How Will You Fuel Your Trading Journey?

Embarking on a trading journey is not just about placing trades or following market trends. It begins with a solid understanding of trading capital, building a secure and well-structured trading account, and implementing strategic financing options that support long-term growth. The early steps you take—how you set up your account, how you manage money, and how you structure your risk—become the foundation that determines your success in the financial markets.

Whether you are a beginner stepping into the world of stocks, forex, crypto, or commodities, or an experienced trader aiming to strengthen your portfolio, the principles explored in this guide will elevate your performance. Here, we dive deep into advanced methods for managing trading capital, optimizing account structures, implementing risk controls, and applying proven strategies that sharpen your edge in the market.

Understanding the Importance of Trading Capital

What Is Trading Capital and Why It Matters

Trading capital represents the financial fuel that powers your market operations. Without adequate capital, even the most brilliant trading strategy collapses under pressure. Your trading capital is not simply the money you invest; it is your operational foundation, a buffer against market volatility, and a tool for unlocking opportunities that require financial flexibility.

A strong capital base allows you to take advantage of market inefficiencies, diversify your positions, and survive periods of high volatility. Traders who lack sufficient capital often find themselves overleveraged, emotionally unstable, and unable to recover from losses.

How Adequate Capital Enhances Performance

Market studies indicate that a majority of new traders struggle because they underestimate the importance of trading capital. Insufficient capital forces traders into risky behaviors:

- Overtrading

- Oversizing positions

- Falling prey to emotional decision-making

- Cutting winning trades prematurely

- Holding onto losing positions out of fear

Having adequate trading capital is more than just a buffer—it creates space for clear, rational decision-making. When traders are not pressured by the fear of losing their last dollars, they think more strategically, plan deeper, and execute trades more systematically.

Effective Capital Allocation

Capital allocation determines how, where, and when you distribute your capital among various assets or strategies. Proper allocation ensures:

- Exposure is spread across multiple sectors

- No single trade can destroy your account

- Losses remain manageable

- Long-term sustainability increases

For example, a trader with $10,000 may decide to allocate:

- 40% to long-term investments

- 30% to swing trading

- 20% to short-term speculative positions

- 10% to reserve or emergency funds

This structured approach prevents catastrophic drawdowns and provides flexibility to adapt to market conditions.

Why Capital Planning Builds Discipline

One of the most underrated benefits of understanding trading capital is the discipline it imposes. Traders who plan their capital carefully adopt a more professional mindset:

- Every trade has a purpose

- Every risk is controlled

- Every strategy is tested

- Every loss has a limit

This disciplined approach separates long-term successful traders from those who quit after a few months.

Building and Managing Your Trading Account

Why a Strong Trading Account Matters

Your trading account is your central hub. It holds your funds, executes your trades, tracks your positions, and connects you to financial markets. A poorly managed trading account can expose you to security risks, liquidity problems, and execution delays. A well-structured, properly maintained account becomes a powerful tool that supports consistency and performance.

Choosing a Reliable Trading Platform

A good platform provides:

- Real-time price data

- Fast execution speeds

- Deep liquidity

- Strong regulatory oversight

- Secure fund protection structures

- Advanced analytical tools

These elements ensure that your strategies run smoothly and that your assets stay protected.

Diversifying Your Trading Accounts

Many professional traders maintain multiple accounts for different purposes:

- A primary trading account for active trading

- A long-term investment account for building wealth

- A high-risk account for experimental strategies

- A hedging account for balancing exposure

This structure strengthens overall financial stability and reduces exposure to any one platform or market.

Security and Customer Support

A secure trading account must offer:

- Two-factor authentication

- Data encryption

- Fast withdrawal systems

- Timely customer support

- Transparent reporting

These features ensure long-term stability and reliability, especially during periods of high volatility when customer assistance becomes essential.

Financing Your Trading Account: Options and Strategies

Why Financing Matters for Traders

Financing determines how large your trading operations can grow. Some traders rely solely on self-funding, while others use leverage or external financing to expand faster. Each method brings advantages—but also risks—that must be managed carefully.

Below are the most effective financing methods and how they impact your trading journey.

Self-Funding Your Trading Account

Self-funding is the most common method, especially for beginners. It offers:

Advantages

- Full control over your capital

- No repayment obligations

- No interest costs

- No external pressure

Limitations

- Growth may be slow

- Limited access to larger positions

- Higher emotional attachment to losses

Self-funding is ideal for individuals who want to learn gradually without pressure.

Leveraging: Expanding Your Market Exposure

Leverage allows traders to control larger positions with smaller capital. For example, with 1:100 leverage, $100 can control a $10,000 position.

Benefits of Leverage

- Amplifies potential returns

- Enables participation in major market moves

- Requires less initial capital

Risks of Leverage

- Losses occur faster

- Overexposure can damage your account

- Requires strict risk management

Traders must understand how leverage works and use it responsibly, ideally with predefined stop-losses.

External Financing for Trading

Some traders use external financing, such as:

- Funding programs

- Prop trading firms

- Investor partnerships

- Structured capital agreements

Advantages

- Higher trading capital without personal risk

- Potential for rapid growth

- Professional oversight

Responsibilities

- Respecting repayment rules

- Following trading guidelines

- Maintaining risk discipline

External financing is powerful but requires professionalism and transparency.

Strategies to Fuel Your Trading Journey

Combining Capital, Strategy, and Risk Management

A successful trading journey blends technical skills with financial discipline. Capital, strategy, and money management must work together for consistent performance.

Below are advanced strategies that significantly improve long-term outcomes.

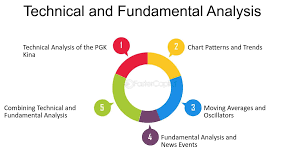

Technical and Fundamental Analysis Synergy

Traders who combine both types of analysis gain a broader perspective:

Fundamental Analysis

Focuses on economic indicators, financial statements, and global news.

Technical Analysis

Focuses on price action, chart patterns, indicators, and market structure.

Using both together strengthens your entry and exit decisions.

Automating Your Trading Approach

Automation tools can:

- Reduce emotional influence

- Improve consistency

- Identify patterns faster

- Execute trades instantly

- Maintain discipline during volatile markets

Algorithms, signals, and automated risk controls support more efficient market participation.

Risk Management Techniques

Risk management is the backbone of long-term success. Some key practices include:

Position Sizing

Limiting each trade to a small percentage of your capital protects your account.

Stop-Loss Orders

Stops prevent large losses and secure discipline.

Diversification

Spreading trades across multiple assets reduces total exposure.

Regular Market Reviews

Analyze trends, update strategies, and adapt to changing conditions.

Real-Life Success Stories and Lessons Learned

Successful traders repeatedly emphasize that the secret to long-term profitability lies not in hype or luck but in:

- Capital discipline

- Strategic financing

- Strong account management

- Continuous learning

Case studies show that traders who follow structured risk management protocols often achieve significantly higher returns, even during market downturns. Many report annual growth of more than 30% simply by adhering to strict discipline and avoiding emotional trading.

Their journeys highlight:

- Mistakes that shaped their evolution

- Strategies that turned losses into learning opportunities

- How they survived volatile markets

- How consistency beat unpredictability

These insights are valuable for beginners and experienced traders alike.

Conclusion

Mastering your trading journey requires more than market knowledge. You must understand the importance of trading capital, build a secure and well-managed trading account, and use smart financing strategies that support long-term growth. Traders who prioritize risk management, structured planning, and continuous learning consistently outperform those who chase quick profits.

The foundation you build today—how you manage your money, how you structure your account, and how carefully you plan your trades—determines the success you experience tomorrow. With discipline, patience, and strategic thinking, your trading journey can evolve into a rewarding and sustainable pursuit.

For more

For more exclusive influencer stories, visit influencergonewild

8 Comments