bias and Emotional Memory

Recent outcomes heavily influence current decisions. A recent loss increases hesitation and caution. A recent win may reduce discipline and increase confusion.

Both scenarios disrupt balanced decision-making.

Anchoring Bias and Price Fixation

Anchoring bias occurs when traders fixate on specific prices—entry points, previous highs, or breakeven levels. This fixation creates hesitation when the market moves away from those anchors.

Instead of responding to current data, traders remain emotionally attached to past numbers.

How Trading History Shapes Hesitation Over Time

Every trader carries emotional baggage from past trades. These experiences silently shape future decisions.

The Lingering Effect of Losses

A significant loss leaves a lasting emotional mark. Even after recovery, the memory influences future behavior.

Traders become overly cautious, hesitant to take risks, and afraid of repeating mistakes. While caution has value, excessive fear prevents growth.

The False Confidence of Wins

Wins can be deceptive. A large win may create unrealistic expectations, leading traders to ignore warning signs.

When the next trade does not behave the same way, hesitation returns—this time driven by confusion and disbelief.

The Long-Term Damage Caused by Trading Hesitation

Trading hesitation rarely destroys accounts overnight. Instead, it causes slow, consistent damage.

Common consequences include:

- Reduced profit potential due to late entries

- Increased losses from delayed exits

- Inconsistent execution of strategies

- Loss of confidence in one’s system

- Emotional fatigue and burnout

Over time, hesitation transforms a sound strategy into inconsistent results.

Why Discipline Is the Antidote to Trading Hesitation

Discipline creates structure, and structure reduces emotion.

Traders who struggle with hesitation often lack clear rules. When decisions are subjective, emotions take control. When decisions are rule-based, hesitation has less room to operate.

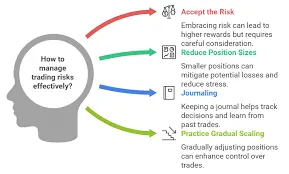

Practical Strategies to Reduce Trading Hesitation

Predefine Every Decision

Entries, exits, stop-loss levels, and position sizes should be decided before the trade begins. When rules are clear, hesitation decreases.

Commit to a Written Trading Plan

A written trading plan acts as a psychological anchor. It provides clarity during emotional moments and reinforces discipline.

Limit Information Intake

Too much information creates doubt. Successful traders reduce noise and focus on a consistent set of tools and signals.

Maintain a Detailed Trading Journal

A journal reveals hesitation patterns. Tracking emotions alongside results helps traders identify triggers and recurring mistakes.

Seek External Perspective

Objective feedback from experienced traders or mentors helps neutralize emotional thinking and restore confidence.

Building Confidence Through Repetition and Process

Confidence does not come from avoiding losses. It comes from executing a proven process consistently.

Every trade reinforces discipline. Every review builds awareness. Over time, hesitation weakens as trust in the process grows.

The goal is not perfection—it is consistency.

Final Perspective: Turning Trading Hesitation Into a Strength

Trading hesitation is not a flaw—it is a signal. It reveals emotional triggers, psychological weaknesses, and areas for growth.

Traders who confront hesitation honestly gain an advantage. They learn to manage fear, recognize bias, and act with clarity.

Every confident trader once struggled with hesitation. The difference is that they chose progress over paralysis.

For more

For more exclusive influencer stories, visit influencergonewild

One Comment